In today’s volatile economic landscape, the debate between real estate vs stock market investing has never been more relevant. With inflation concerns, interest rate fluctuations, and market turbulence dominating headlines in 2025, investors are seeking clarity on where to allocate their hard-earned capital for maximum returns and stability.

Recent data from Gallup shows that Americans still believe real estate is the best long-term investment, with 34% favoring property over stocks (26%) and gold (24%). But is this popular sentiment backed by actual performance metrics?

Whether you’re a seasoned investor looking to optimize your portfolio allocation or a beginner taking your first steps into wealth building, this comprehensive guide will provide you with data-driven insights, expert analysis, and actionable strategies to make informed decisions in the real estate vs stock market debate.

By the end of this article, you’ll understand the distinct advantages each investment avenue offers and how to leverage them based on your unique financial goals and risk tolerance.

The Historical Performance Battle: Real Estate vs Stock Market

When comparing real estate vs stock market historical returns, it’s essential to look at reliable long-term data. According to recent analysis from Investopedia, the S&P 500 has delivered an average annual return of approximately 10% over the past several decades. In contrast, residential real estate has historically provided returns in the 4-8% range, with significant regional variations.

Historical Annual Returns: Stocks vs Real Estate (1975-2025)

| Time Period | S&P 500 Average Annual Return | Real Estate Average Annual Return |

|---|---|---|

| 1975-1985 | 14.2% | 5.5% |

| 1985-1995 | 15.3% | 4.0% |

| 1995-2005 | 9.1% | 8.9% |

| 2005-2015 | 7.4% | 2.8% |

| 2015-2025 | 12.2% | 6.5% |

| 50-Year Avg | 11.6% | 5.5% |

However, this simple comparison doesn’t tell the complete story. While the stock market has outperformed real estate in terms of raw returns, real estate investments offer unique advantages that aren’t captured in basic annual return figures.

According to The Motley Fool’s April 2025 research, REITs (Real Estate Investment Trusts) have actually outperformed the S&P 500 over the past 20-, 25-, 30-, 40-, and 52-year periods. This suggests that real estate, when professionally managed and properly diversified, can compete with or even exceed stock market returns.

Does the stock market always outperform real estate?

Despite common perception, the answer is no. During certain time periods, particularly during housing booms like the mid-2000s or the post-pandemic surge of 2020-2022, real estate has outpaced stock market gains. Additionally, when considering leveraged real estate investments (using mortgage financing), the returns can potentially exceed stock market performance.

For example, with a 20% down payment on a $500,000 property that appreciates at 5% annually, an investor would see their $100,000 initial investment grow by $25,000 in the first year (a 25% return on investment), far exceeding the stock market’s historical average. This illustrates how leverage can dramatically amplify real estate returns.

Risk and Volatility: Weathering Market Storms

Which Investment Type Is Less Volatile?

One of the most significant differences in the real estate vs stock market comparison is volatility. This is an essential factor for investors to consider, especially those nearing retirement or with lower risk tolerance.

Stock Market Volatility: The stock market is notoriously volatile, with significant price fluctuations occurring daily. Consider that in early 2025, the S&P 500 experienced a correction of over 12%, only to recover those losses within a few months. This kind of volatility can be emotionally challenging for many investors.

Real Estate Volatility: By contrast, real estate markets typically move much more slowly, with less dramatic price swings. According to data from Zillow’s May 2025 market report, home values have flattened in recent months, with some forecasts predicting modest price increases of 1.3-4.1% for the year—a far cry from the wild swings seen in equity markets.

Question: Why is real estate generally less volatile than stocks?

Real estate’s lower volatility stems from several factors:

- Physical Asset Value: Unlike stocks, which can sometimes trade based on speculation, properties have intrinsic value as shelter.

- Slower Transaction Process: Real estate deals take weeks or months to close, preventing panic selling.

- Local Market Factors: Property values are heavily influenced by local economic conditions, making them less susceptible to global market shifts.

- Income Generation: Rental properties provide ongoing cash flow regardless of market conditions, stabilizing total returns.

According to the Gatsby Investment blog, “While all investments carry a level of volatility, real estate is generally considered to be less volatile than other asset classes, like stocks.” This lower volatility makes real estate particularly attractive to investors seeking stability and preservation of capital.

Leveraging Power: Amplifying Returns Through Financing

How Leverage Works in Real Estate vs Stock Market Investing

Real Estate Leverage

In real estate, leverage allows investors to control high-value assets with relatively small amounts of capital. For example, with $50,000, you could:

- Put 20% down on a $250,000 property

- Benefit from appreciation on the full property value

- Generate rental income on a $250,000 asset

- Potentially deduct mortgage interest and depreciation

Stock Market Leverage

In the stock market, leverage typically comes through:

- Margin accounts (borrowing from brokers)

- Options trading

- Leveraged ETFs

The key difference is risk exposure: real estate leverage is typically more stable and secure than stock market leverage, which can lead to margin calls and forced liquidation during market downturns.

The Amplifying Effect of Real Estate Leverage

One of the most compelling advantages in the real estate vs stock market debate is the power of leverage available to property investors. While stocks can be purchased on margin, the typical leverage ratio is limited to 2:1, and margin calls create significant risk during market downturns.

In contrast, real estate investors can often purchase properties with just 20-25% down (4:1 or 5:1 leverage), and in some cases, even less. This magnifying effect can dramatically boost returns, as illustrated in this case study:

Real Estate Leverage Example:

- Initial Investment: $50,000 (20% down payment)

- Property Value: $250,000

- Annual Appreciation: 5% ($12,500)

- Return on Investment: 25% ($12,500/$50,000)

Stock Investment Comparison:

- Initial Investment: $50,000

- Stock Portfolio Value: $50,000

- Annual Return: 10% ($5,000)

- Return on Investment: 10% ($5,000/$50,000)

This example demonstrates how leverage can potentially help real estate outperform stocks, even when the underlying appreciation rate is lower than stock market returns. Additionally, the mortgage for the property is gradually paid down through rental income, further increasing equity.

Question: Is leveraging real estate always better than investing in stocks?

Not necessarily. Leverage is a double-edged sword that can magnify losses as well as gains. During housing market downturns, leveraged real estate investors can face significant challenges, including:

- Negative equity situations

- Difficulty refinancing

- Cash flow problems if rental income decreases

According to a recent Reddit discussion on r/Fire, “Real Estate on average has grown 5% annually in the same time period [as stocks], but the leverage can significantly improve those returns. Both have merits…” The key is understanding that leverage increases both potential returns and risks.

How Taxation Impacts Real Estate vs Stock Market Returns

One area where real estate clearly outshines the stock market is in tax advantages. These benefits can significantly enhance the after-tax returns of real estate investments compared to stocks.

Key Real Estate Tax Advantages

Depreciation: Investors can deduct the cost of residential buildings over 27.5 years, creating a “paper loss” that shelters rental income.

Mortgage Interest Deduction: Interest paid on investment property loans is typically tax-deductible.

Property Tax Deductions: Annual property taxes paid on investment properties can be deducted.

Capital Improvements: Various improvements can be depreciated or expensed.

1031 Exchanges: Allows for deferral of capital gains tax when selling one investment property and purchasing another.

Pass-Through Deductions: Under current tax law, real estate investors may qualify for a 20% deduction on pass-through income.

According to tax experts cited in a May 2025 article from Investopedia, “Real estate investors enjoy significant tax advantages that stock market investors do not. For instance, property owners can deduct expenses like mortgage interest, property taxes, landlord insurance, and maintenance costs.”

Real Estate Tax Advantages

Tax Deductions & Write-offs

Deduct property taxes, mortgage interest, insurance, management fees, maintenance costs, and business expenses related to your rental property.

Depreciation

Deduct the cost of rental property over its useful life (27.5 years for residential, 39 for commercial), reducing taxable income without affecting cash flow.

Pass-Through Deduction

Deduct up to 20% of qualified business income from rental properties when owned through pass-through entities like LLCs or S Corps.

1031 Exchange

Defer capital gains taxes by swapping one investment property for another of equal or greater value, allowing wealth to grow tax-deferred.

Opportunity Zones

Invest in designated disadvantaged communities to defer current capital gains and potentially eliminate taxes on future appreciation.

No FICA Tax on Rental Income

Rental income is not subject to self-employment tax (15.3% FICA tax), unlike other self-employed business income.

Stocks Tax Advantages

Long-Term Capital Gains

Pay reduced tax rates (0%, 15%, or 20% based on income) on stocks held over one year, versus ordinary income rates for short-term gains.

Tax-Loss Harvesting

Offset capital gains by selling underperforming stocks at a loss, with the ability to deduct up to $3,000 in net losses against ordinary income annually.

Tax-Advantaged Accounts

Grow investments tax-deferred in traditional IRAs/401(k)s or tax-free in Roth accounts, offering powerful compounding benefits.

Qualified Dividends

Pay lower tax rates (same as long-term capital gains) on qualified dividends from domestic corporations and certain foreign companies.

Tax-Efficient Funds

Invest in ETFs and index funds with low turnover rates to minimize taxable distributions and capital gains exposure.

Municipal Bonds

Earn interest that’s exempt from federal taxes (and often state/local taxes for residents of the issuing state).

Head-to-Head Comparison

Key Takeaways

Real Estate Excels In:

- ✓ Ongoing tax deductions while holding property

- ✓ Depreciation benefits creating paper losses

- ✓ Tax deferral through 1031 exchanges

- ✓ Avoidance of FICA taxes

- ✓ QBI deduction potential

Stocks Excel In:

- ✓ Tax-advantaged account options

- ✓ Flexible tax-loss harvesting

- ✓ Lower transaction costs for tax strategies

- ✓ Liquidity for timing tax events

- ✓ Qualified dividend benefits

Question: How do these tax benefits impact overall returns?

The impact can be substantial. Consider this simplified example:

Real Estate Investment:

- $10,000 annual rental income

- $8,000 in actual expenses (mortgage interest, taxes, insurance)

- $7,000 in depreciation (non-cash expense)

- Taxable income: -$5,000 (loss for tax purposes despite positive cash flow)

Stock Investment:

- $10,000 annual dividend income

- Fully taxable as income (minus qualified dividend tax advantages)

This example illustrates how a real estate investor might have positive cash flow while reporting a tax loss, effectively making some of their income tax-free. In contrast, stock investors typically pay taxes on dividends and capital gains in the year they’re received or realized.

Liquidity and Accessibility: Getting In and Out of Investments

The Liquidity Trade-off Between Real Estate and Stocks

A critical consideration in the real estate vs stock market debate is liquidity—how quickly and easily you can convert your investment to cash without significant price concessions.

Stock Market Liquidity:

- Buy or sell instantly during market hours

- Minimal transaction costs (often under $10 per trade)

- No minimum investment requirements with fractional shares

- Ability to liquidate partial positions

Real Estate Liquidity:

- Typical sale process takes 30-90 days

- High transaction costs (5-6% in realtor commissions alone)

- Significant minimum investment (down payment requirements)

- Difficult to sell “partial” real estate holdings

According to NerdWallet’s February 2025 analysis, “Stocks are highly liquid. While investment cash can be locked up for years in real estate, the purchase or sale of public company shares can be done the moment you decide it’s time to act.”

Question: How can investors address the liquidity constraints of real estate?

Several modern options exist to improve real estate liquidity:

- REITs (Real Estate Investment Trusts): Trade like stocks while providing real estate exposure

- Real Estate Crowdfunding Platforms: Lower minimums and improved liquidity options

- Home Equity Lines of Credit (HELOCs): Access equity without selling

- Cash-Out Refinancing: Extract equity during favorable interest rate environments

The liquidity advantage of stocks remains significant, but the gap has narrowed with these innovative alternatives. For many investors, maintaining a cash reserve alongside real estate investments provides necessary liquidity while allowing participation in the real estate market.

Diversification Benefits: Building a Resilient Portfolio

How Real Estate and Stocks Complement Each Other

Diversification is a cornerstone principle of sound investing, and the real estate vs stock market discussion often overlooks an important point: these asset classes can work exceptionally well together in a diversified portfolio.

Correlation Benefits: According to data from Morningstar’s May 2025 US Stock Market Outlook, real estate has historically maintained a moderate correlation with the broader stock market (approximately 0.6). This imperfect correlation means that when stocks struggle, real estate often performs differently, helping to smooth overall portfolio returns.

Diversification Strategies: Real Estate and Stocks

Approach 1: The Traditional 60/40 with Real Estate

- 50% Stocks (broad market index funds)

- 30% Bonds (government and corporate)

- 20% Real Estate (REITs and/or direct ownership)

Approach 2: The Real Estate Heavy Portfolio

- 40% Stocks (focused on sectors with low correlation to real estate)

- 10% Bonds

- 40% Real Estate (direct ownership, REITs, and crowdfunding)

- 10% Alternative Investments

Approach 3: The Liquid Alternative

10% Cash and Alternatives

70% Stocks (including a 15-20% allocation to REIT stocks)

20% Bonds

Question: What’s the optimal allocation between real estate and stocks?

The answer depends on individual factors including:

- Age and investment timeline

- Risk tolerance

- Expertise in real estate

- Available capital

- Desire for active vs. passive management

Many financial advisors recommend that real estate comprise 15-25% of an investment portfolio for balanced diversification. According to a Reddit discussion in r/Rich from August 2024, “10-20% of your net worth is a comfy number for real estate. Really rich dudes will push this number higher especially if they find something that fits in the perfect risk/reward category.”

Also, Try – Asset Allocation Calculator, Green Investment Portfolio Allocator.

Market Analysis: What’s Driving Real Estate vs Stock Market Performance in 2025?

Current Market Overview: Real Estate vs Stock Market

As of May 2025, both investment sectors face unique challenges and opportunities. Understanding these dynamics is crucial for making informed investment decisions.

Real Estate Market Status: According to Zillow’s March 2025 Market Report, the housing market is showing signs of stabilization after years of volatility:

- Home price growth has flattened nationally

- Inventory levels have increased by 21.4% compared to April 2024

- Mortgage rates have declined slightly to around 6.6%

- The Mortgage Bankers Association expects prices to rise only 1.3% in 2025

Stock Market Performance: The stock market has shown resilience in 2025 despite early challenges:

- The S&P 500 recently turned positive for the year after erasing earlier losses

- Small-cap stocks (Russell 2000) remain down 5.7% year-to-date

- Tech stocks have led the recovery, with the Nasdaq outperforming other indices

- Wall Street analysts predict a 10% rebound by year-end

These contrasting environments present different entry points for investors considering the real estate vs stock market allocation question.

Key Developments and Their Impact

Several significant trends are shaping both markets in 2025:

- Interest Rate Environment: As the Federal Reserve navigates inflation concerns, interest rate policies directly impact both real estate affordability and stock market valuations.

- Remote Work Stabilization: The post-pandemic work arrangement landscape has settled into a hybrid model, reshaping housing demand patterns and commercial real estate usage.

- Generational Shifts: Millennials and Gen Z are entering their prime home-buying years, yet face affordability challenges that influence both housing demand and investment patterns.

- Technological Disruption: PropTech and FinTech innovations are changing how investors access and manage both real estate and stock investments, democratizing both markets.

Expert Analysis and Investor Takeaways

Financial experts remain divided on the optimal allocation between real estate vs stock market investments in the current environment.

Warren Buffett‘s Berkshire Hathaway recently sounded a cautionary note on the housing market, suggesting that “home buyers may need to adjust their market expectations for 2025.” Meanwhile, according to CNBC’s May 8, 2025 report, many financial advisors still maintain that “while real estate and gold are two assets that can appreciate in value over time, the stock market will generally grow at a much higher rate.”

JPMorgan’s 2025 housing market outlook suggests that “the U.S. housing market is likely to remain largely frozen through 2025. Some growth is still expected, but at a very subdued pace of 3% or less.” This contrasts with their more optimistic view on equity markets as inflation pressures ease.

Real-World Case Studies: Real Estate vs Stock Market

Case Study 1: The Long-Term Investor (35-Year Comparison)

A recent 35-year case study shared on Reddit compared property investment to S&P 500 investment with fascinating results. The study tracked identical initial investments from 1990 to 2025, accounting for all expenses, renovations, and reinvestment of dividends.

Key findings:

- The S&P 500 investment grew to $1,257,000 (9.2% annualized return)

- The real estate investment (accounting for rental income and property appreciation) grew to $1,156,000 (8.7% annualized return)

- However, when accounting for tax advantages, the after-tax real estate return was marginally higher

- The real estate investment provided significantly more stable returns with less year-to-year volatility

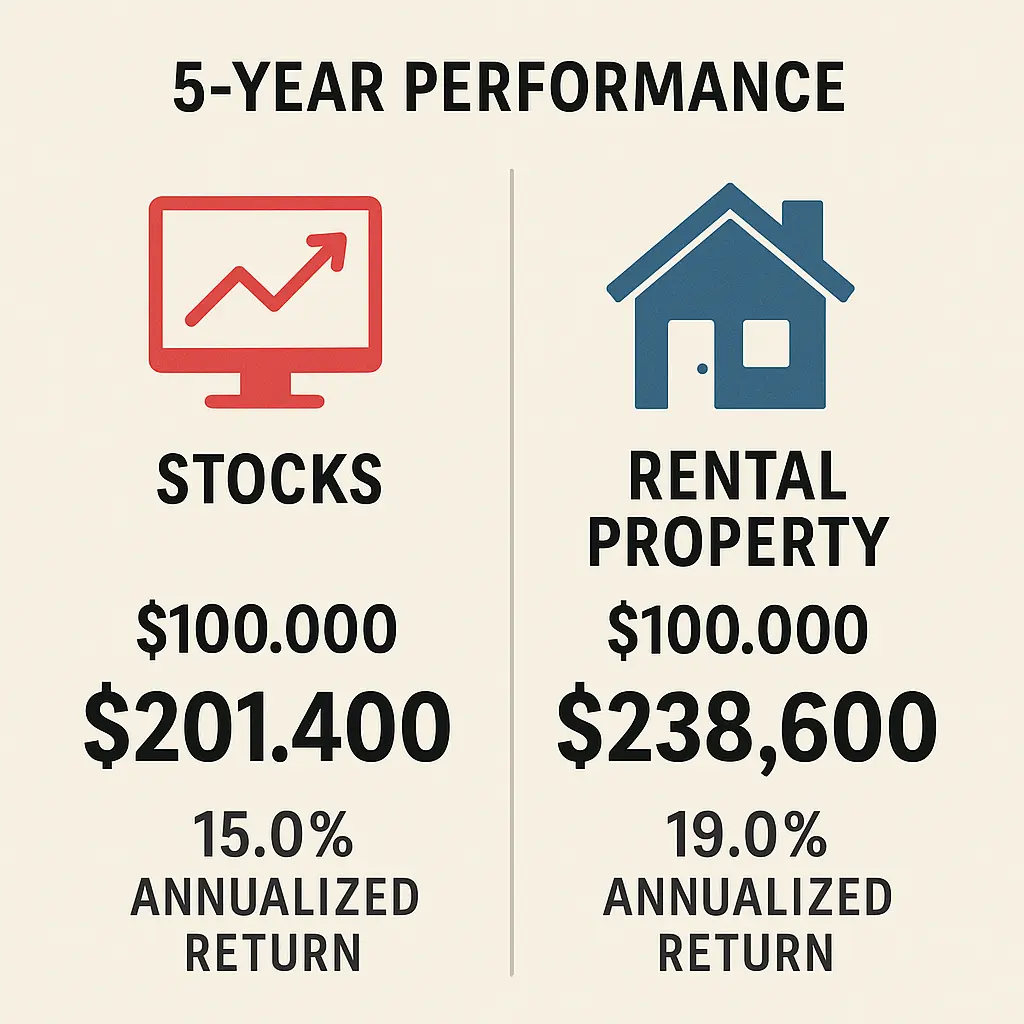

Case Study 2: The Five-Year Investor (2020-2025)

A YouTube creator documented their parallel investments in real estate and stocks over the past five years, with $100,000 invested in each asset class in 2020.

Results after five years:

- Stock portfolio (S&P 500 index fund): $201,400 (15.0% annualized return)

- Rental property (with 20% down payment): $238,600 (19.0% annualized return)

- The rental property outperformed thanks to leverage and the strong housing market of 2020-2022, despite the subsequent slowdown

Case Study 3: The Recession Performance Test (2008-2010)

Examining how both investment types performed during the Great Recession provides valuable insights:

- From peak to trough, the S&P 500 declined 57%

- Residential real estate nationwide declined 19.7% on average

- Stock market recovery: 4 years to previous peak

- Real estate recovery: 10+ years in many markets

This historical example illustrates how real estate, while not immune to economic downturns, has typically experienced less severe peak-to-trough declines compared to equities during major recessions.

How to Determine Your Optimal Investment Strategy

Assessing Your Investment Profile for Real Estate vs Stock Market

Determining the right balance between real estate and stocks requires honest self-assessment across several dimensions:

- Risk Tolerance and Time Horizon

- Longer time horizons favor higher stock allocations

- Imminent need for liquidity favors stocks over direct real estate

- Lower risk tolerance may favor income-producing real estate

- Available Capital and Financing Options

- Direct real estate typically requires larger minimum investments

- Mortgage qualification impacts real estate investing feasibility

- Fractional shares make stock investing accessible with any budget

- Expertise and Interest in Active Management

- Real estate typically requires more active management

- Stock investments can be fully passive through index funds

- REITs offer a middle ground with real estate exposure and stock-like convenience

Question: How do I know if I should focus more on real estate or stocks?

Consider these guiding questions:

- Do you value direct control over your investments?

- Are you comfortable with illiquidity in exchange for potentially higher returns?

- Do you have the time and interest to manage properties?

- Do you have access to favorable financing?

- Would you benefit significantly from real estate tax advantages?

If you answered yes to most of these questions, a higher allocation to real estate might be appropriate. If you answered no, focusing more on stock investments could be the better approach.

Hybrid Strategies: Getting the Best of Both Worlds

Combining Real Estate and Stock Market Investments

Rather than viewing real estate vs stock market as an either/or proposition, sophisticated investors often employ hybrid strategies that capture the advantages of both.

Strategy 1: REITs + Individual Stocks This approach provides real estate exposure with stock-like liquidity. REITs offer:

- Professional property management

- Instant diversification across property types and regions

- Higher dividend yields (average REIT dividend yield in 2025: 3.9% vs S&P 500: 1.4%)

- Required to distribute 90% of taxable income to shareholders

Strategy 2: Direct Real Estate + Index Funds This strategy pairs active real estate investing with passive stock exposure:

- Leverage rental properties for cash flow and tax advantages

- Use low-cost index funds for global diversification

- Balance active and passive management requirements

- Create complementary income streams

Alternative Real Estate Investment Options

Beyond Traditional Property Ownership

Various sectors (residential, commercial, mortgage, etc.)

Real Estate Crowdfunding Platforms

Minimum investments often $1,000-$10,000

Access to commercial properties typically unavailable to individual investors

Both debt and equity investment options

Real Estate Syndications

Pool money with other investors for larger properties

Typically $25,000+ minimum investments

Passive ownership with professional management

Private Real Estate Funds

Professionally managed portfolios of properties

Higher minimums ($50,000+)

Various strategies (value-add, core, opportunistic)

Real Estate ETFs

Ultra-low minimums

Instant diversification

High liquidity

Current Market Data and Statistics (May 2025)

Real Estate Market Indicators

- Median Home Price (National): $428,700 (up 2.3% year-over-year)

- Housing Affordability Index: 98.5 (down from 101.2 last year)

- Average 30-Year Fixed Mortgage Rate: 6.6%

- Rental Yield (National Average): 5.8%

- Housing Inventory: Up 21.4% year-over-year

- Days on Market (Average): 42 (up from 31 last year)

Stock Market Indicators

- S&P 500 Year-to-Date Performance: +0.1%

- P/E Ratio (S&P 500): 21.4 (above historical average of 16.9)

- Dividend Yield (S&P 500): 1.4%

- REIT Sector Average Dividend Yield: 3.9%

- Market Volatility (VIX Index): 19.2 (slightly elevated compared to historical average)

- Sectors Leading Performance: Technology (+8.2%), Healthcare (+4.7%)

This up-to-date market data provides a snapshot of the current investment landscape, helping inform allocation decisions in the real estate vs stock market debate.

Conclusion: Making Your Investment Decision

The real estate vs stock market debate ultimately doesn’t have a one-size-fits-all answer. Each investment avenue offers distinct advantages and challenges that align differently with individual investor goals, resources, and preferences.

Key Takeaways:

- Historical Performance: Stocks have historically provided higher raw returns (10-11% annually) compared to real estate (4-8% annually), but leveraged real estate can potentially outperform stocks when considering total return on investment.

- Risk and Volatility: Real estate typically offers more stability and lower volatility than stocks, making it attractive for risk-averse investors or those nearing retirement.

- Tax Advantages: Real estate provides significant tax benefits through depreciation, mortgage interest deductions, and 1031 exchanges that aren’t available to stock market investors.

- Liquidity: Stocks offer superior liquidity and flexibility, allowing investors to quickly adjust positions or access capital in emergencies.

- Diversification: The moderate correlation between real estate and stocks makes them excellent complementary assets in a diversified portfolio.

- Current Market Conditions: As of May 2025, both markets face unique challenges and opportunities, with real estate showing signs of stabilization and stocks recovering from early-year volatility.

Actionable Steps for Investors:

- Assess your investment timeline and risk tolerance honestly before committing to either investment type.

- Consider starting with a small allocation to your less familiar asset class (either real estate or stocks) to gain experience.

- Consult with financial and tax professionals to understand how each investment type would impact your specific financial situation.

- Explore hybrid strategies like REITs that offer elements of both real estate and stock investments.

- Regularly reassess your allocation between real estate and stocks as market conditions and personal circumstances evolve.

Remember that the most successful investors often incorporate both real estate and stocks into their portfolios, leveraging the unique strengths of each asset class while mitigating their respective weaknesses.

FAQ: Real Estate vs Stock Market

Q: Is real estate a better investment than stocks in 2025?

A: Neither is inherently “better” – it depends on your goals, risk tolerance, and resources. In 2025’s economic environment, stocks have recovered from early volatility, while real estate markets have stabilized with modest growth projections of 1-4%. The best approach for most investors is a diversified strategy incorporating both asset classes.

Q: How much real estate should I have in my investment portfolio?

A: Financial experts typically recommend 10-25% of an investment portfolio be allocated to real estate, either through direct ownership or securities like REITs. This allocation may be higher for investors with specific expertise in real estate or those seeking tax advantages and stable income.

Q: Which has performed better historically: real estate or the stock market?

A: The S&P 500 has delivered average annual returns of approximately 10-11% over the long term, while residential real estate has typically returned 4-8% annually. However, when considering leverage, tax benefits, and reduced volatility, real estate’s risk-adjusted returns become more competitive.

Q: Can I invest in real estate with limited capital?

A: Yes! While traditional property ownership requires substantial capital, alternatives like REITs, real estate ETFs, and crowdfunding platforms allow investments starting from $1 to $1,000. These options provide real estate exposure with lower capital requirements and improved liquidity.

Q: How do tax benefits compare between real estate and stock investments?

A: Real estate offers superior tax advantages including depreciation deductions, mortgage interest write-offs, property tax deductions, and capital gains deferral through 1031 exchanges. Stock investments held outside tax-advantaged accounts lack these benefits, although qualified dividends and long-term capital gains receive preferential tax treatment.

Q: Which investment type requires more active management?

A: Direct real estate ownership typically requires more active management for property maintenance, tenant relations, and administrative tasks. Stock investments, particularly through index funds, can be almost entirely passive. REITs offer a middle ground with real estate exposure and minimal management requirements.

Q: How has the recent economic environment affected these investment types?

A: The high interest rate environment of early 2025 created challenges for both markets, with stocks experiencing volatility and real estate seeing reduced transaction volume. As inflation has moderated and interest rate expectations have stabilized, both markets have shown signs of recovery, though at different paces.

Also, Check – Real Estate vs Stock Market Investment Calculator