Earnings Per Share (EPS) is often the secret behind understanding whether a company is truly making money and why some stocks are seen as better investments than others.

Have you ever wondered how investors figure this out? Let’s unpack what EPS is, why it matters, and how to use it to make smarter financial decisions.

At its core, Earnings Per Share (EPS) is a financial metric that measures a company’s profitability on a per-share basis.

Think of it as the bottom-line snapshot of how much money a company makes for each share of its stock—essentially giving investors a sense of what portion of the company’s profits they “own” per share.

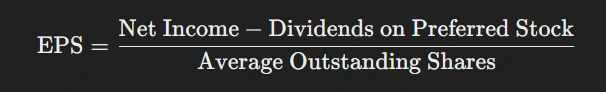

The EPS Formula

The formula for calculating EPS is:

Breaking it down:

- Net Income is the company’s total profit after subtracting all expenses, taxes, and interest. It is the money left over after the bills are paid.

- Dividends on Preferred Stock: If the company has preferred shareholders, they’re entitled to a fixed payout before common shareholders get anything. These payments are deducted from net income to focus on profits available to common stockholders.

- Average Outstanding Shares: This refers to the average number of shares of the company’s stock that were actively traded during the reporting period.

If a company is raking in significant profits and hasn’t issued a ton of shares, its EPS will naturally be higher—a sign of strong profitability.

For example, a company with ₹1 million in net income and 100,000 shares would have an EPS of ₹10. But if that same company had 1 million shares, the EPS would drop to ₹1.

This means that the number of shares matters as much as the profits. If a company has “too many cooks in the kitchen” (i.e., a lot of shares), each shareholder’s piece of the profit pie gets smaller.

Why It Matters

EPS is a universal metric in finance because it distills a lot of complex information into one simple number. It helps investors:

- Gauge whether a company is profitable.

- Compare profitability across companies.

- Evaluate how efficiently a company converts its income into shareholder value.

Example

Let’s say you own a bakery and decide to split your profits among five friends. If you made ₹500 in profit, each friend would get ₹100.

Now imagine inviting 10 more friends into the mix. Unless your profits skyrocket, each person’s share would shrink. That’s essentially how EPS works.

So, next time you see an EPS number, remember—it’s not just about how much profit a company makes, but also about how thinly that profit is sliced across all its shareholders.

Why Should You Care About EPS?

EPS is like the heartbeat of a company—it gives you a quick sense of its financial health. But here’s why it’s particularly useful:

Investment Decision-Making:

When evaluating a stock, EPS is often the first number investors check. A high EPS generally indicates a profitable company, a good sign for potential returns.

On the other hand, a low EPS doesn’t necessarily mean the stock is a bad choice, but it’s a cue to investigate further.

Is the company in a growth phase, reinvesting profits for future expansion? Or is it struggling to control costs?

EPS acts like a litmus test—it won’t give you all the answers, but it will tell you where to look.

Comparing Companies:

EPS helps you compare apples to apples. EPS levels the playing field when comparing businesses of different sizes, sectors, or regions.

It’s like measuring efficiency in a race: regardless of the size of the competitor, you can see who’s running faster based on their relative performance.

For instance, if you’re trying to decide between investing in two companies in the same industry, EPS provides a quick way to see who’s doing better in terms of profitability.

Want to figure out which tech giant or pharma leader is making the most profit per share? Look no further than EPS.

Valuation Metrics:

EPS plays a starring role in one of the most commonly used valuation tools: the Price-to-Earnings (P/E) Ratio. The formula is:

This ratio helps you understand how much investors are willing to pay for a company’s earnings. A low P/E might suggest the stock is undervalued, which could be a buying opportunity.

But hold your horses—it might also signal underlying problems, like declining future earnings or sector-wide challenges.

Example of P/E in Action

Let’s say a company has an EPS of ₹50 and a stock price of ₹500. The P/E ratio is:

P/E=500/50

=10

This means investors are paying ₹10 for every rupee of the company’s earnings. Is that a good deal? That depends on how this P/E compares to similar companies and the industry average. Context matters!

Why Context Matters

EPS and its related metrics like the P/E ratio are incredibly insightful, but they don’t tell the whole story. For example:

- A high P/E might indicate a growth company with massive potential but also higher risk.

- A low P/E could signal a stable company—or one struggling with challenges.

EPS isn’t a crystal ball, but it’s an essential piece of the puzzle when evaluating stocks. It helps you separate promising opportunities from potential pitfalls.

So, why care about EPS? Because in investing, it’s one of the clearest indicators of whether a company is making money—and ultimately, whether you should be putting your money there too.

Not all EPS numbers are created equal. Here are the three most common variations:

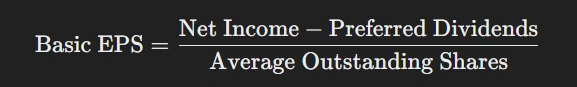

Basic EPS:

This is the most straightforward and commonly referenced type of EPS. Think of it as the “vanilla” version—simple, no frills, and calculated as:

Here’s what makes Basic EPS, well, basic:

- It only considers the shares currently in circulation.

- It doesn’t factor in the potential impact of stock options, convertible securities, or any instruments that could increase the number of shares.

When to use it: If you’re looking for a quick snapshot of profitability without diving into complexities, Basic EPS is your go-to.

Diluted EPS:

Diluted EPS takes a more conservative approach, asking the question: What happens to profitability per share if all possible shares were issued?

This calculation includes:

- Stock options: Rights given to employees or executives to buy shares.

- Convertible securities: Instruments like bonds or preferred shares that can be converted into common stock.

The formula for Diluted EPS is similar to Basic EPS but adjusts the denominator to reflect the maximum possible number of shares.

Why it matters:

Diluted EPS gives you a “worst-case scenario” for earnings. It’s a critical metric for cautious investors who want a realistic sense of profitability if all potential shares come into play.

Adjusted EPS:

Sometimes, companies tweak their EPS figures to account for unusual, non-recurring events—like the sale of a business unit, legal settlements, or restructuring costs. This results in what’s called Adjusted EPS.

Why companies use it:

Adjusted EPS aims to provide a “cleaner” view of a company’s ongoing operations by removing:

- One-time gains: Selling a big asset might boost profits temporarily, but it’s not part of normal business operations.

- Unusual expenses: A hefty lawsuit payout or a rare restructuring cost might skew the picture of profitability.

Be cautious, though:

While Adjusted EPS can offer valuable insight into the core business, it’s sometimes used to mask less favorable results. Always check what adjustments have been made and why.

Quick Comparison Table

| Type | Key Feature | Best For |

| Basic EPS | Simple calculation, no share dilution | General snapshot of profitability |

| Diluted EPS | Accounts for potential share increases | Conservative view of a company’s earnings |

| Adjusted EPS | Excludes one-off gains or expenses | Evaluating core operational performance |

How to Use EPS in Real

Imagine you’re considering two companies for investment:

- Company A: EPS = ₹5

- Company B: EPS = ₹2

At first glance, Company A seems like the winner—it’s earning more per share. Here are some key questions to ask before jumping to conclusions:

1. What’s the Growth Story?

EPS is a snapshot in time, but investing is about the future. Ask yourself:

- Is Company A a mature, stable player with consistent but slow growth?

- Is Company B a scrappy startup doubling its EPS every year?

If Company B’s earnings are growing rapidly, its ₹2 EPS today could outpace Company A’s ₹5 in just a few years. Growth trajectories matter more than just current numbers.

2. What’s the P/E Ratio?

The Price-to-Earnings (P/E) ratio is like the next chapter in the EPS story. It helps you understand whether a stock is reasonably priced for its earnings.

Let’s calculate the P/E ratios:

- Company A: Stock price = ₹250, P/E = ₹250 / ₹5 = 50

- Company B: Stock price = ₹20, P/E = ₹20 / ₹2 = 10

What do these numbers tell us?

- A P/E of 50 for Company A suggests investors are paying ₹50 for every rupee of earnings. This could indicate high growth expectations—or it might mean the stock is overpriced.

- A P/E of 10 for Company B implies it’s more reasonably priced, but it could also mean the market sees less growth potential.

Context is key: Compare P/E ratios to the industry average and consider the company’s growth prospects.

3. Other Metrics to Pair with EPS

EPS is just one piece of the investment puzzle. To make a well-rounded decision, also look at:

- Revenue Growth: Is the company consistently increasing its sales?

- Debt Levels: High earnings are great, but if they’re weighed down by massive debt, the company might be a riskier bet.

- Industry Trends: How does the company stack up against competitors? Is it a leader or struggling to keep up?

Real-Life Scenario

Imagine two friends: one has a steady job earning ₹50,000 per month, and the other just started a business earning ₹20,000.

The first friend seems more financially stable, but what if the second friend’s income is doubling every year? In three years, they might far outpace the first friend.

EPS works the same way—look beyond the numbers and focus on the bigger picture.

Tip: EPS is like the headline of a financial story. It grabs your attention, but it won’t tell you the whole story. Always dig deeper by pairing EPS with other key metrics and evaluating the broader context.

By combining EPS insights with a holistic view of a company’s financials, you’ll be well-equipped to make smarter, more confident investment decisions.

So, next time you see an EPS number, ask yourself: What’s the story behind this figure? That’s where the real investment wisdom lies.

Common Pitfalls When Relying on EPS

While Earnings Per Share (EPS) is a powerful metric, it isn’t foolproof. Companies sometimes tweak or manipulate factors affecting EPS to create a more favorable picture.

Here are a few common pitfalls to watch out for when relying on EPS:

1. Short-Term Focus

Some companies get fixated on delivering strong quarterly EPS results, sometimes at the expense of long-term growth.

How this happens:

- Cutting back on critical investments like research and development (R&D) or marketing to reduce expenses.

- Delaying necessary upgrades or expansions to keep short-term costs low.

Why it’s risky:

These strategies might boost EPS temporarily, but they can weaken the company’s competitive edge over time. A lack of investment in innovation or infrastructure often leads to stagnation, leaving the business vulnerable to rivals.

Tip: When evaluating a company’s EPS, look at its investment patterns and ask whether short-term gains are coming at the cost of long-term success.

Share buybacks can have a significant impact on EPS—and not always for the right reasons.

How this works:

When a company buys back its shares, the overall count of outstanding shares is reduced. This naturally inflates EPS, even if the company’s actual earnings haven’t improved.

For example:

- Before buyback: ₹1 crore in earnings ÷ 10 lakh shares = ₹10 EPS

- After buyback: ₹1 crore in earnings ÷ 8 lakh shares = ₹12.5 EPS

Why it’s problematic:

While existing shareholders might enjoy a bump in value, share buybacks don’t necessarily reflect a thriving business. A company spending heavily on buybacks might lack profitable opportunities to reinvest in its operations.

Tip: Always dig deeper. If EPS growth is primarily driven by buybacks, consider whether the company’s capital could have been better used elsewhere.

3. Accounting Tricks

Adjusted EPS is often touted as a “cleaner” metric, but it can also be a red flag.

How companies manipulate:

- Excluding “non-recurring” expenses like legal settlements, restructuring costs, or losses from asset sales to make the numbers look better.

- Underestimating or excluding potential liabilities that could affect future earnings.

Why it’s dangerous:

What companies call “non-recurring” expenses might not be as one-time as they claim. If adjustments happen too frequently, the numbers could be misleading.

Tip: Always read the fine print in financial reports. Look at both basic EPS and adjusted EPS and pay attention to how often adjustments are made and what they include.

The Bottom Line

Earnings Per Share (EPS) is one of the most widely used metrics in finance for a good reason—it provides a clear, concise snapshot of a company’s profitability on a per-share basis.

Whether you’re comparing stocks, assessing growth potential, or calculating valuation metrics like the P/E ratio, EPS is a cornerstone of sound investment analysis.

However, it’s crucial to remember that EPS is just one piece of the puzzle. On its own, it won’t tell you the full story.

Always pair EPS with other key metrics, such as revenue growth, debt levels, and industry trends, to form a comprehensive view of a company’s financial health.

Keep an eye out for common pitfalls like share buybacks, short-term profit boosts, and adjusted figures that may obscure underlying issues.

With careful analysis and a deeper understanding of the context behind the numbers, EPS can become a powerful tool to guide your investment decisions.

Ultimately, the true value of EPS lies in how you interpret it—so dig deeper, ask questions, and use it wisely as part of your investment strategy. Happy investing!

Also, Read | Understanding the Price-to-Book (P/B) Ratio: A Guide for Investors

Also, Read | EIC Analysis of a Company: A Comprehensive Guide for Investors