The concept of stock market tax harvesting is a powerful strategy that allows investors to legally minimize their tax liability on stock market income.

By the end of this article, you’ll be equipped with the knowledge needed to optimize your tax savings and keep more of your hard-earned money.

Understanding Stock Market Tax Harvesting in India

Stock market tax harvesting is a strategic approach to managing your investment portfolio while minimizing your tax obligations.

Stock Market tax harvesting involves selling investments such as stocks, bonds, or mutual funds to lock in capital losses.

These losses can then be used to offset capital gains in the same year, reducing your overall taxable income.

Why need for tax harvesting?

Tax Rule on Equity

So you would know that before 2018, India did not have any long-term capital gain tax on equity But ever since this rule changed, there was a lot of public protests So the government decided to make a little bit of a change.

Up to 1 lakh every year your capital gain would be exempt. Over and above Rs 1 lakh capital gain, you will have to pay a 10% tax. Source

So, using this LTCG exemption of up to Rs 1 lakh, that technique is called tax harvesting. Stock market tax harvesting can be done even in case of a loss. We will discuss this later in this article.

The Benefits of Tax Harvesting

Tax harvesting offers several key advantages:

1. Minimizing Taxes: By offsetting gains with losses, you can reduce your tax liability, ultimately increasing your after-tax returns.

2. Portfolio Optimization: Tax harvesting provides an opportunity to rebalance your portfolio and reallocate assets according to your financial goals.

3. Long-Term Savings: Over time, tax harvesting can lead to substantial savings, allowing your investments to grow more efficiently.

How does tax harvesting work in India?

Tax Harvesting Process and Technique with Example

Now understand how this tax harvesting works in the Indian Stock market.

Assume you have one share of the ABC Company. A year ago you purchased it for Rs 1 lakh and now the value of that share has become Rs 2 Lakh.

Now if you go and check your DEMAT account, it will show you an unrealized gain of Rs 1 lakh. The term ‘unrealized’ is used here because the profit hasn’t been booked or realized yet. You haven’t yet sold the share.

So as of today, yes it has a notional value of Rs 2 lakh. But maybe tomorrow this value becomes Rs 1,90,000 day after tomorrow, it may become Rs 1,80,000 or it may become even more than that.

So the government says that till you sell the share, your app might show whatever amount of profits or capital gains, We would not include it for tax purposes.

On the date you decide to sell it, whatever profit or capital gain you incur, will be added to your tax calculation.

For understanding assume you have just this one stock in your portfolio and if you ain’t selling it this year, your capital gain for this year would be zero.

So how will you use that limit of Rs one lakh? You won’t be able to. If I suggest you sell it, you may ask why would I sell it, right now the amount has only doubled and as per my calculation, within 10 years it would become 10 times. I will sell my shares at that time.

You may sell it later also, but then you will have to pay a lot of tax. But the technique that I am going to tell you, using that you can save a lot of tax.

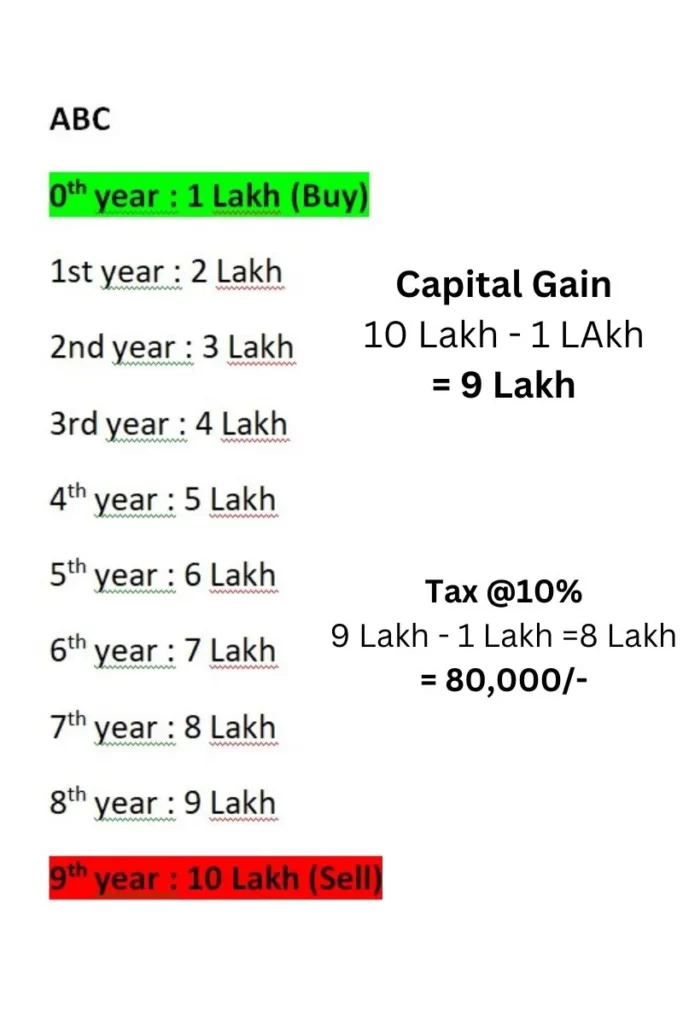

So take the example of this share only, You bought this share in the zeroth year for Rs 1 lakh.

Every year its value increased by Rs 1 lakh Meaning, in the first year it became one lakh to two lakh rupees. then three lakh, four lakh, and in the 10th year, its value became Rs 10 lakh.

Now if you sold it in the 10th year for Rs 10 lakh, then what would be your capital gain? Your selling price is Rs 10 lakh minus cost price which is Rs 1 lakh, which means you incurred a long-term capital gain of Rs 9 lakh.

In the 10th year, the tax on this amount would be 9 lakh minus 1 lakh exemption which is 10% of Rs 8 lakh which amounts to Rs 80,000.

Now if this person did some tax harvesting, he sold this share in the first year for Rs 2 lakh and immediately bought back that share again from the market for Rs 2 lakh.

So in the first year, he incurred a capital gain of Rs 1 lakh, Similarly, after the second year, he sold this share for Rs 3 lakh just one share that had, he sells it for Rs 3 lakh in the market, And with the Rs 3 lakh he received, he again purchased a share in return.

He kept doing this every year, so by the 10th year, his total capital gain, accumulating by Rs 1 lakh each year, His total capital gain became Rs 9 lakh.

But since each year up to Rs 1 Lakh capital gain is tax-exempt, the total tax on the entire amount became zero.

It means that in any financial year, he did not pay tax at all. Now you must have understood the concept.

Things to Keep in Mind for Effective Tax Harvesting

Timing and Liquidity Matters: Be mindful of the timing when selling investments to maximize your losses and minimize gains.

Choose the stocks that you’ve purchased 365 days or before one year. Check their current prices. And if they are running in profits, then you can sell those shares and harvest your tax.

While harvesting you have to bear in mind that you must have enough liquidity in your account that when you sell that stock, you should have enough money to buy back the shares immediately.

When you sell the stocks, the money does not get credited to your account on the same day.T+1 or T+2, one or two days later the amount gets credited to your account.

In such a case, if you do not have current liquidity, And after two days, if the share price which is Rs 100 today becomes Rs 110, you will unnecessarily end up incurring a loss.

Because you sold the shares for Rs 100 you have to buy them back for Rs 110. You must never fall into a situation like that.

So the ideal condition is that, assume you have to sell 10 stocks, Before that place a buy order for 10 shares after placing the buy order, at the same rate place a sell order for 10 shares.

And when will you do this task? This task would be done during the market hours that is between 9.15 AM to 3.30 PM.

Later on, if you do and place the AMO etc., You would not know at what price it will open and close. So you must not take this risk.

Taking care of Exit load in case of Mutual Funds:

What is Exit Load? Many mutual fund companies, avoid the selling of their mutual funds especially in a short duration. Hence they apply an exit load on its sales.

Assume you plan to sell a mutual fund before one year, then you will be charged with 1% of the Exit Load. Meaning whatever amount you get from its sales, the mutual fund company will deduct 1% of it as exit load.

So, I personally choose to invest in those mutual funds in which after 365 days there is no exit load as such. Or after one year there is no exit load on its sales.

But in some good mutual funds, there is an exit load of up to 2 years or even 3 years. In some mutual funds, there is always an exit load attached.

So please pay attention to this fact. It must not happen that while doing tax harvesting, you get charged with an exit load.

In 99% of the cases, generally after one year, the equity mutual funds don’t have an exit load. But in a few mutual funds, it is applicable.

And in case you have invested in such mutual funds, then be cautious while tax harvesting in such cases. If your app is not automatically filtering out those mutual funds.

Also, Read | Limitations of Mutual Funds: Understanding Cash Position and Managing Large Sums

Stay Informed: Stay updated on tax laws and regulations, as changes can impact your tax harvesting strategy.

What is Tax-loss harvesting in India?

Now understand What is Tax-loss harvesting in India.

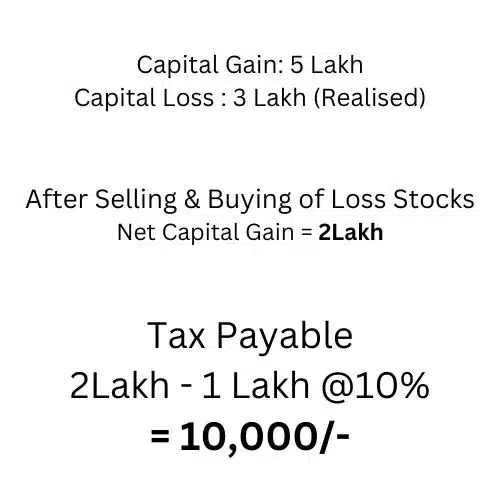

Suppose in any financial year, you get a capital gain of Rs 5 lakh. Which means you will have to pay a 10% tax on it.

But you have certain scripts or stocks, in which you have incurred an unrealized loss of around Rs 3 lakh And you want to hold these stocks for a long term, And you also do not want to pay this much taxes on them.

Then what you have to do is, Somewhere around the month of March, sell these stocks, and immediately purchase them back at the same price.

See this video for clear understanding………

That unrealized loss of Rs 3 lakh now becomes a ‘realized loss’. Now what you can do is, with this Rs 5 lakh of capital gain, you can offset it with a loss of Rs 3 lakh And so your net capital gain would become Rs 2 lakh.

And within that, if you use the Rs 1 lakh limit, then they would have to pay the tax on just Rs 1 lakh. This is called the Tax Loss Harvesting.

You will have to bear one thing in mind here. You can offset a long-term capital loss against long-term capital gain, But a short-term capital loss can be offset against both short-term and long-term capital gain. You can offset it against any of the two.

And ultimately the tax that you need to pay, will be paid on the difference amount. That is on the net capital gain that you have incurred.

Another interesting point to note here is this long-term or short-term capital loss here, isn’t necessary to be booked against equity only.

You can book equity and debt against equity or debt against equity, or equity against debt, you may do anything like that. And accordingly, you may optimize your tax.

FAQs: Tax Harvesting

What is tax harvesting, for example?

Tax harvesting, for example, is a strategy used by investors to minimize their tax liability on investments. It involves selling investments that are at a loss to offset capital gains, thereby reducing the overall taxable income. For instance, if you have stocks that have decreased in value, you can sell them at a loss to lower your tax bill on other profitable investments.

What is tax harvesting in India?

In India, you have to pay a 10% capital gain tax on more than 1 lakh profit. But using some tax harvesting Techniques you can save a lot of tax as harvesting follows a similar principle as in other countries.

Is tax harvesting worth it in India?

Yes, tax harvesting is worth doing in India. Because this is legal in India, Using tax harvesting techniques you can offset your losses against profit potentially leading to higher after-tax returns.

Is tax harvesting legal in India?

Absolutely. Tax harvesting is a legitimate and legal strategy in India to minimize tax liabilities.

How does tax harvesting work?

Tax harvesting involves selling investments at a loss to offset capital gains, reducing your taxable income.

Is tax harvesting beneficial?

Tax harvesting can be highly beneficial for investors looking to minimize tax liabilities and optimize their investment portfolios. It allows you to reduce taxes on capital gains, potentially leading to higher after-tax returns.

Conclusion

The Stock market tax harvesting guide provides investors with a powerful tool to legally reduce their tax liability on stock market income.

By understanding the fundamentals of tax harvesting, employing effective strategies, and staying informed about tax regulations, you can optimize your investment portfolio and maximize your after-tax returns.

Remember to consult with a qualified tax professional or financial advisor to tailor your tax harvesting strategy to your specific financial goals.

With proper execution, tax harvesting can help you keep more of your hard-earned money while staying in compliance with the law.