Mutual funds offer several benefits such as professional management, diversification, convenient and easy investment, and lower costs, which make them a more attractive option than stocks.

In recent years, investment has become a hot topic as more people look for ways to grow their wealth.

While stocks have been a popular choice for many, mutual funds have been gaining ground as a better alternative for long-term investment.

Here, we’ll explore why mutual funds are better than stocks and help you decide about your investment strategy.

Understanding Mutual Funds

Mutual funds provide investors with an opportunity to embrace the beauty of diversification.

These funds grant access to a well-rounded portfolio of diverse asset classes, effectively mitigating the risk associated with relying solely on individual stocks.

Additionally, mutual funds offer a range of benefits that make them a more attractive option for long-term investment.

The Benefits of Investing in Mutual Funds

Here are some of the key benefits of putting your hard-earned money into mutual funds:

Professional Management

One of the biggest advantages of investing in mutual funds is that you have access to well-qualified professional management.

The fund manager is responsible for making investment decisions and managing the portfolio, which takes the burden away from you as an individual investor with very nominal charges.

This means you don’t have to spend time researching individual stocks, monitoring the market, or making investment decisions. That is Why Mutual Funds Are Better Than Stocks.

It is beneficial for those who are office-going or usually busy with their other important work.

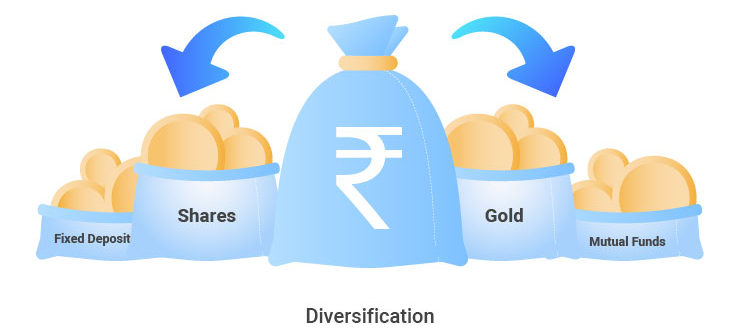

Diversification

As mentioned earlier, mutual funds offer a diverse portfolio of assets, which helps to reduce the risk of investing in a single stock.

Diversification simply means putting money in different stocks or asset classes instead of in a single stock or asset.

Diversification is crucial in reducing the risk of investment and increasing the likelihood of long-term success.

Investing in a mutual fund gives you access to a portfolio of stocks, bonds, and other securities, providing a more balanced approach to investing.

Convenient and Easy to Invest

Investing in mutual funds is convenient and easy. You don’t have to be an expert in the stock market or have a lot of money to get started.

Most mutual funds have a low minimum investment requirement, making it possible for anyone to start investing.

Additionally, you can easily buy and sell units of mutual funds through a broker or financial advisor.

You can start investing with just 100 Indian rupees as your weekly/monthly SIP at your convenience.

Also in a mutual fund, there is no mandatory requirement to invest in daily set intervals, you can put your money any time and in any amount (must be in multiples of the minimum investment amount).

Lower Costs

Compared to individual stocks, mutual funds generally have lower costs. This is because the expenses of managing the fund are spread out over many investors, making it more cost-effective.

Additionally, mutual funds offer economies of scale, which means that the cost of buying and selling securities is lower for the fund than it would be for an individual investor.

The Risks of Investing in Stocks

While stocks have been a popular investment option for many years, they come with several risks that investors need to be aware of.

Here are some of the key risks of investing in stocks:

Market Volatility

The stock market is inherently volatile, which means that stock prices can rise and fall quickly.

This makes it difficult to predict when to buy and sell stocks and can result in significant losses if you invest in the wrong stock at the wrong time.

But in the case of mutual funds, this type of risk varies depending on which type of mutual fund you are invested in as you know there are many types of mutual funds available.

Company Specific Risks

When you invest in individual stocks, you’re taking on company-specific risks. For example, if a company’s earnings fall short of expectations, the stock price can drop dramatically.

Additionally, if a company faces a crisis, such as a major lawsuit or scandal, the stock price can plummet.

In mutual funds, company-specific risks are reduced by diversification.

Lack of Diversification

Investing in individual stocks means you’re not diversifying your portfolio, which increases your risk.

If you invest all your money in a single stock, you’re putting all your eggs in one basket, and if that stock performs poorly, your entire investment could be at risk.

On the other hand, investing in a mutual fund gives you access to a diverse portfolio of assets, reducing your risk and increasing the likelihood of long-term success.

Lack of Professional Management

Another risk of investing in individual stocks is the lack of professional management.

When you invest in individual stocks, you’re responsible for making all the investment decisions, monitoring the market, and managing your portfolio.

This can be overwhelming for inexperienced investors and result in poor investment decisions.

With a mutual fund, you have access to professional management, taking the burden away from you and reducing the risk of poor investment decisions.

Mutual Funds vs. Stocks: A Comparison Table

When it comes to investing, it’s important to consider your options and choose the best option for your financial goals and risk tolerance.

In this comparison table, we’ll compare the key features of mutual funds and stocks, making it easier to choose the right option for you.

| Feature | Mutual Funds | Stocks |

|---|---|---|

| Professional Management | Yes | No |

| Diversification | Yes | No |

| Convenient and Easy to Invest | Yes | Yes |

| Lower Costs | Yes | No |

| Market Volatility | Low to Moderate | High |

| Company Specific Risks | Low | High |

As you can see from the above table, mutual funds offer several benefits that make them a better option than stocks.

Bottom Line:

Investing is a most important part of your wealth building and securing your future financially.

While stocks have been a popular investment option for many years, mutual funds offer a better alternative for long-term investment.

With professional management, diversification, convenient and easy investment, and lower costs, mutual funds provide a more balanced approach to investing, reducing the risk and increasing the likelihood of long-term success.

These are enough reasons to conclude Why Mutual Funds Are Better Than Stocks.

Also, Read | Sip vs Lump Sum Which is Better: Analyzing Returns and Strategies

FAQs: Why Mutual Funds Are Better Than Stocks

Q1: What is the main advantage of investing in mutual funds over stocks?

A1: The primary advantage of investing in mutual funds is diversification.

Mutual funds pool money from multiple investors to invest in a wide range of stocks, bonds, or other assets, reducing the risk associated with investing in a single stock.

Q2: Are mutual funds suitable for beginners with little investment knowledge?

A2: Yes, mutual funds are great for beginners. They are managed by professionals who make investment decisions on your behalf.

This eliminates the need for in-depth market knowledge, making it an accessible option for newcomers.

Q3: Can mutual funds provide better returns compared to investing directly in stocks?

A3: While mutual funds can offer attractive returns, they might not match the potentially higher returns of certain individual stocks. However, mutual funds provide a balanced approach with reduced risk.

Q4: Can I lose money investing in mutual funds?

A4: Yes, like any investment, mutual funds carry risks. While diversification helps reduce risk, there’s no guarantee against losses. It’s important to have a long-term perspective and to choose funds that match your risk tolerance.

Q5: Does market volatility impact mutual funds?

A5: Mutual funds can be influenced by market volatility, but their diversified nature helps cushion the impact. While individual stocks might experience sharp fluctuations, mutual funds spread risk across multiple holdings.

Happy Investing..!