Diversification—have you ever heard this term? It’s the cornerstone of a popular adage, “Don’t put all your eggs in one basket,” and an essential strategy in the world of finance.

While it might sound like an intimidating concept, diversification simply means spreading your investments across various assets.

And the best part? It’s not just for seasoned investors; anyone, whether saving for your child’s education, planning your dream retirement, or aiming to grow wealth steadily, can benefit from this approach.

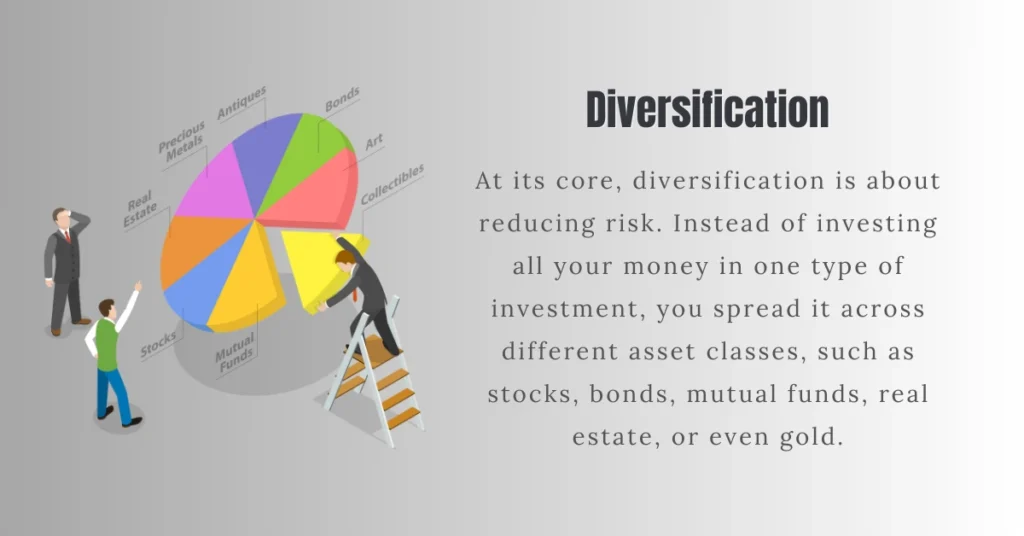

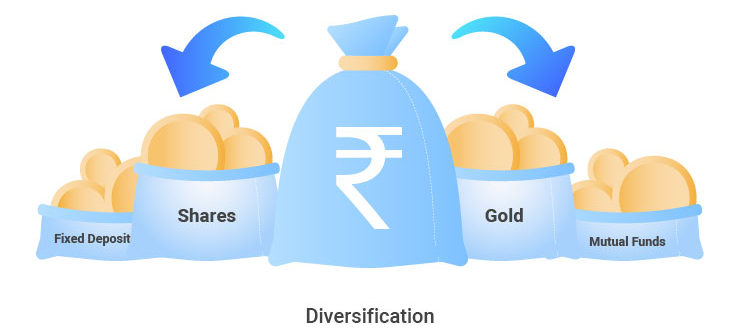

What Is Diversification?

At its core, diversification is about reducing risk. Instead of investing all your money in one type of investment, you spread it across different asset classes, such as stocks, bonds, mutual funds, real estate, or even gold.

Think of it as a cricket team. You wouldn’t want a team made up entirely of bowlers, right? You need batsmen, all-rounders, and a strong wicketkeeper to win the match.

Similarly, diversification ensures your investment “team” performs well, even if one player underperforms.

Why Should You Diversify?

Let’s be honest—India’s financial market can be unpredictable. From stock market fluctuations to inflation and geopolitical events, risks are everywhere. Diversification helps you stay prepared.

1. Minimize Risk, Maximize Returns

Imagine you invested all your money in a single company’s stock. If the company thrives, you win big. But if it falters, your entire investment could be wiped out. Diversification cushions these blows by spreading your risk.

2. Capitalize on Market Opportunities

Different assets perform differently depending on market conditions. For example:

- Equities can offer high returns, but they’re volatile.

- Bonds are more stable, offering steady income.

- Gold often shines during economic uncertainty.

By diversifying, you can enjoy the best of all worlds.

3. Stay Emotionally Grounded

Let’s face it—investing can be nerve-wracking. Diversification helps reduce anxiety by stabilizing your portfolio. If one investment dips, another might rise, keeping you from making hasty, emotion-driven decisions.

How to Build a Diversified Portfolio

Building a diversified portfolio is a fundamental step toward achieving financial security and growth. While it may seem complex, following a structured approach makes it straightforward. Here’s how to get started:

1. Understand Your Goals

Your investment strategy begins with defining your objectives:

- Short-term goals: Are you saving for a car, vacation, or emergency fund? These goals require safer, low-volatility investments like bonds or fixed deposits.

- Long-term goals: Planning for retirement, a house, or your child’s education? Long-term goals allow you to take on higher risks with equities or real estate for better returns over time.

Assess your risk tolerance, financial situation, and timeline to align your investments with your goals.

2. Mix Asset Classes

Combining different types of assets is at the heart of diversification. Each class behaves differently in market conditions, balancing your portfolio’s performance:

- Stocks: Offer high growth potential but come with higher risk. Focus on a mix of large-cap, mid-cap, and small-cap companies for better balance.

- Bonds: Provide stability and predictable returns, acting as a cushion during market downturns.

- Real Estate: A tangible asset that often appreciates over time and provides income through rent. REITs (Real Estate Investment Trusts) are another option for indirect exposure.

- Precious Metals: Gold and silver act as a hedge against inflation and economic uncertainty.

- Mutual Funds/ETFs: Offer instant diversification through professional management. Index funds or thematic ETFs can help you gain exposure to specific markets or trends.

Also, Read | Differences Between ETF, Index Fund, and Mutual Fund

3. Consider Geographical Diversification

Relying solely on domestic markets can expose your portfolio to local economic challenges. Add global exposure for greater stability:

- Why go global? Other markets may outperform when domestic markets struggle.

- How to diversify globally: Explore international mutual funds, ETFs, or direct investment in foreign stocks. Emerging and developed markets can provide unique opportunities.

For example, adding U.S. technology stocks or Asian growth markets can diversify risk while capitalizing on growth in different economies.

4. Don’t Ignore Sectoral Diversification

Sectoral diversification ensures you’re not overexposed to the ups and downs of a single industry.

- Why it matters: Different sectors react differently to economic cycles. For example:

- Tech may thrive during innovation booms but falter during regulatory crackdowns.

- Pharmaceuticals often do well regardless of economic conditions.

- FMCG remains stable due to consistent consumer demand.

Invest in a mix of sectors that complement each other to protect your portfolio against sector-specific downturns.

5. Regularly Rebalance Your Portfolio

Your portfolio isn’t static; market conditions and personal goals evolve. Regular rebalancing ensures your investments align with your risk tolerance and objectives:

- How often? Review quarterly annually, or after significant life events.

- What to adjust? If stocks outperform and occupy a larger share of your portfolio than intended, sell some and reinvest in bonds or other underrepresented asset classes.

6. Monitor Costs and Taxes

- Investment fees: Opt for low-cost options like index funds to maximize returns.

- Tax efficiency: Be aware of tax implications for dividends, capital gains, and interest. Utilize tax-saving instruments where applicable.

7. Stay Educated and Patient

Markets fluctuate, but a diversified portfolio protects you from extreme volatility. Stay informed about economic trends and resist impulsive decisions driven by market emotions.

By following these steps, you’ll be well on your way to creating a robust, diversified portfolio that supports your financial aspirations.

Common Mistakes to Avoid

Even the most diligent investors can make missteps. Being aware of common pitfalls helps you avoid costly errors and maintain a well-structured portfolio. Here are some common mistakes to avoid:

1. Over-Diversification

While spreading your investments is important, doing it too much can hurt your returns.

- Why it’s a problem: Over-diversifying dilutes potential returns because no single investment contributes significantly to your portfolio’s growth.

- What to do instead: Focus on a balanced mix of quality investments. Choose assets that complement each other rather than accumulating too many similar ones.

2. Neglecting to Review

Your portfolio needs ongoing attention to stay effective.

- Why it matters: Markets change, and so do your personal goals. What worked last year may no longer align with your risk tolerance or financial needs.

- What to do:

- Schedule regular reviews (quarterly or annually).

- Adjust allocations if any asset class or sector becomes overrepresented.

- Reassess after major life events like marriage, a new job, or nearing retirement.

3. Chasing Trends

Chasing the latest investment trend without proper research can result in bad choices.

- Why it’s risky: Trends often signal inflated values, leading to potential losses when the hype subsides. For instance, buying overhyped stocks or cryptocurrencies at their peak can erode wealth.

- What to do: Stick to your strategy and avoid the fear of missing out (FOMO). If you’re interested in a trending asset, allocate only a small, calculated portion of your portfolio after diligent research.

4. Ignoring Costs and Fees

High investment costs can silently eat into your returns over time.

- Why it matters: Expense ratios, transaction fees, and hidden charges reduce your net gains.

- What to do: Opt for low-cost investment options like index funds and ETFs. Be mindful of trading frequency to avoid unnecessary transaction fees.

5. Letting Emotions Drive Decisions

Letting emotions take over during market ups and downs can disrupt your long-term plan.

- Why it’s a mistake: Panic selling during downturns locks in losses, while overconfidence during booms can lead to risky bets.

- What to do:

- Maintain a disciplined, long-term perspective.

- Avoid impulsive decisions driven by short-term market noise.

6. Underestimating Risk

Ignoring the risk associated with certain investments can lead to unpleasant surprises.

- Why it’s a problem: High-reward investments often carry significant risks. Without understanding this balance, you may expose your portfolio to undue volatility.

- What to do: Assess risk tolerance carefully and ensure your portfolio has a mix of safer assets like bonds to cushion against volatility.

7. Failing to Diversify

On the flip side, concentrating too heavily on one asset class, sector, or geography can amplify risk.

- Why it’s dangerous: A lack of diversification makes your portfolio vulnerable to sector-specific or regional economic downturns.

- What to do: Balance exposure across multiple asset classes, sectors, and geographies to minimize risk.

Final Thoughts: Is Diversification Right for You?

Absolutely. Whether you’re a cautious investor or someone who loves taking risks, diversification is a strategy that can adapt to your style.

It’s like adding masala to your dal—just the right mix enhances the flavor (and in this case, your returns!).

Start small. Talk to an advisor if needed. Remember, it’s not about avoiding risk altogether but managing it wisely. So, are you ready to diversify and secure your financial future?

Also, Read | Diversification: Building a Balanced Portfolio for Long-Term Success