In 2025, SEBI introduced Specialised Investment Funds (SIFs) to bridge the gap between traditional Mutual Funds (MFs) and Portfolio Management Services (PMS). This new asset class offers advanced investment strategies, catering to investors seeking higher returns with a higher risk appetite. SIFs offer the freedom like PMS and the safety rules like mutual funds, which makes them a good choice for experienced investors.

Specialised Investment Funds (SIFs) represent a significant evolution in India’s investment landscape, bridging the gap between mutual funds and portfolio management services while providing access to sophisticated strategies previously unavailable to many investors.

What Are Specialised Investment Funds (SIFs)?

Specialised Investment Funds (SIFs) are a new type of investment option started by SEBI to fill the gap between mutual funds and Portfolio Management Services (PMS). They are designed to provide sophisticated investors with access to advanced investment strategies that offer potentially higher returns compared to traditional mutual funds, but with a lower entry barrier than PMS.

Key Definition: A Specialised Investment Fund (SIF) is an investment vehicle that pools capital from experienced investors to invest in specific, often non-traditional asset classes using advanced strategies like long-short positions and sector rotation.

Purpose and Goals of Specialised Investment Funds (SIFs)

For Investors

- Access to niche markets and specialized sectors

- Flexible investment strategies for higher potential returns

- Lower entry barrier compared to PMS (₹10 lakh vs ₹50 lakh)

- Professional management with regulatory oversight

For the Market

- Fills the gap in India’s investment ecosystem

- Reduces proliferation of unregistered investment schemes

- Channels capital to high-growth sectors and strategies

- Encourages innovation in investment approaches

Understanding “Investment Strategy” in SIF Context

“Investment Strategy” in SIFs refers to a scheme of mutual funds launched under the SIF. It can be structured as:

- Open-ended investment strategy

- Close-ended investment strategy

- Interval investment strategy

Each strategy follows a specific approach to investing, with subscription and redemption frequencies clearly disclosed in the offer document. The flexibility in strategy design is what makes SIFs appealing to investors seeking tailored approaches beyond traditional mutual funds.

The Evolution of Specialised Investment Funds in India

The journey of Specialised Investment Funds in India represents a significant evolution in the country’s investment landscape. Let’s trace how SIFs came to be and where they fit in the broader investment ecosystem.

| Time Period | Development | Significance |

| July 2024 | SEBI published consultation paper on SIFs | Initial proposal to introduce a new asset class between MFs and PMS |

| December 16, 2024 | SIFs formalized through regulatory amendment | Official recognition of SIFs as a new investment vehicle |

| February 27, 2025 | SEBI released detailed regulatory framework | Comprehensive guidelines for SIF structure and operations |

| April 1, 2025 | SIF framework becomes effective | AMCs can begin creating SIF products |

| April 11, 2025 | Standardized application format introduced | Streamlined process for AMCs to launch SIFs |

| May 2025 | First two SIF applications received by SEBI | Beginning of actual SIF product offerings in the market |

Why Were Specialised Investment Funds (SIFs) Created?

The Investment Gap: SEBI observed a significant gap in the investment landscape between mutual funds (accessible to all but with limited strategies) and PMS (sophisticated strategies but requiring ₹50 lakh minimum). This left many experienced investors with moderate capital (₹10-50 lakh) without suitable options for advanced investment strategies.

The creation of SIFs addresses several market needs:

- Meeting HNI Demands: Catering to high-net-worth individuals seeking more sophisticated investment options without committing to the ₹50 lakh PMS threshold

- Encouraging Innovation: Allowing fund managers more flexibility to develop and implement advanced strategies

- Channeling Capital: Directing investments to niche sectors and alternative strategies that may offer higher growth potential

- Reducing Unregulated Schemes: Providing a regulated alternative to unregistered investment schemes that promise unrealistic returns

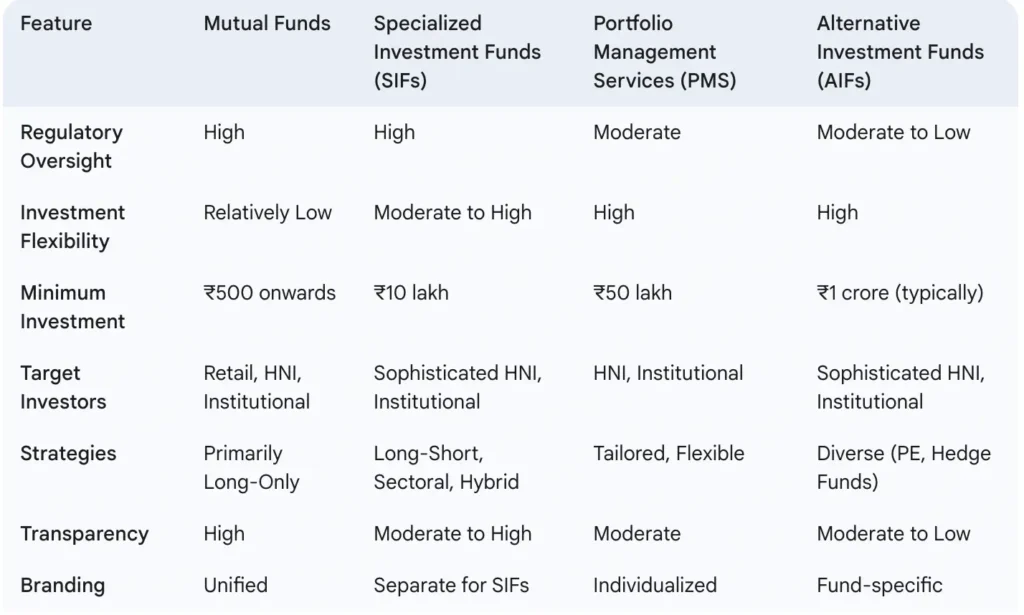

SIFs vs. Mutual Funds vs. PMS: A Comprehensive Comparison

Understanding where Specialised Investment Funds fit in the investment landscape requires a clear comparison with existing options. Let’s examine how SIFs stack up against mutual funds and Portfolio Management Services (PMS).

| Parameters | Mutual Funds | Specialised Investment Funds (SIFs) | Portfolio Management Services (PMS) |

| Minimum Investment | ₹500 to ₹5,000 | ₹10 lakh | ₹50 lakh |

| Target Investors | Retail investors, beginners | Experienced HNIs, sophisticated investors | Ultra-HNIs, institutional investors |

| Investment Flexibility | Limited (predefined strategies) | Moderate to high flexibility | Maximum flexibility (customized portfolios) |

| Risk Level | Low to moderate | Moderate to high | High (can be tailored) |

| Strategy Options | Traditional long-only approaches | Long-short, sector rotation, derivatives | Completely customized strategies |

| Portfolio Transparency | High (monthly disclosures) | Moderate to high | High (client-specific reporting) |

| Redemption Flexibility | Daily (typically) | Varies (daily to quarterly) | As per contract (typically quarterly) |

| Fee Structure | Lower (1-2.5% expense ratio) | Moderate (may include performance fees) | Higher (fixed + performance fees) |

| Tax Treatment | Standard mutual fund taxation | Similar to mutual funds | Individual securities taxation |

Key Differentiating Features of Specialised Investment Funds (SIFs)

Advanced Strategies

SIFs can implement sophisticated strategies like long-short positions, allowing investors to potentially profit in both rising and falling markets.

Specialized Focus

SIFs can concentrate on specific sectors or asset classes, providing targeted exposure to high-growth areas or alternative investments.

Strategic Flexibility

SIF managers have greater freedom to adjust strategies based on market conditions, unlike the more rigid constraints of traditional mutual funds.

Understanding the Investment Continuum

The Indian investment landscape can be viewed as a continuum of increasing sophistication, capital requirements, and potential returns:

- Fixed Deposits & Small Savings: Lowest risk, most accessible, guaranteed returns

- Traditional Mutual Funds: Low to moderate risk, professional management, diversified exposure

- Specialised Investment Funds: Moderate to high risk, advanced strategies, higher minimum investment

- Portfolio Management Services: High risk, customized portfolios, significant capital requirement

- Alternative Investment Funds: Highest risk, most sophisticated strategies, for institutional/ultra-HNI investors

SIFs fill a crucial gap in this continuum, providing a stepping stone for investors ready to move beyond traditional mutual funds but not yet prepared for the full commitment of a PMS.

SIF Investment Strategies Explained

Specialised Investment Funds offer a range of investment strategies across equity, debt, and hybrid asset classes. These strategies are designed to provide sophisticated approaches to market participation that go beyond traditional buy-and-hold methodologies.

Equity-Oriented Investment Strategies

| Strategy Type | Key Characteristics | Target Investor Profile |

| Equity Long-Short Fund | Minimum 80% in equity & equity-related instruments Maximum 25% short exposure through derivatives Daily redemption option | Investors seeking equity exposure with downside protection through short positions |

| Equity ExTop 100 Long-Short Fund | Minimum 65% in equity excluding top 100 stocks by market cap Maximum 25% short exposure in non-large cap stocks Daily redemption option | Investors looking for exposure to mid and small-cap companies with hedging capabilities |

| Sector Rotation Long-Short Fund | Minimum 80% in equity of maximum 4 sectors Maximum 25% short exposure at sector level Daily redemption option | Tactical investors who want to capitalize on sector-specific trends and rotations |

Debt-Oriented Investment Strategies

| Strategy Type | Key Characteristics | Target Investor Profile |

| Debt Long-Short Fund | Invests in debt instruments across durations Can take unhedged short positions through debt derivatives Weekly redemption option | Fixed income investors seeking enhanced returns through active duration management |

| Sectoral Debt Long-Short Fund | Focuses on at least two sectors with max 75% in a single sector Maximum 25% short exposure at sector level Weekly redemption option | Investors looking to capitalize on sector-specific credit opportunities with risk management |

Hybrid Investment Strategies

| Strategy Type | Key Characteristics | Target Investor Profile |

|---|---|---|

| Active Asset Allocator Long-Short Fund | Dynamic allocation across equity, debt, REITs/InVITs, commoditiesMaximum 25% short exposure through derivativesTwice weekly redemption option | Tactical investors seeking dynamic asset allocation across multiple asset classes |

| Hybrid Long-Short Fund | Minimum 25% in equity and 25% in debtMaximum 25% short exposureTwice weekly redemption option | Balanced investors looking for a mix of equity and debt with enhanced flexibility |

Understanding Long-Short Strategies

A long-short strategy is an investment approach where the fund manager:

- Goes “long” (buys) securities expected to increase in value

- Goes “short” (sells borrowed securities) on those expected to decrease in value

This strategy aims to generate returns regardless of overall market direction. In SIFs, short positions are primarily achieved through derivatives with exposure limited to 25% of the portfolio.

For example, an Equity Long-Short Fund might be long on promising technology stocks while simultaneously shorting overvalued companies in the same sector, aiming to profit from both positions.

Important Note on Strategy Limitations: To prevent proliferation of similar schemes, SEBI allows only one investment strategy per category under each SIF. This ensures focused offerings and prevents investor confusion.

Eligibility Criteria & Minimum Investment

Specialised Investment Funds have specific eligibility requirements for both the AMCs offering them and the investors participating in them.

Eligibility for Asset Management Companies (AMCs)

AMCs can establish a SIF through either of two routes:

Route 1: Sound Track Record

- Mutual fund operational for at least 3 years

- Average AUM of at least ₹10,000 crore in the preceding 3 years

- No regulatory actions against sponsor/AMC under SEBI Act sections 11, 11B, or 24 in the last 3 years

Route 2: Alternate Route

- Appointment of a Chief Investment Officer with 10+ years experience managing average AUM of ₹5,000+ crore

- Additional Fund Manager with 3+ years experience managing average AUM of ₹500+ crore

- No regulatory actions against sponsor/AMC under SEBI Act sections 11, 11B, or 24 in the last 3 years

Eligibility for Investors

Minimum Investment Threshold

- Minimum investment of ₹10 lakh across all investment strategies under a SIF

- This threshold applies at the PAN level (per investor)

- The ₹10 lakh minimum is exclusive to SIF investments and does not include regular mutual fund schemes of the same AMC

- Exception: Accredited investors are exempt from the minimum investment requirement

Investment Options

SIFs may offer various systematic investment options while ensuring compliance with the minimum investment threshold:

- Systematic Investment Plan (SIP): Regular, periodic investments

- Systematic Withdrawal Plan (SWP): Regular, periodic withdrawals

- Systematic Transfer Plan (STP): Regular transfers between schemes

Important Notice for Investors:

The ₹10 lakh minimum investment applies to the aggregate of all SIF strategies under one AMC at the PAN level. For example, if you invest in three different SIF strategies from the same fund house, your total investment across all three must be at least ₹10 lakh.

Risk Assessment and Management in Specialised Investment Funds (SIFs)

Understanding and managing risk is critical when investing in Specialised Investment Funds. SEBI has established a comprehensive risk assessment framework to help investors gauge the risk level of different SIF strategies.

SIF Risk Bands

Similar to mutual funds, SIFs use a pictorial risk meter called a “Risk-band” to depict the potential risk associated with each investment strategy. The Risk-band has five levels:

(Lowest risk)

(Highest risk)

Low Risk (Level 1-2)

Generally applies to debt-oriented strategies with minimal short exposure and high-quality debt instruments. Lower volatility expected.

Medium Risk (Level 3)

Typically hybrid strategies or diversified equity approaches with some hedging components. Moderate volatility expected.

High Risk (Level 4-5)

Usually specialized equity strategies with concentrated sectors or higher derivative usage. Significant volatility expected.

Risk Monitoring and Disclosure

- Risk-band is evaluated monthly and disclosed on the websites of SIFs/AMCs and AMFI within 10 days from month-end

- SIFs must disclose the risk level as of March 31st each year, along with the number of times the risk level changed during the year

- Any change in risk band must be communicated to unitholders via Notice cum Addendum and email/SMS

Understanding Derivatives Risk in SIFs

SIFs can use derivatives both for hedging and non-hedging (strategic) purposes, but with specific limitations:

- Maximum exposure through derivatives for non-hedging purposes: 25% of net assets

- Cumulative gross exposure across cash and derivatives markets: Cannot exceed 100% of net assets

Derivatives in SIFs can serve multiple purposes:

- Hedging: Protecting the portfolio against adverse market movements

- Tactical positioning: Taking advantage of short-term market opportunities

- Long-short strategies: Generating alpha through paired positions

While derivatives can enhance returns, they also introduce additional complexity and risk that investors should understand thoroughly.

Risk Management Best Practices for SIF Investors:

- Understand the specific risk factors associated with each SIF strategy

- Review the risk-band disclosures regularly to track changes in risk profile

- Diversify across multiple SIF strategies and asset classes to spread risk

- Consider your overall portfolio allocation when determining appropriate exposure to SIFs

- Consult with a financial advisor to ensure SIFs align with your risk tolerance and financial goals

Benefits and Drawbacks of Investing in SIFs

Like any investment vehicle, Specialised Investment Funds come with their own set of advantages and limitations. Understanding these thoroughly is essential for making informed investment decisions.

Benefits of SIFs

- Access to sophisticated investment strategies previously unavailable to most investors

- Higher potential returns compared to traditional mutual funds

- Professional management by experienced fund managers

- Lower entry barrier compared to PMS (₹10 lakh vs ₹50 lakh)

- Ability to benefit from both rising and falling markets through long-short strategies

- Exposure to niche sectors and alternative investment approaches

- Regulatory oversight providing investor protection

- Systematic investment options (SIP, SWP, STP) available

Drawbacks of SIFs

- Higher minimum investment threshold than regular mutual funds

- Potentially higher risk levels due to complex strategies

- Limited liquidity compared to traditional mutual funds

- Higher potential for manager-specific risk

- Complex strategies may be difficult for some investors to understand

- Limited track record as a new investment vehicle

- Possibility of underperformance during certain market conditions

- Potentially higher fee structures compared to mutual funds

Real-World Perspective

“SIFs represent a significant advancement in India’s investment landscape by democratizing access to sophisticated strategies. They’re particularly valuable for investors who understand that higher returns often require accepting higher volatility and longer investment horizons. However, they’re not suitable for everyone—particularly those who prioritize capital preservation or require frequent access to their investments.”

Who Should Consider Investing in SIFs?

SIFs are generally most suitable for:

- Experienced investors with a solid understanding of market dynamics and investment principles

- High-net-worth individuals with sufficient investable surplus beyond core financial needs

- Risk-tolerant investors comfortable with higher volatility for potentially superior returns

- Long-term investors with an investment horizon of 5+ years

- Portfolio diversifiers looking to add non-correlated assets to a traditional portfolio

SIFs may NOT be suitable for:

Investors without a diverse portfolio of more traditional assets

New investors still learning the basics of investing

Conservative investors with low risk tolerance

Short-term investors needing quick access to their capital

Market Overview: What’s Driving Specialised Investment Funds in 2025?

The introduction and growing interest in Specialised Investment Funds is driven by several key market factors and trends that are reshaping India’s investment landscape in 2025.

Key Market Drivers

Growing Investor Sophistication

India’s investor base has evolved significantly, with more investors seeking advanced strategies beyond traditional options. The mutual fund industry has seen AUM growth from ₹10 lakh crore in 2014 to over ₹51 lakh crore in 2025, indicating increasing financial awareness and participation.

Expanding HNI Segment

India’s HNI population has grown at a CAGR of approximately 12% over the last five years. This expanding segment has created significant demand for investment products that bridge the gap between mass-market mutual funds and ultra-high-net-worth PMS offerings.

Need for Alternative Return Sources

With traditional equity and fixed income markets facing challenges in delivering consistent alpha, investors are increasingly looking for alternative sources of returns through more advanced strategies like long-short, sector rotation, and dynamic asset allocation.

Regulatory Evolution

SEBI’s progressive approach to expanding investment options while maintaining investor protection has created a favorable regulatory environment for innovative products like SIFs. This balanced regulation helps mitigate risks while enabling market development.

Latest Developments (May 2025)

- First SIF Applications: SEBI has received the first two SIF applications from mutual fund AMCs and expects to approve them within 10 days

- Industry Preparation: At least seven additional AMCs are reportedly preparing to enter the SIF arena this year

- PMS/AIF Players: Several established PMS and AIF managers are pursuing mutual fund licenses specifically to launch SIF products

- “UPI Moment”: Some analysts have compared the potential impact of SIFs to the revolutionary effect of UPI on digital payments, suggesting it could significantly transform India’s investment landscape

Expert Market Analysis

“SIFs represent an inflection point in India’s investment ecosystem. They arrive at a time when India’s capital markets are maturing, and investors are increasingly seeking more sophisticated ways to participate in India’s growth story. By democratizing access to advanced investment strategies, SIFs could accelerate capital formation and potentially direct more resources to underserved but high-potential sectors of the economy.”

Potential Market Impact of SIFs

The introduction of SIFs could have several significant impacts on India’s investment landscape:

Market Maturation: As more capital flows into diverse strategies, India’s capital markets may become more resilient and less susceptible to retail-driven volatility

Competition with PMS: SIFs may create competitive pressure on the PMS industry, potentially leading to fee reductions or strategy innovations in the PMS space

Increased Capital for Alternative Strategies: SIFs could channel substantial capital to alternative investment strategies, potentially increasing market efficiency and price discovery

Product Innovation: The success of SIFs could accelerate the development of other innovative investment products targeting specific investor segments

Investor Education: The introduction of sophisticated strategies through SIFs is likely to drive greater financial literacy and understanding of advanced investment concepts

Strategic Approach to Specialised Investment Funds (SIF) Investments

Investing in Specialised Investment Funds requires a thoughtful, strategic approach. Here’s a comprehensive framework to help potential investors navigate this new asset class effectively.

Step-by-Step Investment Process

- Self-AssessmentBegin by evaluating your investment goals, risk tolerance, time horizon, and existing portfolio composition. SIFs are best suited for investors who have already built a core portfolio and are looking to enhance returns through more sophisticated strategies.

- Eligibility VerificationEnsure you meet the minimum investment threshold of ₹10 lakh across all SIF strategies of a particular AMC. If you qualify as an accredited investor, familiarize yourself with the specific requirements and documentation needed.

- Strategy SelectionResearch different SIF strategies (equity, debt, hybrid) and identify those that complement your existing portfolio and align with your market outlook. Consider how each strategy might perform in different market environments.

- AMC EvaluationAssess the track record, expertise, and resources of the AMC offering the SIF. Look for fund managers with proven experience in the specific strategies being offered and robust risk management processes.

- Documentation and KYCComplete all required KYC and documentation processes. These may be more extensive than for regular mutual funds, given the specialized nature of SIFs.

- Investment AllocationDetermine the appropriate allocation to SIFs within your overall portfolio. As a general guideline, SIFs should typically represent no more than 15-30% of a diversified investment portfolio, depending on your risk profile.

- Regular Monitoring and ReviewEstablish a systematic process to monitor your SIF investments. Pay attention to changes in risk-band levels, portfolio composition, and performance relative to appropriate benchmarks.

Portfolio Integration Strategies

Core-Satellite Approach

Use traditional mutual funds as your core holdings (70-80%) for broad market exposure, and add SIFs as satellite positions (20-30%) to enhance returns through specialized strategies.

Barbell Strategy

Combine very conservative investments (like government bonds) with aggressive SIF strategies, minimizing allocation to “middle-ground” investments to potentially optimize risk-adjusted returns.

Completion Portfolio

Use SIFs to access specific market segments or strategies that are underrepresented in your current portfolio, improving overall diversification and potential return sources.

Investment Timing Considerations

When considering the timing of SIF investments, keep these factors in mind:

Subscription/Redemption Windows: Be aware of the specific subscription and redemption frequencies of each SIF strategy. Some may offer daily liquidity, while others might be weekly or less frequent, affecting your ability to time entries and exits.

Market Cycle Positioning: Different SIF strategies may perform better at different points in the market cycle. For example, long-short strategies might outperform in sideways or volatile markets, while sector rotation strategies might excel during transitions between economic cycles.

Initial Launch Period: As SIFs are a new asset class, consider that the first wave of offerings may have teething issues or require adjustments as the market develops. Early adopters should be prepared for potential strategy refinements.

Systematic Entry: Rather than committing your entire intended allocation at once, consider a systematic entry approach (particularly if using an SIP) to average your entry points and reduce timing risk.

Strategic Allocation Framework:

| Investor Profile | Suggested SIF Allocation | Recommended SIF Strategies |

|---|---|---|

| Moderate Risk Investor | 5-15% of portfolio | Hybrid Long-Short, Debt Long-Short |

| Growth-Oriented Investor | 15-25% of portfolio | Equity Long-Short, Active Asset Allocator |

| Aggressive Investor | 25-35% of portfolio | Sector Rotation, Equity ExTop 100 |

Real-World Case Studies and Examples

While Specialised Investment Funds are a new investment vehicle in India, we can examine hypothetical scenarios based on similar strategies used in other markets and contexts to understand how they might perform.

Case Study 1: Long-Short Equity Strategy in Volatile Markets

Scenario:

During the 2022 market correction, traditional equity mutual funds in India saw significant drawdowns, with many large-cap funds declining 15-20%. In contrast, similar long-short equity strategies in more mature markets demonstrated resilience with typical drawdowns limited to 5-10% during the same period.

Strategy Implementation:

A hypothetical Equity Long-Short SIF might maintain 80% long exposure to quality stocks while using the remaining capacity to short overvalued or fundamentally weak companies through derivatives. This balanced approach can potentially dampen overall portfolio volatility while still participating in market upside.

Key Takeaway:

Long-short strategies can provide meaningful downside protection during market corrections while still capturing a significant portion of the upside during rallies, resulting in smoother return patterns over full market cycles.

Case Study 2: Sector Rotation Strategy in a Transitioning Economy

Scenario:

As India’s economy transitions through different phases of its growth cycle, various sectors lead performance at different times. In 2023-2024, we saw a shift from IT and pharmaceuticals outperformance to manufacturing, capital goods, and financial services dominance.

Strategy Implementation:

A Sector Rotation Long-Short SIF might dynamically allocate across 4 sectors based on economic indicators, valuation metrics, and momentum signals. When transitioning between sector exposures, the fund could maintain long positions in emerging leaders while shorting fading sectors, potentially enhancing returns during transitional periods.

Key Takeaway:

Sector rotation strategies with short capabilities can more quickly adapt to changing economic environments, potentially avoiding prolonged exposure to underperforming sectors while increasing allocation to emerging leaders.

Case Study 3: Active Asset Allocator in Rising Rate Environment

Scenario:

During 2022-2023, as interest rates rose globally, traditional balanced funds with static equity-debt allocations faced challenges as both asset classes experienced simultaneous pressure.

Strategy Implementation:

An Active Asset Allocator SIF might dynamically adjust exposures across asset classes based on the interest rate environment. As rates began rising, the fund could reduce duration in its fixed income allocation, increase exposure to rate-beneficiary sectors like financials, and potentially use short positions in rate-sensitive assets.

Key Takeaway:

The flexibility to adjust asset allocation dynamically and employ short positions can be particularly valuable during major economic transitions, potentially transforming challenging environments into opportunities.

Note: These case studies are hypothetical and illustrative. Actual results will depend on specific fund management, market conditions, and implementation details. Past performance of similar strategies in other markets is not a guarantee of future results for SIFs in India.

Potential Real-World Application: Technology Sector Example

Here’s a specific example of how a SIF might implement a long-short strategy in the technology sector:

Scenario: Indian Technology Sector in Transition

The Indian technology sector is experiencing a significant transition as companies adapt to AI integration, evolving global service delivery models, and changing client spending patterns.

Long Positions (80% of portfolio):

- Companies with strong AI/ML capabilities and intellectual property

- Firms successfully transitioning to product-based models

- Technology enablers for India’s digital infrastructure growth

- Companies with robust domestic market positioning

Short Positions (via derivatives, 20% of portfolio):

- Legacy IT services companies facing margin pressure

- Companies with high exposure to discretionary spending in challenging markets

- Technology firms with weak balance sheets facing rising costs

This nuanced approach would allow investors to maintain significant exposure to the technology sector’s long-term growth potential while potentially hedging against specific challenges facing parts of the industry.

Strategic Takeaways for Investors

For First-Time SIF Investors

- Start with more straightforward strategies like Hybrid Long-Short or Equity Long-Short before exploring more complex options

- Limit initial allocation to 5-10% of your overall portfolio to gauge comfort with the strategy and performance patterns

- Select AMCs with strong track records in similar strategies and robust risk management frameworks

- Extend your investment horizon to at least 3-5 years to allow strategies sufficient time to demonstrate their potential

- Regularly review performance in different market conditions to better understand how the strategy behaves

For Sophisticated Investors

- Consider creating a multi-strategy SIF portfolio across different asset classes and approaches to enhance diversification benefits

- Evaluate SIF strategies based on how they complement your existing portfolio rather than standalone performance

- Use SIFs strategically to access specific market segments or investment approaches otherwise unavailable

- Monitor correlation patterns between SIF strategies and your core portfolio to ensure diversification benefits are maintained

- Consider tactical allocation adjustments based on changing market environments to maximize the flexibility that SIFs offer

Looking Ahead: The Future of SIFs in India

As SIFs establish themselves in India’s investment landscape over the coming years, we can anticipate several developments:

- Product Evolution: Initial SIF offerings will likely evolve based on investor reception and market conditions, leading to strategy refinements

- Market Expansion: Successful implementation could lead SEBI to gradually approve additional strategy types beyond the initial categories

- Competitive Dynamics: SIFs may spark innovation in both mutual funds and PMS offerings as providers compete for investor attention

- Performance Benchmarking: Specialized benchmarks for SIF strategies will likely emerge as the category matures, enabling better performance evaluation

- Investor Education: Growing SIF adoption will likely drive enhanced education around advanced investment concepts, benefiting the broader investment ecosystem

Potential Challenges and Considerations

While SIFs offer promising opportunities, several challenges and considerations warrant attention:

Implementation Challenges

- Strategy Execution: The success of sophisticated strategies depends heavily on execution capabilities, which may vary across AMCs

- Talent Pool: The limited pool of fund managers with experience in advanced strategies like long-short investing could affect initial implementation quality

- Market Constraints: India’s derivatives markets, while growing, have certain limitations compared to more mature markets that could impact strategy implementation

Investor Considerations

Evaluation Metrics: Traditional performance metrics may not fully capture the value proposition of SIFs, requiring more sophisticated evaluation approaches

Performance Expectations: Investors must calibrate expectations appropriately—SIFs aim for risk-adjusted returns rather than simply maximizing absolute returns

Tax Implications: The tax treatment of various SIF strategies, particularly those involving derivatives, may be complex and warrant professional advice

Frequently Asked Questions about Specialised Investment Funds

What is a Specialised Investment Fund (SIF)?

A Specialised Investment Fund (SIF) is a new investment vehicle introduced by SEBI to bridge the gap between mutual funds and Portfolio Management Services (PMS). SIFs allow experienced investors to access sophisticated investment strategies like long-short equity, sector rotation, and dynamic asset allocation with a minimum investment of ₹10 lakh.

How are SIFs different from regular mutual funds?

SIFs differ from regular mutual funds in several key ways: they have a higher minimum investment (₹10 lakh vs. ₹500-5,000), employ more sophisticated strategies including short positions through derivatives, offer potentially higher risk-return profiles, and cater to experienced investors rather than retail investors. They also generally have different redemption frequencies and may employ more flexible portfolio construction approaches.

What is the minimum investment amount required for SIFs?

The minimum investment threshold for SIFs is ₹10 lakh per investor across all investment strategies offered by a particular AMC. This threshold applies at the PAN level and is exclusive to SIF investments (not including regular mutual fund investments with the same AMC). Accredited investors are exempt from this minimum investment requirement.

Who should invest in SIFs?

SIFs are most suitable for experienced investors with a good understanding of market dynamics, high-net-worth individuals with sufficient investable surplus, risk-tolerant investors comfortable with higher volatility, those with a long-term investment horizon (5+ years), and investors looking to diversify their existing portfolios with more sophisticated strategies.

What types of investment strategies are available under SIFs?

SIFs offer three main categories of investment strategies:

- Equity-Oriented: Equity Long-Short Fund, Equity ExTop 100 Long-Short Fund, and Sector Rotation Long-Short Fund

- Debt-Oriented: Debt Long-Short Fund and Sectoral Debt Long-Short Fund

- Hybrid: Active Asset Allocator Long-Short Fund and Hybrid Long-Short Fund

Each category employs different approaches to generate returns while managing risk.

What are the risk levels associated with SIFs?

SIFs use a “Risk-band” system with five levels to indicate potential risk, from Risk band level 1 (lowest risk) to Risk band level 5 (highest risk). These risk levels are assessed monthly and disclosed on the AMC’s website. Generally, debt-oriented SIFs have lower risk levels, hybrid strategies have moderate risk, and specialized equity strategies carry higher risk.

Can I invest in SIFs through SIP?

Yes, SIFs may offer systematic investment options such as Systematic Investment Plan (SIP), Systematic Withdrawal Plan (SWP), and Systematic Transfer Plan (STP). However, investors must ensure that their total investment across all SIF strategies of a particular AMC meets the minimum threshold of ₹10 lakh.

How liquid are SIF investments?

Liquidity in SIFs varies by strategy type. Equity-oriented strategies typically offer daily redemption, debt-oriented strategies offer weekly redemption, and hybrid strategies offer twice-weekly redemption. However, AMCs may implement notice periods of up to 15 working days for redemptions. Additionally, close-ended and interval SIF strategies must be listed on recognized stock exchanges to provide an exit option for investors.

What is the tax treatment for SIFs?

SIFs are expected to follow taxation rules similar to mutual funds, with specific treatment depending on the underlying asset class and holding period. Equity-oriented SIFs would likely follow equity mutual fund taxation, while debt-oriented SIFs would follow debt fund taxation. However, given the complexity of some strategies, investors should consult tax professionals for guidance on their specific investments.

When will SIFs be available for investment?

As of May 2025, SEBI has received the first two SIF applications from mutual fund AMCs and expects to approve them within 10 days, according to SEBI Chairman Tuhin Kanta Pandey. This suggests that the first SIF products should be available for investment by mid-2025, with more offerings expected to follow throughout the year.

Conclusion: Is a Specialised Investment Fund Right for You?

Specialised Investment Funds represent a significant evolution in India’s investment landscape, bridging the gap between traditional mutual funds and more sophisticated portfolio management services. They offer experienced investors access to advanced strategies with greater flexibility and potentially higher returns, albeit with corresponding risk considerations.

As SIFs begin to enter the market in 2025, they present an opportunity for qualified investors to diversify their portfolios and access investment approaches previously unavailable to most. However, they require careful consideration, thorough understanding, and appropriate integration into a broader investment strategy.

Key Takeaways

- SIFs bridge the gap between mutual funds and PMS with a ₹10 lakh minimum investment threshold

- They offer sophisticated strategies including long-short approaches across equity, debt, and hybrid asset classes

- Risk levels vary by strategy and are regularly monitored and disclosed through the Risk-band system

- SIFs are best suited for experienced investors with a long-term horizon and moderate to high risk tolerance

- The first SIF products are expected to be approved by mid-2025, with more offerings to follow

Ready to Take the Next Step?

As SIFs become available in the market, consider these action steps:

Educate

Continue learning about specific SIF strategies and how they align with your investment goals and risk tolerance.

Evaluate

Assess your portfolio to identify where and how SIFs might complement your existing investments and enhance diversification.

Engage

Connect with financial advisors who understand SIFs to develop a strategic approach tailored to your specific financial situation.

Remember that while SIFs offer exciting potential, they should be part of a well-diversified investment strategy aligned with your financial goals, time horizon, and risk tolerance.

Disclaimer: This article is for informational purposes only and should not be considered financial advice. Always consult with a qualified financial professional before making investment decisions.