Have you ever watched a stock skyrocket and thought, “I should’ve invested in that”? Or maybe you’ve jumped into a trade just because everyone else was talking about it, only to regret it later.

This feeling—the Fear of Missing Out (FOMO)—is common among investors. It’s a powerful emotion that can cloud judgment and lead to impulsive decisions in the fast-paced stock market world.

Here, we’ll explore FOMO in the stock market, how it affects your investment strategy and actionable ways to overcome it.

What Is Fear of Missing Out in the Stock Market?

Fear of Missing Out in the stock market is the anxiety or regret that arises when investors see others profiting from a stock or trade they didn’t participate in.

It’s the nagging thought that you’re missing a golden opportunity while everyone else seems to be cashing in.

Why Does FOMO Happen?

- Herd Mentality: People often follow the crowd, believing that if others are investing in something, it must be a good idea.

- Social Media and News Hype: Platforms like Twitter, Reddit, and financial news channels can amplify success stories, making investors feel like they’re late to the party.

- Greed and Regret: The stock market is inherently tied to money, and the fear of losing potential profits can overpower rational thinking.

The Science Behind FOMO

- Neuroscience: FOMO is rooted in our brain’s reward system. When we perceive others enjoying something, our brain releases dopamine, making us crave the same experience.

- Psychology: Research shows that FOMO often stems from insecurities, low self-esteem, or the innate desire to belong.

In a 2013 study published in Computers in Human Behavior, researchers found that frequent social media use is directly linked to higher levels of FOMO. Sound familiar? source.

How FOMO Impacts Investment Decisions

FOMO isn’t just a passing feeling—it can significantly influence your actions in the market. Here’s how:

1. Chasing Overhyped Stocks

FOMO often drives investors to buy into stocks that are already overpriced, hoping they’ll continue to rise. This can lead to losses if the stock experiences a sudden correction.

Example: During the GameStop frenzy in early 2021, many investors jumped in at the peak, driven by FOMO, only to see the stock’s value plummet shortly afterward.

2. Overtrading

Constantly jumping in and out of trades out of fear of missing the next big thing can rack up transaction fees and dilute returns. It also leads to emotional burnout.

3. Ignoring Fundamentals

FOMO can make you overlook a company’s financial health, business model, or industry outlook, focusing solely on the stock’s recent performance.

Quick fact: According to a study by DALBAR, the average investor significantly underperforms the market due to emotional decision-making, including FOMO.

Also, Read | EIC Analysis of a Company: A Comprehensive Guide for Investors

How to Overcome Fear of Missing Out in the Stock Market

The good news? FOMO can be managed. Here’s how to stay level-headed when the market tempts you to act impulsively:

1. Have a Clear Investment Plan

Set defined goals, whether it’s long-term wealth building, retirement savings, or short-term trading. When you know what you’re aiming for, it’s easier to ignore distractions.

2. Stick to Your Strategy

Develop a strategy that aligns with your risk tolerance and financial goals. Whether you prefer value investing, growth stocks, or index funds, sticking to your plan helps you resist impulsive decisions.

Pro Tip: Use tools like stop-loss orders and automated investing to remove emotion from the equation.

3. Focus on Fundamentals

Before buying any stock, ask yourself:

- Does this company have strong financials?

- Is the valuation reasonable?

- Does it fit my investment thesis?

By prioritizing due diligence over hype, you’ll make more informed decisions.

Also, Read | How to Conduct Fundamental Analysis for Stock Selection: 10 key points

The constant stream of market chatter on social media can amplify FOMO. Set boundaries around your screen time and focus on trusted sources for market analysis.

5. Embrace JOMO (Joy of Missing Out)

Not every stock is a good fit for your portfolio, and that’s okay. Missing out on one opportunity doesn’t mean you’ve lost—there will always be other opportunities.

Think about this: Warren Buffett famously avoided the dot-com bubble, missing out on short-term gains, but ultimately protecting his portfolio from the crash.

Why Addressing FOMO in the Stock Market Is Important

Fear of Missing Out (FOMO) might seem harmless at first glance—a fleeting emotion tied to market trends or the latest stock everyone’s buzzing about.

But if left unchecked, FOMO can significantly undermine your long-term investment success. Here’s how:

1. Higher Risk: The Danger of Overleveraging or Speculative Investing

When FOMO strikes, logic often takes a backseat to emotion. You may feel tempted to pour money into speculative assets, like volatile meme stocks or cryptocurrencies, hoping to catch the next big wave.

Worse, some investors overleverage themselves, borrowing money to maximize potential gains.

This approach is inherently risky:

- Speculative investments are often driven by hype, not fundamentals.

- Overleveraging can amplify losses, leaving investors in financial distress if the market turns against them.

Example: During the cryptocurrency boom, many novice investors took out loans to buy digital assets at peak prices, only to face heavy losses when the market corrected.

2. Lower Returns: Chasing Trends Rarely Pays Off

One of the biggest traps of FOMO is chasing stocks that have already surged in value. By the time you join the crowd, the opportunity for substantial gains is often gone, and you risk buying at inflated prices.

This behavior, called “buying high,” can result in poor returns.

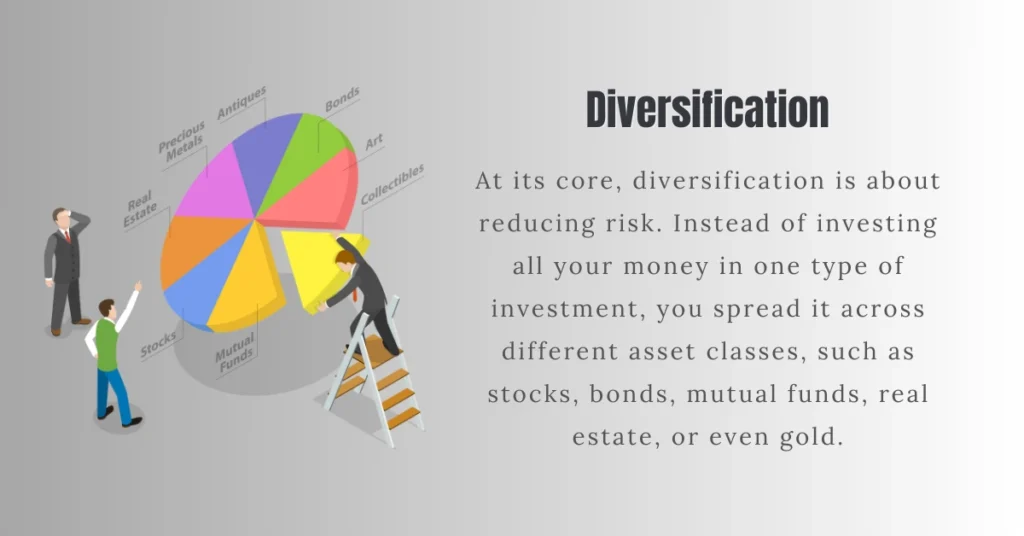

Consider this: Research shows that long-term investment success depends more on disciplined strategies, like dollar-cost averaging or diversified portfolios, than on timing the market.

When FOMO drives decisions, you’re more likely to miss the bigger picture and underperform in the long run.

3. Increased Stress: The Psychological Toll of FOMO

The emotional side effects of FOMO extend beyond financial losses. Constantly monitoring the market, obsessively checking social media for the latest trends, and comparing your portfolio to others can lead to:

- Anxiety about making the wrong decision.

- Regret over missed opportunities.

- Burnout from the relentless pace of reactive investing.

This stress doesn’t just harm your mental well-being; it can also impair your judgment, creating a vicious cycle of poor decisions driven by heightened emotions.

Quick Tip: Recognizing that the market will always present new opportunities can help alleviate the pressure of “missing out.” There’s no need to catch every wave—focus on riding the ones that align with your strategy.

The Benefits of Keeping FOMO in Check

Addressing FOMO is more than just avoiding mistakes—it’s about laying the foundation for a disciplined, sustainable investment approach. When you manage FOMO effectively:

- You make decisions based on research and logic rather than emotion.

- You avoid the pitfalls of overleveraging or speculative investing.

- You experience greater peace of mind, knowing your strategy is designed for long-term success.

Think of it this way: The most successful investors, like Warren Buffett, don’t react to market noise or chase fleeting trends. They focus on value, patience, and consistency—qualities that outlast even the most hyped stocks.

Final Thoughts

The fear of missing out in the stock market is a natural emotion, but it doesn’t have to dictate your decisions.

Remember, successful investing is a marathon, not a sprint. The market will always offer opportunities, and you don’t need to chase every trend to succeed.

The next time you feel FOMO creeping in, pause and ask yourself: Am I making this decision based on logic or emotion? Chances are, the best move is to stick to your plan and let the noise fade away.

By staying informed, patient, and focused on your goals, you’ll not only conquer FOMO but also position yourself for long-term success.