What is an Investment Strategy?

The Investment Strategy is defined as a time-tested strategic action plan to achieve your financial goal.

“Investment strategy is much more important than individual investment decisions.” – David Dreman

Here David Dreman says that we should not solely focus on our investment choices but also we should focus on investment methodology or investment strategy.

When it comes to growing your money, one of the smartest choices you can make is investing. However, investing isn’t just about buying any investment instrument and then holding it.

It involves selecting the right investment strategy to help you reach your financial goals. In this article, we will explore various types of investment strategies so you can start your investment journey with confidence.

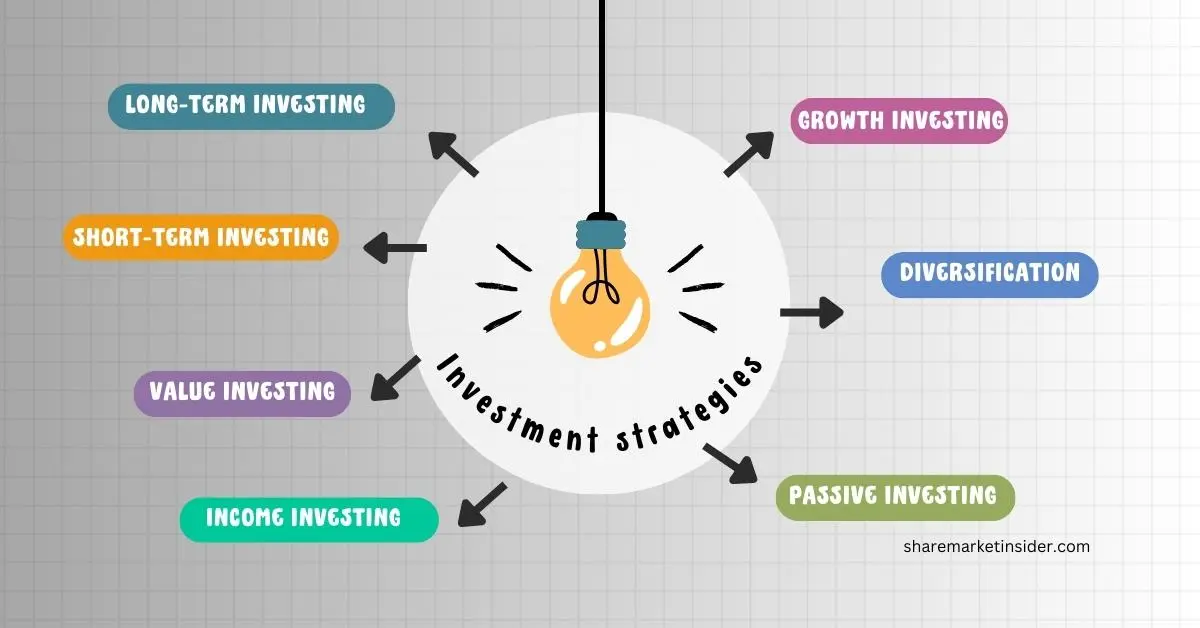

Types of Investment Strategies

Investing in the share market can be risky and to reduce this risk you should have to follow some time-tested approaches to make your investment worthy and achieve your desired financial goal.

Here are some investment styles you must use as per your financial goal.

Long-Term Investing

Long-term investing is like planting a tree and watching it grow over the years. It involves purchasing assets like stocks, real estate, or mutual funds with the intention of holding onto them for an extended period.

This strategy often offers more significant returns over time and is less affected by short-term market fluctuations.

In this strategy, you will get most of the benefit from the power of compounding.

Warren Buffett has said, “My wealth has come from a combination of living in America, some lucky genes, and compound interest.”

Short-Term Investing

If you want quicker results, short-term investing may be your choice. This strategy focuses on buying and selling assets within a short time frame, often taking advantage of market fluctuations.

Day trading and swing trading can be considered as short-term investment approaches.

But remember that this approach of investing can be riskier and requires experience in the share market and a deep understanding of market movements.

Value Investing

Value investors are like bargain hunters. They look for stocks or assets that are undervalued or the stocks that are good companies but the market has not recognized their true potential yet meaning they believe the current market price doesn’t reflect the true worth of the investment.

By purchasing undervalued assets and holding onto them until their value increases, value investors aim to make a profit.

Income Investing

Income investing is like creating a source of income that generates income consistently for regular intervals.

People who follow this strategy often invest in dividend-paying stocks, bonds, or real estate investment trusts (REITs).

These investments pay out regular dividends or interest, providing a steady income for the investor.

Growth Investing

Growth investors want to find out the companies that have the potential for fast expansion.

They invest in stocks of companies expected to experience significant growth in the future.

While this strategy can be rewarding, it comes with more risk, as not all growth-focused companies succeed.

The opportunity for growth investing is mostly found in small-cap to medium-cap companies as large-cap companies have already succeeded so large-cap companies don’t have much space for larger growth in a short span of time.

Diversification

Diversification is not exactly an investment strategy on its own, but it’s a crucial concept in investing.

It involves spreading your investments across different asset classes (like stocks, bonds, and real estate) to reduce risk.

By not putting all your eggs in one basket, you can safeguard your investments against market downturns.

Passive Investing

Passive investing, often associated with index funds and exchange-traded funds (ETFs), aims to replicate the performance of a specific market index.

This strategy is popular because it tends to have lower fees and is less time-intensive. It’s a hands-off approach for those who want to invest without actively managing their portfolio.

This investment approach is good for them lacking share market knowledge or a person just entering into share market investing.

Choosing an Investment Strategy

Here are some key factors you must consider before choosing your investment strategy:

Risk Tolerance:

Investors should assess their risk tolerance level before putting their hard-earned money into the share market, risk tolerance refers to your comfort level with the potential ups and downs in the value of your investments.

A higher risk tolerance might allow for more aggressive investment strategies, while a lower risk tolerance may require a more conservative approach.

Time Horizon:

Determine your investment time horizon or the length of time you plan to invest before needing the funds.

If you can wait for your money to get back in your bank account you can choose a longer time horizon in which you can choose investments with high risk but also high return in the long run, while a shorter time horizon might require a more conservative approach to protect capital.

Investment Goals:

Before choosing any investment style you should clearly define your investment goals, whether they are focused on capital appreciation, income generation, wealth preservation, or a combination of these.

Your goals will help you to choose the right type of investment strategy and asset allocation decisions.

Diversification:

Consider diversifying your investments across various asset classes, industries, and geographic regions to reduce overall portfolio risk.

Diversification will help you protect your capital in adverse market conditions or from the negative impact of any single investment or market sector.

Market Conditions:

Keep yourself updated about current market conditions and economic trends that might influence the performance of different asset classes.

Timely adjust your investment strategy in response to market fluctuations and changes in the economic environment.

Investment Knowledge:

Evaluate your understanding of different investment options and strategies. It’s essential to invest in assets you understand and are comfortable with to make informed decisions and manage risks effectively.

Tax Implications:

Be aware of the tax implications associated with different investment strategies and asset types. Consider tax-efficient investment options and account structures to optimize your after-tax returns.

Learn the basics of tax calculation and how you can save these taxes from share market income.

Fees and Expenses:

When you buy or sell in the share market you have to pay some transaction charges which you should have to know before making an investment.

Evaluate the fees and expenses associated with different investment products and services. Minimize costs where possible to maximize your investment returns over the long term.

Liquidity Needs:

Consider your liquidity needs, including any upcoming financial obligations or emergencies that may require access to cash.

Ensure that your investment strategy allows for the necessary liquidity without significant penalties or restrictions.

Some investments allow you to withdraw your invested funds with low to no extra charges but some investments demand some percentage of funds before letting you exit that fund. So before entering into any investment keep these things in mind.

Regular Review:

Regularly review and monitor your investment portfolio’s performance and make necessary adjustments to ensure that your investments remain aligned with your financial goals and risk tolerance.

Investment Strategy Process

Investing can be a rewarding way to grow your wealth over time, but it’s important to approach it with a well-thought-out strategy.

Here’s a step-by-step guide to help beginners create an investment strategy process:

Set Clear Goals:

The very first step is to define your financial objectives as well as how long can invest your money.

Determine whether you’re investing for retirement, a down payment, or other specific goals.

Understand Risk Tolerance:

Assess your willingness to take risks based on your age, financial situation, and comfort level with market fluctuations.

Diversify Your Portfolio:

Make sure to spread your investments across different asset classes, such as stocks, bonds, and real estate, to mitigate risk.

Invest Regularly:

Consistently contribute to your investment portfolio, taking advantage of dollar-cost averaging to smooth out market fluctuations.

Monitor and Rebalance:

You must review your portfolio’s performance at regular intervals and make necessary adjustments if needed to maintain your desired asset allocation and risk level.

Final Words

Understanding the various investment strategies is the first step to becoming a successful investor.

Whether you prefer a long-term, short-term, or income-focused approach, there’s a strategy that can align with your financial goals and risk tolerance.

Remember, it’s essential to conduct thorough research and, if possible, seek advice from financial professionals before making any investment decisions.

By diversifying your investments and staying informed, you can work towards building a more secure financial future. Happy investing!