Are you considering joining a startup but unsure about the equity package you should negotiate? Whether you’re evaluating an offer or preparing to negotiate, understanding startup equity is crucial for making informed decisions that could potentially change your financial future. This comprehensive guide breaks down everything you need to know about asking for and valuing startup equity in 2025.

Understanding Startup Equity: The Basics

Startup equity is ownership in a company, representing your stake in its future success. Unlike established companies where compensation primarily comes through salary and benefits, startups often offer equity as a significant part of the total compensation package. But equity isn’t just about potential future wealth—it’s about aligning your interests with the company’s growth and sharing in its success.

“Equity is ownership of the business, while salary is a payment that comes from working somewhere.” — Darwin Hanson, Startup Advisor

Equity comes in several forms:

- Stock options: The right to purchase company shares at a predetermined price

- Restricted Stock Units (RSUs): Company shares granted after meeting specific conditions

- Founder’s stock: Direct ownership shares typically reserved for founding team members

- Employee Stock Purchase Plans (ESPP): Programs allowing employees to purchase company shares at a discount

The value of your equity depends entirely on the company’s future performance. While a salary provides predictable income, equity offers potentially unlimited upside if the company succeeds—but also carries the risk of being worth nothing if the startup fails.

Why Equity Matters: The Risk-Reward Tradeoff

When joining a startup, you’re likely accepting a lower salary than you could earn at an established company. This salary gap represents the risk you’re taking, and equity is your compensation for that risk.

The Equity Compensation Equation

Equity Value = Risk Premium × Growth Potential × Your Impact

Where:

- Risk Premium: The salary difference between the startup role and a comparable position at an established company

- Growth Potential: The realistic assessment of the startup’s future success

- Your Impact: How significantly your contributions will affect company outcomes

The Psychology Behind Equity Compensation

Equity creates powerful psychological alignment between employees and the company. When you own a piece of the business, you’re motivated to think and act like an owner rather than just an employee. This ownership mentality often leads to:

- Longer-term thinking

- Greater willingness to work through challenges

- Stronger commitment to company success

- Higher tolerance for temporary setbacks

Research shows that employees with meaningful equity stakes tend to stay with companies 2-3 years longer on average than those without equity, creating stability in early-stage companies where continuity is crucial.

Benchmark Equity Percentages by Role and Stage

Startup equity percentages vary significantly based on your role, when you join, and the company’s stage. Here’s a breakdown of typical equity ranges across different positions and funding stages:

Pre-Seed/Seed Stage Startups

- C-level executives (non-founder): 0.8-2.5%

- VP-level roles: 0.3-2%

- Directors: 0.5-1%

- Managers: 0.2-0.7%

- Early employees (non-management): 0.1-0.5%

Series A Startups

- C-level executives (non-founder): 0.5-1.5%

- VP-level roles: 0.3-0.8%

- Directors: 0.2-0.5%

- Managers: 0.1-0.3%

- Other employees: 0.05-0.2%

Series B and Beyond

As a company raises more funding rounds, equity offers typically decrease while cash compensation increases. By Series B, equity percentages might be half of what they were at Series A for comparable roles.

According to SeedLegals data from 2022-2025, most UK startups reserve between 10-15% of equity for their employee pool, with technical roles typically receiving more equity than non-technical positions at the same level. This matches data from Carta showing U.S. companies typically reserve 13-20% for employee equity pools.

Factors That Influence Your Equity Package

Multiple factors determine how much equity you can reasonably ask for when joining a startup:

1. Company Stage and Valuation

The earlier you join, the more equity you should receive. Early employees take on greater risk and have more significant impact on the company’s trajectory.

2. Your Role and Seniority

C-suite executives and other leadership roles command higher equity percentages than individual contributors, reflecting their broader responsibilities and impact.

3. Your Experience and Expertise

Specialized skills or experience that are particularly valuable to the startup strengthen your negotiating position for more equity.

4. Salary Trade-off

Lower-than-market salary should be compensated with higher equity. Many startups offer an explicit trade-off between cash and equity.

5. Funding Status

Well-funded startups typically offer less equity but more cash, while bootstrapped companies may offer more equity to compensate for cash limitations.

6. Geographic Location

Equity standards vary by region. Silicon Valley startups typically offer higher equity percentages than those in other regions.

7. Industry Norms

Some industries (like biotech) have different equity distribution patterns than others (like SaaS).

Case Study: The Early Engineer Dilemma

A software engineer was offered two positions in 2023:

Option A: Enterprise company offering $180,000 base salary with minimal equity Option B: Series A startup offering $120,000 base salary with 0.5% equity

The engineer calculated the “risk premium” of $60,000 annually. If the startup reached a $100 million valuation in 4 years, the equity would be worth $500,000 (minus dilution)—worth the gamble. Additionally, the startup role offered greater responsibilities and faster career progression.

The engineer joined the startup, negotiating for 0.7% equity to better balance the salary differential, and set specific milestones for equity refreshes as the company grew.

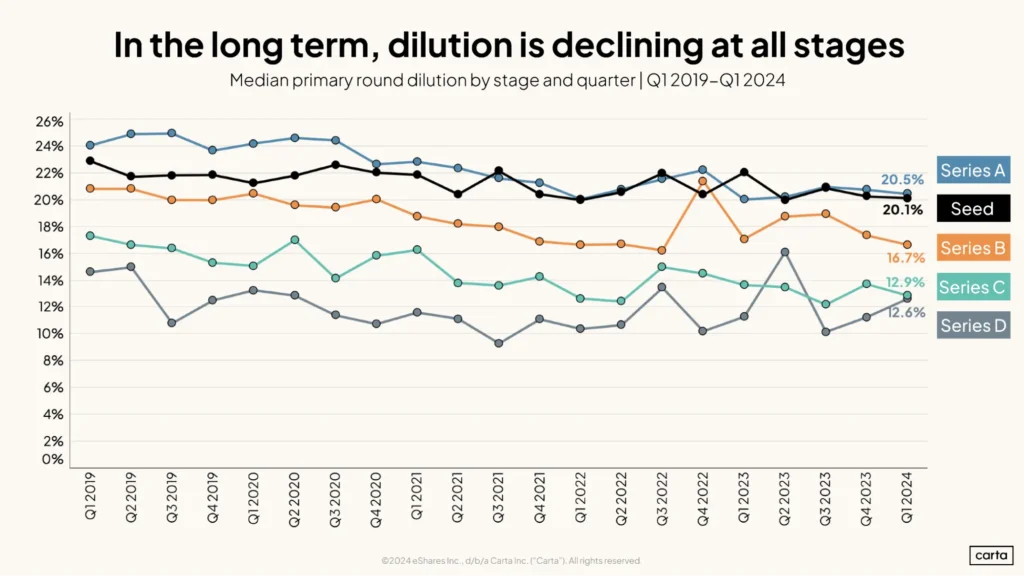

Latest Dilution Trends: What to Expect

Dilution is a critical factor affecting the ultimate value of your equity. When a startup raises additional funding, new shares are created, reducing existing shareholders’ percentage ownership. According to the most recent data from Carta in 2025:

- Seed stage: Median dilution was 18.8% in Q1 2025, down from 21.4% a year earlier

- Series A: Approximately 20.5% dilution (down from 24.1% in previous years)

- Series B: Around 15-18% dilution

- Series C: 10-15% dilution

- Series D: Below 10% in recent quarters (nearly halved between Q1 2024 and Q1 2025)

Interestingly, dilution rates have been declining across all funding stages in recent years, making equity potentially more valuable for early employees. However, you should still expect your initial equity percentage to be reduced by 30-50% by the time a company reaches an exit event (acquisition or IPO).

The Equity vs. Salary Tradeoff Calculator

When evaluating a startup offer, it’s crucial to understand the potential value of your equity compared to what you might be giving up in salary. Here’s a simple calculator framework to help you assess equity offers:

Step 1: Calculate Your Annual Salary Sacrifice

Annual Salary Sacrifice = Market Rate Salary - Offered Salary

Step 2: Determine Expected Company Exit Value

Research comparable companies in the same industry and stage to make an educated guess about potential valuation at exit.

Step 3: Calculate Your Equity Value at Exit

Your Equity Value = (Exit Valuation × Your Equity Percentage) × (1 - Expected Dilution)

Step 4: Calculate Annual Return

Annual Return = Your Equity Value ÷ Expected Years to Exit

Step 5: Compare Annual Return to Annual Salary Sacrifice

If the Annual Return is significantly higher than your Annual Salary Sacrifice, the equity offer might be worth considering.

Interactive Decision Framework: Salary vs. Equity

Consider creating a “weighted decision matrix” where you assign personal importance to different factors:

- Financial security (1-10): How important is consistent cash flow to your current life situation?

- Risk tolerance (1-10): How comfortable are you with uncertainty?

- Career growth (1-10): How valuable is the accelerated responsibility at the startup?

- Exit timeline (Years): How long can you wait for a potential equity payoff?

Based on your answers, you can better determine whether to prioritize higher equity or higher salary in your negotiations.

Several free online calculators can help you evaluate equity offers, including:

Essential Questions to Ask Before Accepting Equity

Before accepting an equity offer, you need to gather critical information to understand what you’re really being offered:

Company Structure and Valuation Questions

- What is the company’s current valuation? This helps you calculate what your equity percentage is actually worth today.

- How many outstanding shares exist? This tells you what percentage of the company your options represent.

- What was the most recent 409A valuation? This determines the strike price of your options.

- What’s the projected timeline to an exit event? Understanding if liquidity is 3 years away or 10+ years affects your decision.

Equity Terms Questions

- What type of equity am I being offered? Options, RSUs, and direct shares have different tax implications and risks.

- What’s the vesting schedule? Standard is 4 years with a 1-year cliff, but terms can vary.

- What’s the exercise window? If you leave the company, how long do you have to exercise your options?

- Is there accelerated vesting under certain conditions? Some companies offer acceleration upon acquisition or other trigger events.

Future Outlook Questions

- What is the expected dilution from future funding rounds? Understanding how much your stake might be reduced helps set realistic expectations.

- Does the company offer equity refreshes? Regular equity grants can offset dilution and reward continued contributions.

As one Reddit commenter advised: “The cap table is important. Ask to see the cap table.” While some companies consider this confidential, understanding the overall ownership structure helps you evaluate your offer in proper context.

Negotiation Strategies That Actually Work

When negotiating equity at a startup, preparation and knowledge are your strongest assets. Here are proven strategies for securing the best equity package:

1. Do Your Research

- Research industry benchmarks for your role, experience level, and the company’s funding stage

- Understand the company’s recent valuation, funding history, and growth trajectory

- Talk to others in similar roles at comparable companies to gauge standard equity offers

2. Know Your Value Proposition

- Clearly articulate how your specific skills and experience will contribute to company growth

- Quantify your potential impact where possible (e.g., “My experience scaling similar products resulted in 40% revenue growth”)

- Highlight specialized expertise that’s particularly valuable to the startup’s goals

- The number of shares means little without context—focus on the percentage ownership

- Ask specifically: “What percentage of the fully diluted shares does this option grant represent?”

- Compare percentages, not raw numbers, when evaluating multiple offers

4. Consider the Total Compensation Package

- Negotiate equity as part of a complete package including salary, benefits, and other perks

- Be willing to make trade-offs—higher equity for lower cash, or vice versa

- Calculate the different scenarios (both optimistic and conservative) for equity outcomes

5. Ask for Equity Refreshes

- Negotiate for additional equity grants tied to performance milestones or company valuations

- Request equity refreshes as part of annual compensation reviews

- Secure commitments in writing regarding future equity considerations

6. Improve Equity Terms, Not Just Quantity

- Negotiate for favorable exercise terms, longer post-employment exercise windows, or accelerated vesting

- Consider asking for early exercise rights to optimize tax treatment

- Ask about what happens to your equity in various scenarios (acquisition, company failure, your departure)

7. Time Your Negotiation Strategically

- Negotiate during transitions (new role, new funding round)

- Wait until you’ve received a formal offer before discussing specific numbers

- Consider when the company might be particularly motivated to bring you on (before fundraising, product launches, etc.)

Remember that equity negotiations aren’t just about getting the highest percentage possible—they’re about creating alignment between your contributions and the company’s success.

Understanding Vesting Schedules and Cliffs

Vesting is the process through which you earn your equity over time. Understanding vesting terms is crucial when evaluating an equity offer:

Standard Vesting Terms

The most common vesting schedule in startups is 4 years with a 1-year cliff. This means:

- You earn 0% of your equity if you leave before 1 year (the “cliff”)

- At your 1-year anniversary, you vest 25% of your total equity grant

- After the cliff, you typically vest the remaining equity monthly (approximately 1/48 of your total grant each month)

- After 4 years, you’re “fully vested” in your initial equity grant

Alternative Vesting Structures

Some companies use different structures:

- Back-weighted vesting: Higher percentages vest in later years to encourage longer tenure

- Milestone-based vesting: Equity vests upon achieving specific company or individual goals

- Cliff-only: Full vesting occurs at a future date with no gradual vesting

- No cliff: Monthly vesting starts immediately without a one-year waiting period

Vesting Acceleration

There are two important types of vesting acceleration to understand:

- Single-trigger acceleration: Vesting accelerates upon a specific event, typically an acquisition

- Double-trigger acceleration: Vesting accelerates if two events occur, usually an acquisition followed by your termination within a specific timeframe

Negotiating for double-trigger acceleration provides protection if you’re let go after an acquisition, ensuring you don’t lose unvested equity.

The Vesting Calendar: A Visual Approach

For a standard 4-year vesting schedule with a 1-year cliff on a 1% equity grant:

Year 1:

- Months 1-11: 0% vested (0% total)

- Month 12: 0.25% vests (25% total)

Years 2-4:

- Months 13-48: 0.0208% vests monthly (approximately)

- End of Year 4: 1% fully vested (100% total)

Creating a vesting calendar helps visualize exactly when you’ll reach specific ownership thresholds, which can be important for financial planning.

Tax Implications of Startup Equity

Different forms of equity have vastly different tax implications, and understanding these differences can save you thousands or even millions of dollars:

Stock Options Tax Considerations

Incentive Stock Options (ISOs):

- No tax at grant

- No ordinary income tax at exercise (but may trigger Alternative Minimum Tax)

- Long-term capital gains treatment if held for 1+ year after exercise and 2+ years after grant

- Must exercise within 90 days of leaving the company (typical)

Non-Qualified Stock Options (NSOs):

- No tax at grant

- Ordinary income tax on the spread between exercise price and fair market value at exercise

- Capital gains tax on appreciation after exercise when sold

RSU Tax Considerations

- Taxed as ordinary income when they vest (based on fair market value at vesting)

- No need to exercise; automatically receive shares upon vesting

- More common in later-stage startups approaching IPO

Early Exercise and 83(b) Elections

Early exercise allows you to purchase unvested shares immediately, potentially creating significant tax savings:

- By exercising early when the stock price equals the strike price, you eliminate the taxable “spread”

- Filing an 83(b) election within 30 days of early exercise starts the capital gains holding period immediately

- This can convert ordinary income (taxed at up to 37%) to long-term capital gains (currently 20%)

Important: Consult with a tax professional familiar with startup equity before making major equity decisions. The tax implications are complex and mistakes can be costly.

Red Flags to Watch For in Equity Offers

Not all equity offers are created equal. Here are warning signs that should make you scrutinize an offer more carefully:

1. Unclear or Evasive Answers About Equity

If the company is unwilling to provide clear information about your equity percentage, outstanding shares, or valuation, that’s a serious concern.

2. Unusually Short Exercise Windows

Standard exercise windows after leaving a company are 90 days. Extremely short windows (30 days or less) can force you to make rushed decisions or lose your equity entirely.

3. No Acceleration Provisions

Without any acceleration provisions, you could lose significant unvested equity in an acquisition, even if the acquisition happens just before your vesting cliff.

If founders or investors have anti-dilution protections that you don’t, your equity could be disproportionately diluted in future funding rounds.

Multiple classes of shares with different rights can leave common shareholders (typically employees) at a disadvantage.

6. Unrealistic Valuation Claims

If the company claims an unusually high valuation without supporting evidence, your equity percentage might represent less real value than advertised.

7. Buyback Rights

As startup expert Yoko Spirig warned in a 2022 interview: “Sometimes there are cases where companies have a right to buy back shares, which is not great at all… I would really pay attention to these buyback rights.”

Always request the complete equity documentation in writing and consider having it reviewed by a professional experienced in startup equity before accepting.

Success Stories: When Startup Equity Paid Off

While many startups fail, successful equity stories demonstrate why equity can be worth the risk:

The Early Engineer

Sarah joined a fintech startup in 2018 as their fifth engineer with 0.5% equity. She negotiated for early exercise rights and filed an 83(b) election. When the company was acquired four years later for $500 million, her stake was worth $1.8 million after dilution—a life-changing sum that let her buy a house and start her own company.

The Compromise Case

Michael took a 35% pay cut to join an AI startup in 2020, receiving 0.8% equity as compensation for the salary reduction. While the company hasn’t had an exit yet, their latest funding round valued his stake at $960,000—far exceeding what he sacrificed in salary.

The Long Game

Priya joined a healthcare startup in 2016 with 0.3% equity. Over seven years and multiple funding rounds, her stake was diluted to 0.12%. However, when the company went public in 2023 at a $3.5 billion valuation, her patience was rewarded with $4.2 million in stock.

These success stories share common elements:

- Joining companies with strong growth potential

- Negotiating favorable equity terms

- Understanding and optimizing the tax implications

- Patience through funding rounds and dilution

Remember that for every success story, many startup employees end up with worthless equity. The key is making informed decisions based on realistic assessments of the company’s potential.

Conclusion: Making Your Equity Work for You

When deciding how much equity to ask for in a startup, remember that the number itself is less important than what it represents—your stake in the company’s future success and your compensation for taking a risk on an unproven business.

The right equity amount depends on multiple factors including your role, the company’s stage, your salary trade-off, and industry standards. Armed with the benchmarks and strategies in this guide, you can approach equity negotiations with confidence and make informed decisions.

Key takeaways for negotiating startup equity:

- Research thoroughly before negotiations, understanding both industry standards and the specific company’s situation

- Think in percentages, not share counts, and understand the company’s current valuation

- Consider the total package, balancing equity with salary, benefits, growth opportunities, and work environment

- Understand dilution and factor it into your calculations

- Optimize for favorable terms like acceleration clauses and exercise windows, not just equity percentage

- Plan for tax implications and consider strategies like early exercise when appropriate

- Verify everything in writing before accepting an offer

Startup equity offers unique wealth-building potential that traditional compensation can’t match, but it comes with significant uncertainty and complexity. By educating yourself and negotiating thoughtfully, you put yourself in the best position to benefit from your equity if the company succeeds.

FAQ: Your Top Equity Questions Answered

Is 1% equity in a startup good?

Whether 1% equity is good depends on several factors:

- Company stage: 1% at a pre-seed startup might be standard for an early employee, while 1% at a Series B company would be exceptional for a non-executive hire.

- Your role: For a C-level executive at an early-stage company, 1% might be low. For a mid-level employee at a funded startup, it could be generous.

- Salary trade-off: If you’re taking a significant salary cut, 1% might not adequately compensate for the risk.

- Company potential: 1% of a company with strong growth prospects is worth more than 1% of a company with limited potential.

According to 2025 data, 1% equity is often appropriate for senior roles at seed-stage companies or exceptional contributions at Series A companies.

How much dilution should I expect through funding rounds?

Based on recent Carta data from 2025, expect approximately:

- 18-20% dilution in Seed rounds

- 20% dilution in Series A

- 15-18% dilution in Series B

- 10-15% dilution in Series C

- Under 10% dilution in Series D

This means if you start with 1% equity, you might end up with around 0.5% by the time the company reaches Series C, assuming no equity refreshes.

Should I negotiate for more equity or more salary?

This depends on your:

- Financial situation: If you have significant financial obligations or limited savings, prioritize salary.

- Risk tolerance: If you’re comfortable with uncertainty for potentially higher rewards, lean toward equity.

- Belief in the company: Your assessment of the company’s potential should heavily influence this decision.

- Career stage: Earlier in your career, you might have more flexibility to take equity risk.

A balanced approach often works best: negotiate for enough salary to meet your needs comfortably, then maximize equity with any remaining negotiating leverage.

What’s the difference between options and RSUs?

Stock Options:

- Give you the right to buy shares at a predetermined price (strike price)

- Require you to pay money to exercise (purchase) the shares

- Better for early-stage companies where share prices are low

- More favorable tax treatment possible with careful planning

Restricted Stock Units (RSUs):

- Actual shares granted when vesting conditions are met

- No purchase required; shares are given to you

- More common in later-stage companies approaching IPO

- Taxed as ordinary income when they vest

Options typically offer more potential upside in early-stage companies because the strike price is low relative to potential future value, but they require capital to exercise and carry more risk.

How do I calculate what my equity is actually worth?

To estimate your equity’s current value:

Current Value = (Company Valuation × Your Equity Percentage) × (1 - Liquidation Preferences Impact)

To estimate potential future value:

Future Value = (Projected Exit Valuation × Your Equity Percentage) × (1 - Expected Additional Dilution) × (1 - Liquidation Preferences Impact)

Remember that liquidation preferences can significantly impact common shareholders’ returns, especially if the company sells for less than anticipated.

Online calculators from Carta, Front, or Range can help with these calculations.

What are typical vesting terms for startup equity?

Standard vesting terms are:

- 4-year vesting period

- 1-year cliff (nothing vests until your first anniversary)

- Equal monthly vesting after the cliff (approximately 2.08% of your total equity per month)

Variations include:

- Longer vesting periods (5+ years) for significant equity grants

- Performance-based vesting tied to company or individual milestones

- Accelerated vesting upon acquisition (single-trigger) or acquisition plus termination (double-trigger)

Always verify the exact vesting terms in your offer letter or equity agreement.

What happens to my equity if I leave the company?

For vested equity:

- For options: You typically have a limited window (often 90 days) to exercise your options by paying the strike price, or you lose them

- For RSUs: Vested RSUs are usually yours to keep regardless of departure

- For early exercised shares still subject to repurchase: The company may have the right to buy back unvested shares

For unvested equity:

- You typically lose all unvested equity when you leave, regardless of the type

Some companies now offer extended post-employment exercise periods (5-10 years) to be more employee-friendly, which is a valuable benefit worth negotiating for.

Recommended Resources

For deeper learning on equity compensation, these resources are invaluable: