In a major development in India’s tech and food delivery landscape, Swiggy is set to debut in the stock market with a highly anticipated Initial Public Offering (IPO) in early November.

With plans to raise nearly ₹11,300 crore (approximately $1.35 billion), this move is significant for investors in emerging markets, particularly in tech-driven sectors.

Let’s explore what this IPO means for investors, Swiggy’s strategies, and the broader market implications.

Market Overview: Swiggy’s Position in the Competitive Food Tech Sector

Swiggy’s IPO has been valued at around $11.2 billion, a slight decrease from its initial target of $15 billion, reflecting current market conditions.

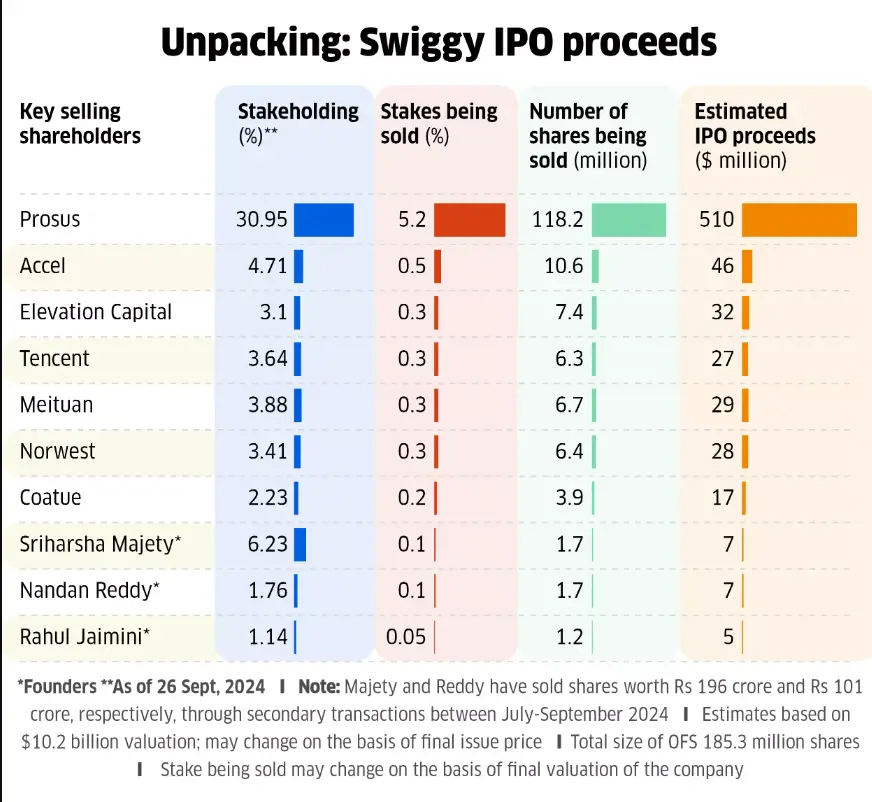

The IPO will include a secondary share sale, offering existing investors an exit opportunity, and a primary capital raise. Prominent investors, such as BlackRock, the Canada Pension Plan Investment Board (CPPIB), and SBI Mutual Fund, are expected to participate, making this one of India’s largest public issues of 2024.

This IPO arrives as India’s food delivery sector experiences rapid evolution, fueled by increasing demand for convenient dining solutions and quick commerce options.

With rivals like Zomato and the rise of fast-growing grocery delivery services, Swiggy’s entry into the stock market marks a pivotal moment, inviting fresh capital that could influence its competitive approach.

Also, Read | Zomato and Swiggy Raise Platform Fees: Analyzing the Impact on the Indian Food Delivery Market and Investor Sentiment

Key Metrics Table for Swiggy’s IPO:

| IPO Details | Amount (₹) | USD Equivalent |

| Total Capital Raise | ₹11,300 crore | $1.35 billion |

| Offer for Sale (OFS) | ₹6,800 crore | $810 million |

| Fresh Equity Issue | ₹4,500 crore | $540 million |

| Estimated Valuation | ₹11.2 billion | $11.2 billion |

Impact on Investors: Opportunities and Potential Risks

Swiggy’s IPO could offer investors exposure to India’s rapidly growing online services market, which has witnessed steady expansion even amid global economic challenges. Here’s what potential investors should consider:

- Sector Opportunities: India’s food delivery sector is forecasted to grow significantly over the next few years, driven by the country’s urban population, rising smartphone usage, and improved digital payments ecosystem.

- Long-Term Revenue Potential: Swiggy plans to allocate a substantial portion of the IPO funds to technology infrastructure, brand-building, and the expansion of its subsidiary, Scootsy. This long-term investment in operational efficiency and scalability might lead to revenue growth.

- Risk Factors: The IPO valuation was cut from $15 billion to $11.2 billion in response to volatile market conditions and cooling investor interest post-IPO for several high-profile tech companies. Investors should keep an eye on potential challenges, including high operational costs and competition from players like Zomato, which have shifted focus to profitability.

Future Outlook: Growth Strategies and Competitive Landscape

Following Zomato’s IPO in 2021, Swiggy’s IPO is poised to strengthen its position as a tech-forward food delivery leader. The company is expected to channel IPO proceeds toward building a sustainable and scalable business model, with a core focus on:

- Technology and Cloud Infrastructure: Investments in cloud capabilities and data-driven insights could support Swiggy’s quest for operational efficiency, aiding in better delivery logistics and customer experience.

- Advertising & Brand Building: Given the competitive pressure in the quick commerce and food delivery sector, Swiggy’s targeted approach to branding and marketing is likely to enhance user engagement and expand its customer base.

- Expansion of Quick Commerce Services: Swiggy will look to enhance its grocery delivery options through partnerships and possible acquisitions, positioning itself to compete with Zomato-owned Blinkit, Zepto, and Tata’s BigBasket.

This strategy closely mirrors that of Zomato, which prioritized profitability post-IPO, successfully pivoting from growth-driven tactics to profit-focused initiatives.

Opinions: Will Swiggy Follow Zomato’s Path to Profitability?

Industry experts believe Swiggy is likely to adopt a strategic approach similar to Zomato’s, where initial growth-driven expenses give way to targeted efforts toward profitability.

Swiggy’s decision to reduce promotional spending post-IPO could help improve its EBITDA, a key financial metric, by trimming non-essential costs.

We’ve seen Zomato’s focus on EBITDA bear fruit, and Swiggy will likely adopt a similar strategy as it enters the public market.

As Swiggy scales, efficient cost management will be crucial to sustain investor confidence and drive long-term value.

Bottom line

For investors eyeing the tech-driven consumer sector, Swiggy’s IPO presents a unique opportunity.

However, the company’s ability to maintain growth while moving toward profitability will be key to its market valuation post-IPO.

For investors considering Swiggy’s IPO, staying informed on emerging market trends and understanding the potential impact of IPOs on tech stocks is essential.

Explore more insights and subscribe to our newsletter for updates on market analysis and the latest economic reports.