Market Overview

In a significant development for the fintech sector, Paytm has received the green light from the National Payments Corporation of India (NPCI) to onboard new Unified Payments Interface (UPI) users.

This approval comes nearly nine months after the Reserve Bank of India (RBI) imposed restrictions on Paytm Payments Bank Ltd. (PPBL), hindering its ability to add new customers.

As a result, Paytm’s market share in the UPI ecosystem has seen a sharp decline from 13% in January to approximately 7% in September.

This new directive could mark a pivotal shift in Paytm’s operational dynamics and overall market strategy.

Impact on Investors

The NPCI’s approval is poised to revive Paytm’s user base, which has suffered from regulatory constraints and a dip in transaction volumes.

For investors, this news is a breath of fresh air, signaling a potential turnaround for one of India’s leading fintech companies.

Key Takeaways:

- Market Share Recovery: Paytm’s approval to onboard new UPI users could help reclaim lost market share and increase transaction volumes.

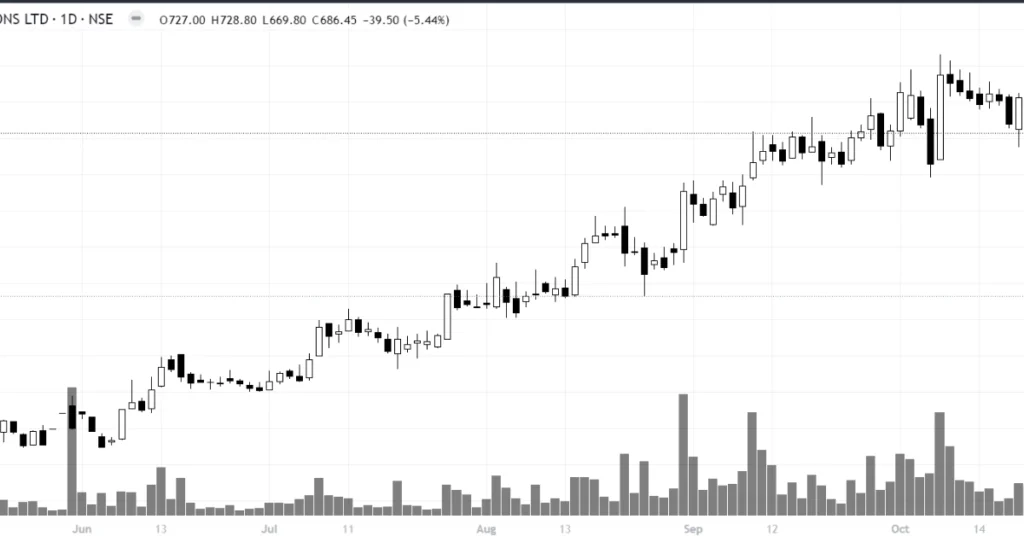

- Stock Performance: Following the announcement, Paytm’s shares experienced volatility, closing at ₹687.30 apiece, reflecting a 5.31% decline. Investors will need to monitor stock fluctuations closely in light of this new development.

- Long-term Outlook: Analysts are optimistic about Paytm’s long-term trajectory, with expectations of profitability by FY26E/FY27E, contingent on regaining user engagement and addressing past compliance issues.

Future Outlook

Looking ahead, the potential for Paytm to recover its foothold in the digital payments market is promising, but it is not without risks. Analysts emphasize that a sustained recovery will depend on several factors, including:

- User Migration: Successfully transitioning existing users to a new handle without further regulatory disruptions.

- Partnership Strength: Strengthening relationships with Payment Service Provider (PSP) banks, including SBI, HDFC, Axis, and YES Bank, to facilitate seamless onboarding.

- Regulatory Landscape: Continued scrutiny from regulators could impact operational flexibility and growth.

Key Opportunities:

- Increased UPI Transactions: With new user onboarding, Paytm could see a significant boost in UPI transaction volumes.

- Diverse Revenue Streams: A focus on financial services could provide a robust revenue stream beyond core digital payments.

Opinions:

“Paytm’s recent approval marks a critical juncture in its quest for user growth. The company’s cost optimization efforts and strategic turnaround plan are essential for regaining market confidence.”

“Investors should remain vigilant as the landscape evolves. Paytm’s recovery will hinge on its ability to navigate regulatory challenges and strengthen user engagement.”

Bottom Line:

The market will keenly observe Paytm’s strategies to reclaim its user base and enhance profitability. Investors are encouraged to stay informed about upcoming earnings reports and shifts in the digital payments sector, as these factors could significantly influence investment strategies.

Summary Table of Key Metrics

| Metric | Q2 FY25 Data |

| Paytm Share Price | ₹687.30 |

| UPI Market Share (Jan 2024) | 13% |

| UPI Market Share (Sep 2024) | 7% |

| Net Profit (Q2 FY25) | ₹930 crore |

| Revenue Growth (QoQ) | 11% |