What Is Diversification?

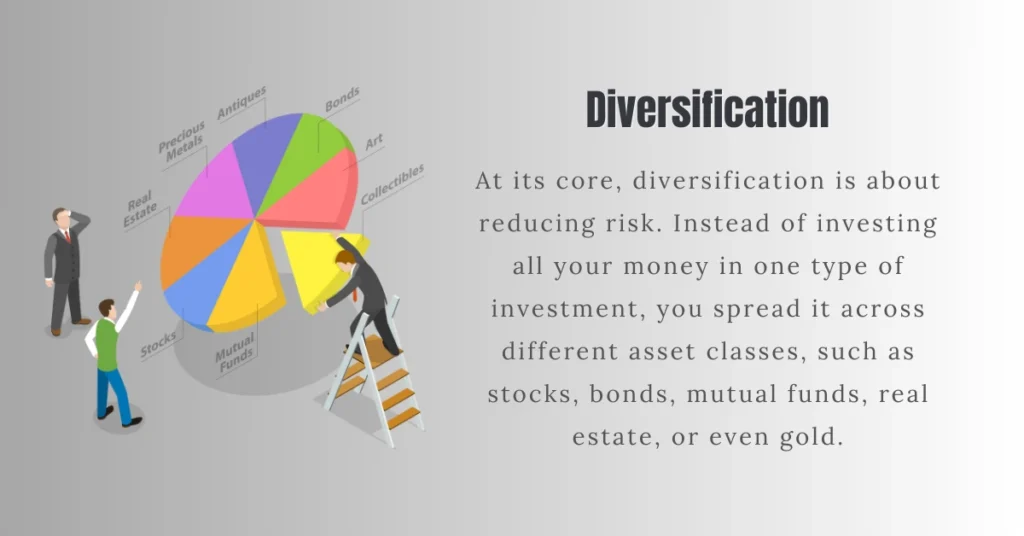

Diversification is a risk management strategy that involves spreading investments across a variety of assets or asset classes in order to reduce the overall risk of a portfolio.

The main idea behind diversification is to avoid putting all your eggs in one basket, which can help protect your investments from significant losses if a particular asset or sector performs poorly.

Key Aspects of Diversification:

Asset Variety: Diversification involves investing in different types of assets, such as stocks, bonds, real estate, commodities, and cash equivalents.

These assets can have different risk-return profiles and can react differently to economic and market conditions.

Asset Allocation: Investors need to determine how to allocate their capital among these various asset classes based on their financial goals, risk tolerance, and investment horizon. This may vary depending on circumstances.

Risk Reduction: By holding a diversified portfolio, an investor can reduce the risk associated with any single asset or investment.

While some assets may perform poorly at any given time, others may perform well, potentially offsetting losses.

Correlation: It’s essential to consider the correlation between assets. Negatively correlated Assets tend to follow opposite directions.

For example, when stocks perform poorly, bonds may perform well. This negative correlation can enhance diversification benefits.

Portfolio Rebalancing: As asset values change over time, the portfolio may drift away from its intended allocation.

Periodic rebalancing is necessary to bring the portfolio back in line with the desired asset allocation.

Long-Term Strategy: Diversification is generally considered a long-term strategy. It does not guarantee high returns but aims to manage risk over time.

It may not protect against all losses, especially during severe market downturns.

Professional Guidance: Some investors choose to work with financial advisors or use diversified mutual funds or exchange-traded funds (ETFs) that are managed by professionals to achieve diversification without having to pick individual assets.

Diversification Across Different Asset Class

Diversification across different asset classes involves allocating your investment capital across a range of asset categories, each with its own risk and return characteristics.

The goal is to create a balanced portfolio that can potentially generate returns while managing risk effectively. Here are some common asset classes and how they can be used in diversification:

Equities (Stocks):

Stocks represent ownership in a company and offer the potential for capital appreciation.

They are considered higher risk but can provide higher returns over the long term.

Diversifying within equities involves investing in different types of stocks, such as large-cap, mid-cap, and small-cap stocks, and across various sectors and industries.

Fixed-Income (Bonds):

Bonds are debt securities issued by governments, municipalities, or corporations, and they pay periodic interest and return the principal at maturity.

Bonds are generally considered less risky than stocks and can provide income and capital preservation.

Diversifying within fixed income involves investing in government bonds, corporate bonds, municipal bonds, and bonds with different maturities and credit qualities.

Real Estate:

Real estate investments can include physical properties like residential and commercial real estate, as well as real estate investment trusts (REITs).

Real estate offers the potential for rental income and property appreciation.

Diversifying within real estate can involve investing in different types of properties and geographic locations.

Commodities:

Commodities include physical assets like gold, oil, agricultural products, and industrial metals.

They can serve as a hedge against inflation and offer diversification benefits due to their low correlation with other asset classes.

Diversifying within commodities can involve investing in a mix of different commodities.

Cash and Cash Equivalents:

Cash and cash equivalents, such as money market funds, provide liquidity and stability to a portfolio.

They are the least risky but typically offer lower returns than other asset classes.

Maintaining a portion of your portfolio in cash can provide flexibility for taking advantage of investment opportunities.

Alternative Investments:

Alternative investments, such as hedge funds, private equity, and venture capital, can diversify a portfolio further by introducing less correlated assets.

These investments often have unique risk-return profiles and may be less liquid than traditional assets.

To achieve effective diversification across different asset classes, you’ll need to determine your investment goals, risk tolerance, and time horizon.

The specific allocation to each asset class will depend on your individual circumstances and preferences.

Asset allocation strategies can range from conservative (e.g., more bonds and cash) to aggressive (e.g., more stocks and alternative investments), and they may change over time as your financial situation evolves.

Strategies for Building a Diversified Portfolio

Creating a diversified stock portfolio requires careful planning and consideration. Here are some essential strategies to achieve diversification, including:

- Asset Allocation: Determining the ideal distribution of investments across different asset classes based on risk tolerance, investment goals, and time horizon.

- Sector and Industry Allocation: Spread investments across various sectors and industries to avoid concentration risk and take advantage of different market trends.

- Geographic Diversification: Investing in companies across different regions and countries to reduce exposure to any single economy and benefit from global growth opportunities.

- Investment Styles and Strategies: Combining investments with different styles, such as growth, value, or income-oriented stocks, to diversify risk and optimize returns.

Pros and Cons of Diversification Strategy

Diversification is a widely used investment strategy that involves spreading your investments across a variety of assets or asset classes to reduce risk.

While diversification offers several benefits, it also comes with certain drawbacks. Here are the pros and cons of diversification:

Pros of Diversification:

Risk Reduction: The primary advantage of diversification is risk mitigation. By investing in a range of assets or asset classes, you can reduce the impact of poor performance in any single investment on your overall portfolio. This can help protect your wealth from significant losses.

Steady Returns: Diversification can provide more stable and consistent returns over time. When one asset class performs poorly, others may perform well, helping to balance out your portfolio’s overall returns.

Enhanced Risk-Return Profile: Diversifying across different asset classes can potentially improve the risk-return profile of your portfolio.

By combining assets with different risk levels and return potential, you can aim for a more favorable risk-adjusted return.

Reduced Emotional Stress: Diversification can reduce emotional stress and anxiety associated with investing because you are less reliant on the performance of a single investment. This can lead to more disciplined and rational decision-making.

Tailored to Risk Tolerance: Diversification allows you to customize your portfolio to match your risk tolerance and financial goals.

You can adjust your allocation to be more conservative or aggressive as needed.

Cons of Diversification:

Lower Potential Returns: One of the drawbacks of diversification is that it may limit the potential for exceptionally high returns.

When you diversify, you are intentionally spreading your investments across various assets, which means you might miss out on the full upside of a single, high-performing investment.

Complexity: Managing a diversified portfolio can be more complex and time-consuming than investing in a single asset or asset class.

It may require ongoing monitoring and periodic rebalancing to maintain your desired allocation.

Diluted Expertise: If you diversify too broadly, you might not have the expertise to make informed decisions about each asset or asset class in your portfolio.

This could lead to suboptimal choices or the need for professional guidance.

Transaction Costs: Diversification may result in higher transaction costs, particularly if you are investing in a wide range of assets or using actively managed funds with higher fees.

Potential Overdiversification: Overdiversification can occur when you spread your investments too thin, making it difficult to track and manage your portfolio effectively. This can lead to mediocre returns and higher fees.

Market Correlations: Diversification’s effectiveness relies on the assets in your portfolio having low correlations with each other.

During extreme market events, correlations between asset classes can increase, potentially reducing diversification benefits.

FAQs

What do you mean by diversification?

Diversification is an investment strategy that involves spreading your investments across different assets or asset classes to reduce risk.

What is a diversification strategy?

A diversification strategy is a plan to allocate your investments across various assets, such as stocks, bonds, real estate, and cash, to manage risk and optimize returns.

What are the benefits of diversification?

Benefits include risk reduction, more stable returns, improved risk-return profile, reduced emotional stress, and customization to match your risk tolerance and goals.

What is the best diversification strategy?

The best strategy depends on your individual financial goals and risk tolerance. Common approaches include asset allocation, diversification within asset classes, and international diversification.

How does diversification reduce risk?

Diversification reduces risk by spreading investments across assets with different risk profiles. When one asset performs poorly, others may perform well, helping to offset losses and minimize overall portfolio risk

Conclusion

Diversification is not a one-size-fits-all strategy. The level and type of diversification should align with an investor’s specific financial goals and risk tolerance.

It’s important to note that while diversification can help mitigate risk, it cannot eliminate it entirely.

Market conditions, economic factors, and other variables can impact the performance of diversified portfolios.

In summary, diversification is a strategy that involves spreading investments across various asset classes to reduce risk and potentially improve the risk-return profile of a portfolio.

It is a fundamental principle of modern portfolio theory and is widely used by investors to manage their investment risk.

By following the principles of diversification and implementing effective strategies, you can enhance your chances of long-term investment success.