Understanding SIP vs. Lump Sum:

Sip vs. Lump Sum Which is Better: The choice between SIP vs. Lump Sum Investment is a common dilemma for many investors When it comes to investing in mutual funds.

Advertisements for mutual funds often highlight the benefits of SIP, emphasizing the advantage of averaging costs.

In this article, we will explore the advantages of both SIP and lump sum investments, analyze the returns of a mutual fund over the past 10-12 years, and determine which type of investor should consider each strategy.

Sip vs Lump Sum Which is Better ?

| Aspect | SIP (Systematic Investment Plan) | Lump Sum Investment |

|---|---|---|

| Investment Approach | Regular, fixed investments at intervals | One-time large investment |

| Investment Frequency | Regular intervals (e.g., monthly) | One-time or randomly |

| Risk Mitigation | Dollar-cost averaging (reduces risk) | Market timing risk |

| Volatility | Smoother ride due to averaging | Immediate market impact |

| Entry Point Risk | Reduced as investments are spread out | Subject to market timing |

| Market Timing | Less important as it’s automated | Critical timing required |

| Investment Flexibility | More flexible for smaller investors | Requires a lump sum |

| Rupee Cost Averaging | Yes, benefits from market fluctuations | No |

| Potential for Compounding | Yes, due to regular investments | Depends on investment |

| Psychological Comfort | Eases emotional decisions | May be stressful |

| Goal-Oriented Saving | Well-suited for long-term goals | Applicable to any goal |

| Liquidity | May have exit loads or lock-ins | Generally liquid |

| Investment Discipline | Promotes disciplined saving habits | Requires self-discipline |

Advantages of SIP:

- Low investment threshold: SIP allows investors to start with a small amount, such as Rs 500, making it accessible for individuals with limited funds.

- No need to time the market: With SIP, investors do not need to track market fluctuations or attempt to time their investments, as they can consistently invest a fixed amount each month.

- Cost averaging: By investing regularly, the cost of acquiring mutual fund units is averaged out over time. This helps mitigate the impact of market volatility on overall returns.

- Inculcates saving and investment discipline: SIP encourages individuals to develop a habit of saving and investing regularly, promoting long-term wealth creation.

Advantages of Lump Sum Investment:

- Capitalizing on windfall gains: Lump sum investments are suitable for individuals who receive unexpectedly large sums of money, such as bonuses, stock options, or inherited wealth. Investing in such windfall gains can potentially multiply the capital.

- Market timing opportunity: If an investor can accurately identify market bottoms and invest a lump sum during those periods, they can potentially earn substantial returns. Investing at opportune times can yield better results compared to averaging returns through SIP.

- Flexibility: Lump sum investments offer the flexibility of investing a significant amount at once, which may be more suitable for individuals who prefer to invest periodically rather than committing to monthly investments.

Analyzing Returns with an Example:

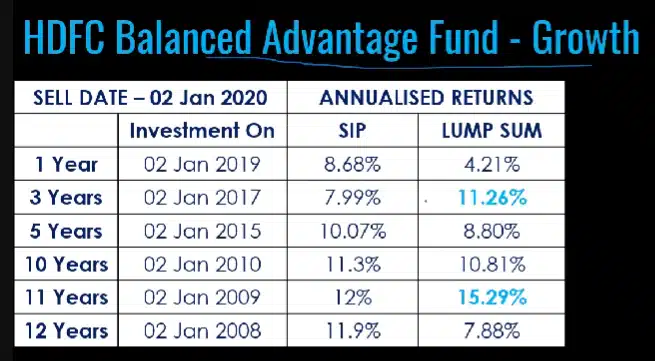

To illustrate the difference in returns between SIP and lump sum investments, let’s analyze the HDFC Balanced Advantage Fund Growth over the past 10-12 years.

Please note that this example is for illustrative purposes and other funds may yield different results.

- One-year returns: SIP – 8.68%; Lump Sum – 4.21%

- Three-year returns: SIP – 7.99%; Lump Sum – 11.26%

- Five-year returns: SIP – 10.07%; Lump Sum – 8.80%

- Ten-year returns: SIP – 11.3%; Lump Sum – 10.81%

- Eleven-year returns: SIP – 12%; Lump Sum – 15.29%

- Twelve-year returns: SIP – 11.9%; Lump Sum – 7.88%

Analyzing the data and considering the market conditions during those periods, it becomes evident that market timing played a significant role in determining the returns.

Lump sum investments tend to perform better when made during market bottoms, while SIP investments provide more consistent returns over the long term.

Strategies for Different Types of Investors:

- Investors with limited time or knowledge: If you lack the time or expertise to track the market, consider investing windfall gains in debt funds to secure fixed returns. Simultaneously, start a SIP with a portion of your monthly income in equity funds. Over time, SIP investments will average out costs and generate satisfactory returns compared to fixed deposits.

- Investors with market knowledge and time: If you have the ability to track the market and analyze macro factors, accumulate capital through monthly investments in debt funds. When you identify market bottoms, deploy lump sum investments into equities for long-term growth potential.

Also, Read | Why Mutual Funds Are Better Than Stocks: A Comprehensive Guide

FAQs: Sip vs. Lump Sum Investment

Which is better SIP or lump sum?

SIP is better for regular, disciplined investing and risk reduction.

Lump Sum can be suitable if you have a substantial amount to invest and can time the market effectively.

Is it good to invest in lumpsum?

A lump Sum can be good if you have a lump sum available and are confident in market timing.

SIP is a safer choice for most investors, promoting long-term wealth creation and risk management.

Conclusion:

There is no definitive answer to whether SIP or lump sum investment is better, as it depends on individual circumstances and market conditions.

SIP offers the advantage of cost averaging and disciplined investing, making it suitable for investors without the time or expertise to track the market closely.

On the other hand, lump sum investments can potentially yield higher returns if timed correctly during market downturns.

It’s important to note that the example provided with the HDFC Balanced Advantage Fund Growth is just one illustration.

Investors should conduct thorough research and analysis of different funds before making investment decisions.

Additionally, past performance is not indicative of future results, and market conditions can vary significantly.

Ultimately, investors should consider their risk tolerance, financial goals, and market knowledge when deciding between SIP and lump sum investments.

Seeking advice from a financial advisor or investment professional can also provide valuable guidance based on individual circumstances.

Remember, investing in mutual funds involves risk, and it’s essential to diversify investments, regularly review the portfolio, and stay informed about market trends to make informed investment decisions.

Also, Read | LIMITATIONS OF MUTUAL FUNDS: UNDERSTANDING CASH POSITION AND MANAGING LARGE SUMS