Introduction: The Financial Revolution at Your Fingertips

Imagine a world where you could borrow, lend, invest, and trade without banks, brokers, or intermediaries taking a cut of your money. A world where financial services are accessible to anyone with an internet connection, regardless of location, income level, or social status. This isn’t some far-off utopian dream—it’s the reality being created today through Decentralized Finance (DeFi).

DeFi represents a fundamental shift in how we think about and interact with money, creating an open financial ecosystem that’s transforming traditional finance as we know it. With the global DeFi market projected to reach a staggering $351.75 billion by 2031 (growing at an impressive 48.9% CAGR), this isn’t just another tech bubble—it’s a financial revolution that’s reshaping our economic landscape. Source

Whether you’re a crypto enthusiast, a traditional investor curious about new opportunities, or simply someone who wants more control over their financial future, this comprehensive guide will break down everything you need to know about DeFi literacy and its potential impact on the future of finance.

What Is Decentralized Finance (DeFi)? Breaking Down the Basics

Decentralized Finance (DeFi) Definition and Core Concepts

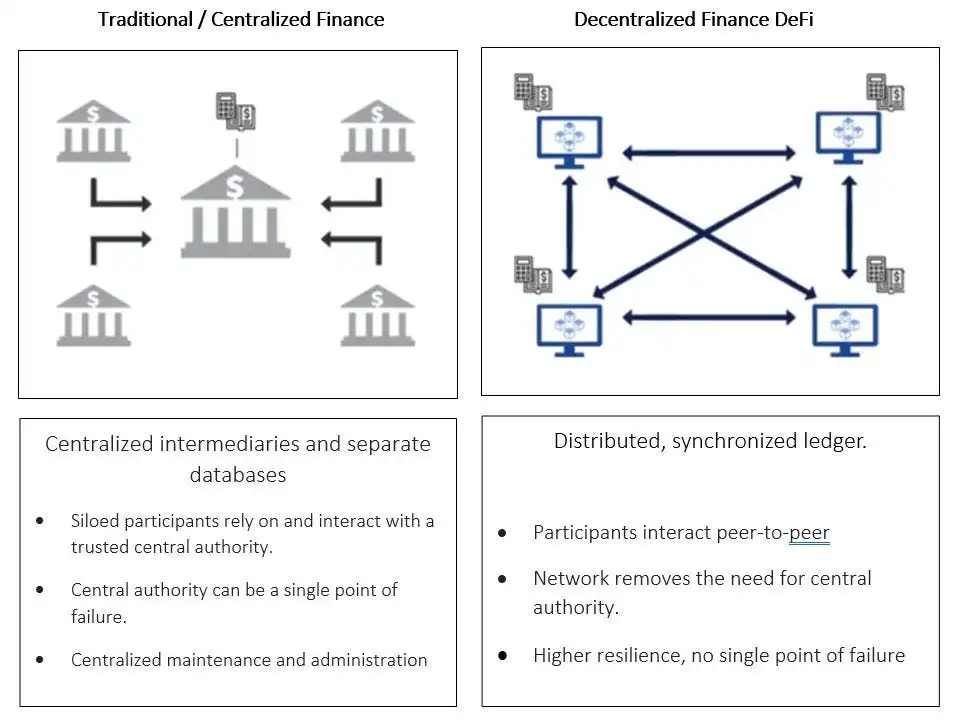

Decentralized Finance (DeFi) is an umbrella term for a new financial system built primarily on public blockchain networks, most notably Ethereum. Unlike the traditional financial system that relies on centralized authorities like banks and brokerages to facilitate transactions, DeFi uses smart contracts and blockchain technology to create financial services and products that can function without intermediaries.

At its core, DeFi aims to recreate and improve traditional financial services in a decentralized architecture, outside the control and fees of traditional financial institutions. This means:

- No central authority controls your money

- No permission needed to access financial services

- 24/7 availability without banking hours or holidays

- Global access for anyone with an internet connection

- Transparency through public blockchain records

The foundation of DeFi is built on several key technologies:

- Blockchain: A distributed and secure digital ledger that records all transactions

- Smart Contracts: Self-executing contracts with the terms directly written into code

- Cryptocurrency: Digital assets that can be transferred, stored, or used within DeFi applications

- Decentralized Applications (dApps): User interfaces that connect people to DeFi protocols

These technologies work together to create an open financial system that’s accessible to anyone with an internet connection, regardless of where they live or their financial status.

The DeFi Ecosystem: Understanding the Landscape

Decentralized Finance (DeFi) isn’t just a single application or blockchain—it’s an entire ecosystem of interconnected protocols, platforms, and services that together form a new financial infrastructure. This ecosystem includes:

- Lending and Borrowing Platforms: Services like Aave, Compound, and MakerDAO allow users to earn interest on deposits or take out loans without going through a bank.

- Decentralized Exchanges (DEXs): Platforms like Uniswap and SushiSwap enable direct peer-to-peer trading of cryptocurrencies without centralized intermediaries.

- Stablecoins: Cryptocurrencies pegged to stable assets like the US dollar, providing stability in the volatile crypto space. Examples include DAI, USDC, and USDT.

- Asset Management Protocols: Services that help users optimize their returns across various DeFi platforms, like Yearn Finance.

- Insurance Protocols: Platforms that provide coverage against smart contract risks and other DeFi-specific vulnerabilities.

- Payment Networks: Systems that allow for fast, low-cost transfers of value globally.

- Derivatives and Synthetic Assets: Platforms creating tokenized versions of traditional financial instruments like options, futures, and stocks.

- Prediction Markets: Decentralized betting platforms where users can wager on event outcomes.

What makes this ecosystem truly revolutionary is that these components can be combined and integrated in endless ways, creating new financial products and services that weren’t possible in traditional finance. This “money Lego” approach allows developers to build on each other’s work, leading to rapid innovation and evolution of the DeFi space.

Decentralized Finance (DeFi) vs. Traditional Finance: The Fundamental Differences

| Aspect | Traditional Finance | Decentralized Finance (DeFi) |

|---|---|---|

| Control | Centralized institutions (banks, brokers) | Decentralized networks, smart contracts |

| Accessibility | Limited by location, credit scores, minimum balances | Open to anyone with internet access |

| Operating Hours | Business hours, weekdays only | 24/7/365 availability |

| Transaction Speed | Days for settlements | Minutes to hours (blockchain-dependent) |

| Transparency | Limited, private ledgers | Fully transparent, public blockchain |

| Interoperability | Siloed systems with limited integration | Composable “money Legos” that can be combined |

| Security Model | Trust in institutions and regulations | Trustless, cryptographic security |

| Fees | Often high, hidden fees | Generally lower, more transparent |

| Privacy | KYC required, but data is private | Pseudonymous, but transactions are public |

The Power of Interoperability: DeFi’s Secret Weapon

One of the most revolutionary aspects of Decentralized Finance (DeFi) is its interoperability—the ability for different protocols and applications to work seamlessly together. Unlike traditional finance, where banks, insurance companies, and investment firms operate in isolation with proprietary systems, DeFi platforms are designed to be composable and integrated.

This interoperability creates what developers call “money Legos”—financial building blocks that can be stacked and combined to create increasingly complex financial products. For example:

- You can deposit ETH as collateral in MakerDAO to mint DAI (a stablecoin)

- Use that DAI to provide liquidity on Uniswap and earn trading fees

- Then stake your Uniswap LP tokens in a yield optimizer like Yearn Finance

- All while taking out insurance on your positions through Nexus Mutual

This level of integration and composability simply isn’t possible in traditional finance, where each institution guards its own systems and data. As one fintech expert put it: “Traditional finance doesn’t permit interoperability. Each player has a differentiated product. One cannot build on or alter this product… In DeFi, projects are built on the same foundations, creating better interoperability.” Source

The Future Impact of DeFi: 5 Ways It’s Transforming Finance

1. Democratizing Financial Access

Perhaps the most profound impact of DeFi is how it’s expanding financial access to the unbanked and underbanked populations around the world. According to the World Bank, approximately 1.7 billion adults remain unbanked globally, lacking access to basic financial services.

DeFi eliminates many barriers to entry:

- No need for bank accounts or credit checks

- No minimum balance requirements

- No geographical restrictions

- No identity documentation in many cases

This means that someone in a rural village with just a smartphone and internet connection can access the same financial services as someone on Wall Street. The implications for financial inclusion and economic empowerment in developing regions are enormous.

2. Real-World Asset (RWA) Tokenization

One of the most exciting developments in DeFi is the tokenization of real-world assets (RWAs)—the process of representing physical and traditional financial assets as digital tokens on a blockchain.

RWA tokenization is unlocking trillions in previously illiquid assets, including:

- Real Estate: Enabling fractional ownership of properties, making real estate investing accessible to more people

- Art and Collectibles: Fractionalizing ownership of high-value items

- Commodities: Tokenizing gold, oil, and other physical commodities

- Traditional Securities: Bringing stocks, bonds, and other securities onto the blockchain

- Private Equity: Making previously inaccessible investments available to retail investors

The market for tokenized assets is projected to reach $16 trillion by 2030, representing a massive shift in how we define and trade value in our economy. This development connects traditional finance with DeFi, creating a bridge that could accelerate mainstream adoption. Source

3. Redefining Financial Services and Products

DeFi isn’t just replicating traditional financial services—it’s reinventing them, creating new financial primitives that weren’t possible before:

- Flash Loans: Uncollateralized loans that are borrowed and repaid within a single blockchain transaction

- Automated Market Makers: New models for liquidity provision that don’t rely on traditional order books

- Yield Farming: Strategies for optimizing returns across different protocols

- Liquid Staking: Unlocking the value of staked assets while still earning staking rewards

- Non-Fungible Token (NFT) Finance: Using NFTs as collateral for loans or as financial instruments

These innovations are pushing the boundaries of what’s possible in finance, creating entirely new categories of products and services that may eventually find their way into mainstream financial practices.

4. Reshaping Financial Regulation

As Decentralized Finance (DeFi) continues to grow, it’s forcing regulators around the world to reconsider traditional approaches to financial oversight. The borderless, decentralized nature of DeFi presents unique challenges:

- How do you regulate protocols that exist on globally distributed networks?

- Who is responsible when something goes wrong in a decentralized system?

- How can consumer protection be ensured without stifling innovation?

- What constitutes securities fraud in a system where many tokens blur the lines between currencies, securities, and utilities?

This regulatory uncertainty remains one of the biggest hurdles to mainstream DeFi adoption. However, we’re seeing progress as regulators and industry leaders work together to create frameworks that protect consumers while enabling innovation. The outcome of these discussions will have profound implications for the future of finance, potentially laying the groundwork for a new regulatory paradigm.

5. Transforming Corporate and Institutional Finance

Increasingly, traditional financial institutions are exploring how to integrate Decentralized Finance (DeFi) into their operations. This isn’t just about banks offering cryptocurrency services—it represents a fundamental rethinking of financial infrastructure:

- JPMorgan has launched its own blockchain platform (Onyx) for institutional payments and settlements

- Fidelity is exploring DeFi lending and borrowing markets

- Goldman Sachs is investigating tokenization for private markets

- Singapore’s DBS Bank has launched a digital exchange for cryptocurrencies and digital assets

As more institutions enter the space, we’re likely to see hybrid models emerge that combine the innovation of Decentralized Finance (DeFi) with the reliability and regulatory compliance of traditional finance. This “TradFi-DeFi convergence” could accelerate adoption while bringing increased capital, expertise, and legitimacy to the DeFi ecosystem.

Understanding Decentralized Finance (DeFi) Risks and Challenges

Critical Risk Factors in DeFi

While Decentralized Finance (DeFi) offers extraordinary potential, it also comes with significant risks that all participants should understand:

Technical Risks

- Smart Contract Vulnerabilities: Code vulnerabilities can lead to exploits and hacks. In 2024 alone, DeFi protocols lost over $2 billion to various exploits and hacks.

- Oracle Failures: DeFi applications rely on oracles to provide external data. If these fail or are manipulated, it can lead to system failures or exploits.

- Scaling Limitations: Current blockchain infrastructure faces challenges handling high transaction volumes, leading to congestion and high gas fees during peak periods.

Financial Risks

- Liquidation Risk: In overcollateralized lending protocols, market volatility can lead to sudden liquidations of positions.

- Impermanent Loss: Liquidity providers on automated market makers can experience losses when token prices diverge from their initial ratio.

- Protocol Insolvency: Poor risk management or extreme market conditions can lead to protocol insolvency, potentially resulting in losses for users.

Regulatory and Compliance Risks

- Regulatory Uncertainty: The evolving regulatory landscape creates uncertainty about the legal status of many DeFi activities.

- Tax Compliance Challenges: The complexity of DeFi transactions makes proper tax reporting difficult for users.

- Anti-Money Laundering (AML) Concerns: The pseudonymous nature of transactions raises concerns about illicit activities.

Usability and Education Barriers

- Technical Complexity: The technical knowledge required to use DeFi safely limits mainstream adoption.

- User Experience: Current interfaces and processes can be complex and unintuitive for non-technical users.

- Education Gap: Many potential users lack understanding of blockchain basics, let alone complex DeFi concepts.

Managing these risks requires a combination of technological improvements, better risk management practices, regulatory clarity, and continued education efforts.

Getting Started with DeFi: A Beginner’s Action Plan

If you’re interested in exploring DeFi but don’t know where to start, here’s a step-by-step approach to begin your journey safely:

Step 1: Educate Yourself

Before putting any money at risk, invest time in understanding the fundamentals:

- Learn blockchain basics: Understand how blockchains work and what makes them secure

- Study smart contracts: Grasp the concept of self-executing code that powers DeFi

- Research specific protocols: Understand how lending, borrowing, and exchanges work in DeFi

Recommended Resources:

- Coinbase Learn

- Ethereum.org’s DeFi section

- DeFi Pulse’s Blog

- Finematics YouTube channel

Step 2: Set Up Your Wallet

Your crypto wallet is your gateway to DeFi. Consider these options:

- MetaMask: The most popular Ethereum wallet for DeFi

- Trust Wallet: Mobile wallet with multi-chain support

- Ledger or Trezor: Hardware wallets for maximum security

Critical Security Tips:

- Store your recovery phrase offline in a secure location

- Never share your private keys or seed phrases with anyone

- Use hardware wallets for large amounts

Step 3: Start Small with Basic DeFi Activities

Begin with simple, low-risk activities to get familiar with how DeFi works:

- Buy a small amount of ETH through a regulated exchange

- Transfer it to your wallet

- Try a simple stablecoin swap on a decentralized exchange like Uniswap

- Deposit some funds into a lending protocol like Aave or Compound

Step 4: Gradually Explore More Complex Strategies

As you gain confidence and understanding, you can explore more advanced DeFi strategies:

- Providing liquidity to earn trading fees

- Staking cryptocurrencies for passive income

- Participating in governance by voting with governance tokens

- Exploring yield optimization strategies

Step 5: Stay Informed and Manage Risk

The DeFi landscape evolves rapidly, so staying informed is crucial:

- Follow reputable DeFi news sources

- Join communities on Twitter, Discord, or Reddit

- Use portfolio tracking tools to monitor your positions

- Never invest more than you can afford to lose

- Diversify your DeFi activities across different protocols

Market Analysis: Current State and Future Projections

Decentralized Finance (DeFi) by the Numbers (2025)

- Total Value Locked (TVL) in DeFi: $102 billion (as of April 2025)

- Number of Unique DeFi Users: 8.1 million addresses

- Market Size: $42.76 billion in 2025, projected to reach $351.75 billion by 2031

- Annual Growth Rate: 48.9% CAGR from 2024-2031

- Dominant Blockchain: Ethereum (65% of DeFi TVL)

- Fastest Growing Sector: Real-World Asset (RWA) tokenization (112% YoY growth)

Key Market Trends in 2025

- Institutional Adoption Accelerating: Financial institutions are increasingly entering the DeFi space, with 38% of surveyed banks planning DeFi integration by 2026

- Cross-Chain Integration: Solutions connecting different blockchain networks are gaining traction, with cross-chain transaction volume up 215% year-over-year

- Regulatory Clarity Emerging: Major jurisdictions including the EU, Singapore, and UAE have introduced specific DeFi regulatory frameworks

- Layer 2 Dominance: Layer 2 scaling solutions now account for over 40% of all DeFi activity, reducing transaction costs by an average of 94%

- Real-World Asset Integration: Tokenized real-world assets now represent over $25 billion in DeFi, growing faster than any other sector

These trends point to a maturing ecosystem that’s gradually addressing its early limitations while expanding its reach into traditional finance domains.

FAQ: Your Most Common DeFi Questions Answered

What is the difference between Decentralized Finance (DeFi) and cryptocurrencies like Bitcoin?

Cryptocurrencies like Bitcoin primarily function as digital money or stores of value. DeFi, on the other hand, represents an entire ecosystem of financial applications built on blockchain technology. Think of cryptocurrencies as digital cash, while DeFi provides the financial services that let you do things with that cash—like lending, borrowing, trading, and earning interest. Most DeFi applications are built on smart contract platforms like Ethereum rather than Bitcoin.

Is Decentralized Finance (DeFi) safe to use?

DeFi comes with significant risks including smart contract vulnerabilities, market volatility, and regulatory uncertainty. While the technology itself removes certain risks associated with centralized financial systems, it introduces new types of risks. The safety of using DeFi depends on your knowledge, risk tolerance, the specific protocols you use, and how carefully you follow security best practices. Never invest more in DeFi than you can afford to lose, especially as a beginner.

Do I need technical knowledge to use DeFi?

While DeFi is becoming increasingly user-friendly, having some technical knowledge is still valuable. You should understand blockchain basics, how wallets work, and the fundamentals of the specific DeFi protocols you plan to use. However, user interfaces have improved significantly, and there are now more educational resources available to help beginners get started safely.

How is DeFi regulated?

DeFi regulation varies significantly by country and is still evolving. Some jurisdictions have begun developing specific regulatory frameworks for DeFi activities, while others are attempting to apply existing financial regulations. Key regulatory concerns include consumer protection, anti-money laundering requirements, securities laws, and tax compliance. Users should stay informed about regulations in their jurisdiction, as non-compliance can lead to legal issues.

Will DeFi replace traditional banking?

While DeFi offers alternatives to many traditional banking services, complete replacement of the traditional banking system is unlikely in the foreseeable future. A more probable outcome is a hybrid system where DeFi and traditional finance coexist and integrate in various ways. Banks are already exploring how to incorporate DeFi technologies, while DeFi protocols are looking at ways to comply with regulations and provide more user protection. The future likely involves a convergence rather than one system completely replacing the other.

How does DeFi make money without charging fees like banks?

DeFi protocols do have fees, but they function differently from traditional banking fees. Instead of paying fees to a central company, users pay network fees (gas fees) to blockchain validators and may pay protocol fees that are often distributed to the protocol’s token holders or used for protocol development. Additionally, many DeFi protocols have their own tokens that capture value from the protocol’s usage, providing another revenue stream for developers and early investors.

What is yield farming in DeFi?

Yield farming refers to strategies where users move their assets between different DeFi protocols to maximize returns. This typically involves providing liquidity to various platforms in exchange for interest, fees, or additional token rewards. While yield farming can generate high returns, it also comes with significant risks including smart contract vulnerabilities, impermanent loss, and token value fluctuations. It’s generally considered an advanced strategy not suitable for beginners.

Conclusion: The Path Forward for DeFi

Decentralized Finance represents one of the most significant innovations in financial services since the internet itself. By removing intermediaries and creating an open, permissionless financial system, DeFi has the potential to expand access to financial services, reduce costs, increase efficiency, and spark a wave of financial innovation.

However, the path to mainstream adoption isn’t without obstacles. Technical challenges, regulatory uncertainty, security concerns, and usability issues all need to be addressed before DeFi can reach its full potential. The sector is still in its early stages, with many of the products and protocols still experimental in nature.

What’s clear is that DeFi isn’t going away. The fundamental value proposition of an open, accessible financial system is too compelling to ignore. Whether DeFi eventually replaces traditional finance, integrates with it, or creates an entirely new parallel financial system remains to be seen. What’s certain is that the future of finance will be profoundly influenced by the innovations emerging from the DeFi ecosystem today.

For individuals, the recommendation is clear: educate yourself about this emerging technology, start small if you decide to participate, and never invest more than you can afford to lose. The opportunities in DeFi are substantial, but so are the risks.

For financial institutions and policymakers, the challenge is to find the right balance between allowing innovation to flourish while ensuring consumer protection and financial stability. Those who embrace this technology thoughtfully while managing its risks will be well-positioned for the financial landscape of tomorrow.

The DeFi revolution has only just begun, and its ultimate impact on our financial system may be greater than anything we can imagine today.

Actionable Next Steps

- Start your DeFi education journey with resources like Coinbase Learn or Ethereum.org

- Set up a small wallet with MetaMask or a similar provider

- Join DeFi communities on platforms like Discord or Reddit to learn from others

- Track DeFi trends using analytics platforms like DeFi Pulse or DappRadar

- Begin with simple, low-risk DeFi activities once you feel comfortable with the basics

Remember: the best investment in DeFi is first in your education, then in the technology itself.

Recommended Interactive Tools:

- DeFi Risk Calculator: A tool that assesses the risk profile of different DeFi protocols based on audits, time in market, TVL, and other factors.

- Yield Comparison Tool: An interactive calculator that compares potential yields across different DeFi platforms accounting for fees, rewards, and risks.

- DeFi Portfolio Simulator: A tool allowing users to create mock DeFi portfolios to practice strategies without risking real assets.