The bearish engulfing candlestick pattern is a popular signal, most traders use this to predict the potential reversals in the stock or forex market.

It’s often considered a warning that an upward trend may end and that a price drop could happen anytime soon.

Here, I’ll explain what the pattern looks like, how it works, and why it’s important.

What is a Bearish Engulfing Candlestick Pattern?

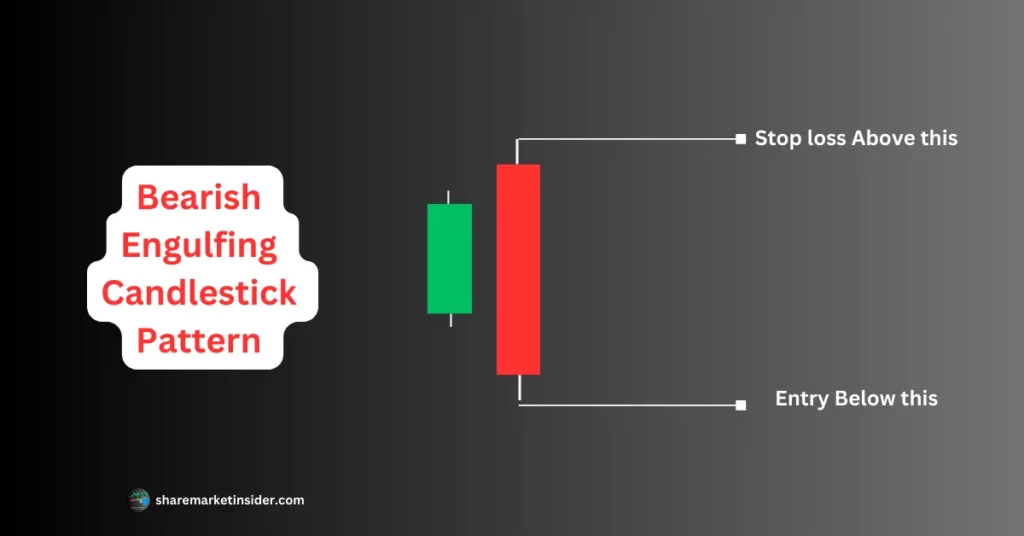

A bearish engulfing pattern forms when two specific candlesticks appear on a price chart. It shows up at the top of an uptrend and signals a possible trend reversal. Here’s what it looks like:

- First candlestick: The first candlestick is bullish, meaning the price closed higher than it opened, showing buyers were in control.

- Second candlestick: The second candlestick is bearish and much larger, completely “engulfing” the previous bullish candle. This indicates that sellers have stepped in strongly, overpowering the buyers.

The name “engulfing” comes from how the second candle completely surrounds the first one, signaling that the market sentiment has shifted from bullish (buying) to bearish (selling).

How Does the Bearish Engulfing Pattern Work?

The bearish engulfing pattern typically forms at the end of an uptrend. It signals that sellers are gaining control and the price may drop. Here’s how traders interpret this pattern:

- The uptrend in progress: The market is in an upward trend, with prices steadily rising as buyers dominate.

- Bearish engulfing candle forms: A small bullish candle is followed by a large bearish candle that completely engulfs the previous one.

- Market sentiment shifts: The large bearish candle suggests that selling pressure has increased significantly, and the trend might reverse downward.

This pattern shows that even though the buyers were in control initially, the sellers have come in stronger, suggesting the potential possibility for a price reversal.

Why is the Bearish Engulfing Pattern Important?

For traders, the bearish engulfing pattern is a key reversal signal. When spotted at the top of an uptrend, it can indicate that the price is about to drop. Here are some reasons why this pattern matters:

- Early warning of a trend reversal: The pattern is often seen as a sign that the bulls (buyers) are losing strength, and the bears (sellers) are taking over. It can help traders exit their long positions (buy trades) or prepare for short trades (sell positions).

- High reliability: Compared to other candlestick patterns, the bearish engulfing pattern is considered relatively reliable in indicating potential reversals, especially when confirmed with other technical indicators like moving averages or RSI (Relative Strength Index).

- Simple to spot: The pattern is easy to identify on a chart, even for beginners. All it requires is recognizing the two-candle formation where the second candle engulfs the first.

How to Trade the Bearish Engulfing Pattern

Trading the bearish engulfing pattern can be a straightforward strategy. Here are the basic steps to follow:

- Identify the pattern: Look for the bearish engulfing pattern at the end of an uptrend. Make sure the second candle fully engulfs the first.

- Confirm with other indicators: Before jumping into a trade, use other indicators like the RSI or moving averages to confirm the pattern’s strength.

- Enter the trade: Once the pattern is confirmed, you can enter a short (sell) position. Entry must be once the price crosses the low of the red candle. For stop-loss, place it above the red candle’s high.

- Exit the trade: Set a target for your exit. You can use support levels, Fibonacci retracement, or other methods to find a good point to close your trade and lock in profits.

Note: In my personal experience bearish engulfing candlestick pattern works best when it forms near the resistance or supply zone.

Key Points to Remember

- The bearish engulfing pattern forms after an uptrend and signals a potential reversal to the downside.

- The second (bearish) candle must fully engulf the first (bullish) candle for the pattern to be valid.

- It’s a high-reliability pattern when confirmed with other technical indicators.

- Always use risk management strategies like setting stop losses to protect your trades.

Conclusion

The bearish engulfing candlestick pattern is a powerful tool for traders looking to predict market reversals.

By understanding how to spot and trade this pattern, you can make more informed decisions when the market is about to shift.

Remember, no pattern is foolproof, so it’s always important to use additional analysis and proper risk management when trading.

By mastering the bearish engulfing pattern, you can add a valuable signal to your trading strategy and better navigate the ups and downs of the market.

Happy trading!

Also, Read | Bullish Engulfing Candlestick Pattern