In investing, we often hear the word “long-term,” but what does it really mean? Many people talk about it, but few explain it clearly.

Understanding how long you should hold onto investments is important, especially if you save for big goals like retirement or a child’s education.

Let’s break down what long-term investing means and why it pays off to be patient.

Why Long-Term Investing Works

Long-term investing isn’t just about waiting; it’s a strategy to help you grow wealth steadily while reducing risks.

Data from WhiteOak Capital shows that monthly investing in India’s BSE Sensex has yielded positive returns 100% over an 8-year period since 1996. Even over shorter periods like five years, the chances of earning a profit are high at 92%.

This doesn’t mean you should invest blindly for many years. It just shows that, with time, your chances of higher returns go up. Here’s how the average returns have looked over different time spans in India’s market:

- 8+ Years: 100% positive returns, with an average return of 16.2% per year

- 5 Years: 92% positive returns, averaging 15.3% per year

- 10 Years: Even more stable, averaging 15.6% per year with less risk

- 15 Years: Consistent returns with less ups and downs, averaging 14.3% per year

This shows that the longer you stay invested, the more the market’s ups and downs even out, helping you get steadier growth.

Common Misunderstandings About Long-Term Investing

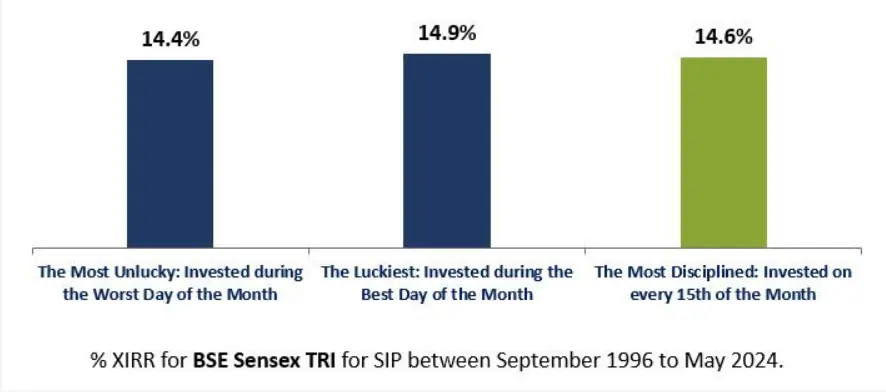

Many people think they need to constantly watch their investments or guess the best time to invest. However, research shows that picking the “perfect” day to invest doesn’t really change returns much over the long run.

For example, in the BSE Sensex, the difference between the highest and lowest returns over a 10-year period was only about 1.25%. This proves that being consistent is far more important than trying to time the market.

Another misunderstanding is that long-term investing means you can’t access any of your money for years. But it’s possible to set aside some funds for short-term needs while leaving other funds to grow for the long term.

This can reduce the temptation to make quick decisions that might harm your long-term plan.

Simple Tips for Growing Wealth Over Time

Long-term investing doesn’t mean you “set it and forget it.” Here are some practical tips to help you get the most out of a long-term plan:

- Start Early: The earlier you invest, the longer your money has to grow and earn returns.

- Set Clear Goals: Whether it’s retirement or a big purchase, having specific goals helps keep you focused.

- Invest Regularly: Put in a fixed amount regularly, like monthly, regardless of the market. This way, you buy more when prices are low and less when prices are high, balancing your costs.

- Diversify: Don’t put all your money in one place. Spread your investments across different stocks or funds to reduce risk.

- Check Your Portfolio Annually: The market moves, and so does your portfolio. Review it once a year to make sure it still fits your goals and risk comfort.

Key Takeaway: Patience Pays

Investing is not about getting rich quickly. Those who stay patient and focus on long-term goals usually see the most stable returns.

Investors who stick to their plans and think long-term often do the best. It’s important to stay consistent, review your goals occasionally, and only adjust for personal life changes, not just market movements.

Bottom line

Long-term investing doesn’t mean ignoring your investments completely. Stay informed about market trends and consider getting help from a financial advisor to build a strategy that fits your needs.

Also, Read | Beginner’s Guide to Stock Market Investing | नए लोग स्टॉक मार्किट में Invest कैसे करे ?