Have you ever wondered how to determine if a stock is worth its price? The price-to-book (P/B) ratio is one of the most effective tools for helping investors gauge whether a stock might be overvalued or undervalued.

Valuing a company can sometimes feel like solving a complex puzzle, but with the P/B ratio, the process becomes much more straightforward.

Whether you’re new to investing or eager to expand your knowledge, this guide will break down everything you need to know about the P/B ratio.

What Is the Price-to-Book (P/B) Ratio?

The Price-to-Book (P/B) Ratio is a straightforward yet powerful financial metric that helps investors determine how a company’s stock price compares to its net worth, or “book value.”

This comparison can reveal whether a stock is potentially undervalued, fairly priced, or overpriced relative to the company’s assets.

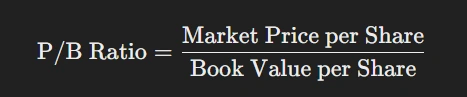

The Formula

The P/B ratio is calculated as:

This ratio acts as a bridge between what the stock is currently trading for in the market and what the company’s financial statements say it’s worth.

Here’s a quick breakdown:

- Market Price per Share: The price at which the company’s stock is currently trading on the stock market. Think of it as what buyers are willing to pay for ownership of one share today.

- Book Value per Share: The company’s total assets minus its liabilities, divided by the total number of shares outstanding. In essence, this reflects the net worth of the company if it were liquidated and all debts were paid off.

The Essence of the P/B Ratio

In simple terms, the P/B ratio tells you how much investors are paying for every dollar of a company’s net worth.

For example:

- A P/B ratio of 1 means the stock price equals the book value, suggesting the company is valued at its net worth.

- A P/B ratio of 0.8 might indicate the stock is undervalued, trading below the company’s book value.

- A P/B ratio of 2 or higher suggests investors are paying a premium, likely due to expectations of future growth or other intangible assets not reflected on the balance sheet.

An Analogy for Better Understanding

Imagine you’re shopping for a house.

- The market price is the amount the seller is asking for—what the market has determined the property is worth based on demand, location, and other factors.

- The book value, on the other hand, is the home’s fundamental worth—the cost of materials, land, and construction.

If the seller’s price is much higher than the home’s intrinsic value, you’d question whether it’s worth it. But if the price is lower, you might see it as a bargain, provided there are no hidden issues like structural damage.

Similarly, the P/B ratio helps investors assess whether a stock is priced reasonably compared to the company’s tangible assets.

A Practical Perspective

Investors often view the P/B ratio as a lens into market sentiment. A low ratio might signal pessimism or a potential buying opportunity, especially if the company’s fundamentals are strong.

Conversely, a high P/B ratio could reflect market optimism about future growth, brand strength, or competitive advantages—but it might also signal overvaluation.

Understanding the P/B ratio isn’t just about crunching numbers; it’s about interpreting what those numbers say about investor confidence and the company’s intrinsic value.

This metric, while simple, provides a gateway to deeper insights when used alongside other financial tools.

Why Is the P/B Ratio Important?

The P/B ratio offers a snapshot of how investors perceive a company’s value relative to its financial foundation. Here’s what it can reveal:

1. Identifying Undervalued Stocks

A P/B ratio below 1 might indicate that a stock is undervalued. This means the market price of the company’s stock is less than its book value—essentially, you’re buying the company for less than the value of its net assets.

- Why this matters: For value investors, this scenario is often a sign of a potential bargain. It’s like buying a ₹100 bill for ₹80. Companies with a low P/B ratio may be temporarily out of favor with the market, offering an opportunity for those willing to take the risk.

- Caution: A low P/B ratio isn’t always a green flag. Sometimes, it reflects deeper issues such as poor management, declining revenues, or industry challenges. A closer look at the company’s fundamentals is essential to ensure the undervaluation isn’t due to structural weaknesses.

2. Spotting Overvalued Stocks

A P/B ratio above 1 signals that investors are paying a premium for the company’s stock. This often happens when the market is optimistic about a company’s growth prospects, brand reputation, or competitive edge.

- Why this matters: High P/B ratios are common in sectors driven by innovation or intangible assets (like tech or pharmaceuticals), where future earnings potential may outweigh the current book value. For growth investors, such stocks might still be attractive despite their higher valuations.

- Caution: Paying a premium comes with risks. A high P/B ratio could indicate that the stock is overhyped and may underperform if the company fails to meet market expectations. Think of the dot-com bubble—stocks with soaring P/B ratios eventually crashed when the hype wore off.

It’s tempting to rely solely on the P/B ratio, but its interpretation requires context.

- A low P/B ratio might also signal:

- Poor earnings potential.

- Industry downturns or high-risk environments.

- Inefficiencies in asset utilization.

- A high P/B ratio might reflect:

- Strong future earnings growth or innovative products.

- Substantial intangible assets not captured in the book value (like intellectual property, patents, or goodwill).

- Efficient management and industry leadership.

Why Context Matters

The P/B ratio doesn’t operate in a vacuum. Its true value lies in how it’s interpreted alongside other metrics and within the context of the industry.

- Sector Differences: Asset-heavy industries like banking and manufacturing often have lower P/B ratios, while asset-light sectors like tech or software tend to have higher ones.

- Historical Trends: A declining P/B ratio for a company might signal trouble, but it could also present a buying opportunity for savvy investors.

How to Use the P/B Ratio in Your Investment Decisions

1. Compare Within the Same Sector

The P/B ratio isn’t one-size-fits-all. Industries with heavy physical assets (like manufacturing or real estate) tend to have lower P/B ratios.

On the other hand, tech companies—where intellectual property (valuable intangible assets-think patents or software) drives value—often boast higher P/B ratios.

Example: Comparing Apple’s P/B to Ford’s wouldn’t make sense because their assets and business models are vastly different.

2. Historical Trends Matter

Look at how a company’s P/B ratio has changed over time. A declining ratio could indicate a company’s struggles—or a potential opportunity for value investors.

3. Combine with Other Metrics

Think of the P/B ratio as one tool in your investor toolbox. Pair it with others like:

- Price-to-Earnings (P/E) Ratio: For profit-focused analysis.

- Debt-to-Equity (D/E) Ratio: To check financial stability.

- Return on Equity (ROE): To see how effectively management uses assets.

By looking at these together, you’ll get a fuller picture of a company’s value.

Real-Life Examples

Case 1: A Bargain Hunter’s Dream

During the 2020 market downturn, many airlines had P/B ratios below 1. For investors confident in a post-pandemic rebound, this signaled a potential buying opportunity.

Case 2: Beware of Overpriced Stocks

In the late 1990s, dot-com companies often had sky-high P/B ratios, even though they lacked tangible assets or profits. Investors who overlooked these warning signs faced significant losses when the bubble burst.

Limitations of the Price-to-Book (P/B) Ratio

While the Price-to-Book Ratio is a valuable tool in assessing a company’s valuation, it’s far from perfect. Like any metric, it has its limitations and is most effective when used in conjunction with other financial indicators.

Here’s a closer look at the key blind spots of the P/B ratio:

1. Neglect of Intangible Assets

The P/B ratio primarily focuses on tangible assets—things like buildings, machinery, and inventory—while ignoring intangible assets that often play a critical role in a company’s value.

- Why this matters: In today’s economy, many leading companies derive significant value from intangible assets such as:

- Patents and intellectual property.

- Brand reputation (e.g., Coca-Cola’s brand equity).

- Proprietary technology (e.g., Google’s algorithms).

These assets don’t appear directly on the balance sheet, meaning a company with substantial intangible value could have a high P/B ratio that falsely suggests overvaluation.

Example:

A tech company like Google may have a P/B ratio that appears high because its intangible assets—like its search engine technology or ad platform—aren’t reflected in its book value. This could mislead investors who rely solely on the P/B ratio.

2. Variations in Accounting Practices

The calculation of book value depends heavily on a company’s accounting methods, which can vary widely across industries and regions.

- Depreciation Policies: Companies may use different depreciation methods (e.g., straight-line vs. accelerated), leading to variations in asset valuations.

- Write-offs and Impairments: Some companies might write off assets aggressively, lowering their book value, while others retain higher asset values on their balance sheets.

These differences can distort the P/B ratio, making it less reliable for comparing companies, especially across industries or international markets.

Example:

A company that frequently updates its book value to reflect market conditions may show a lower P/B ratio than a competitor that doesn’t, even if its actual value is similar.

3. Limited Applicability Across Industries

The P/B ratio works best in industries with significant physical assets, such as manufacturing, real estate, or banking. However, it becomes less useful for companies in asset-light or innovation-driven sectors.

- Why this matters: In industries like technology, entertainment, or consulting, much of a company’s value lies in human capital, intellectual property, or future growth potential—none of which are captured in the book value.

Example:

A consulting firm with minimal physical assets may have a high P/B ratio because its value lies in its employees’ expertise and relationships with clients.

The P/B ratio fails to account for these critical drivers of success, potentially misleading investors.

4. Outdated Reflections of Value

Book value is based on historical costs, meaning it doesn’t always reflect current market conditions.

- Why this matters: Over time, the value of physical assets like real estate or equipment may increase (or decrease), but the book value often doesn’t capture these changes accurately. This can result in an outdated or skewed P/B ratio.

Example:

A company that owns real estate purchased decades ago may have a low book value for those assets, even if their market value has skyrocketed. This could make the company’s P/B ratio misleadingly low.

5. Focus on Liquidation Value

The P/B ratio implicitly assumes that the book value represents what shareholders would receive if the company were liquidated.

This may not be relevant for companies that are not in financial distress or that operate in high-growth industries.

- Why this matters: For growth-focused investors, the company’s future earnings potential and market opportunities often outweigh its current book value.

Example:

A startup with innovative technology may have a high P/B ratio because it has minimal assets and significant future growth potential. The P/B ratio doesn’t adequately reflect this forward-looking value.

How to Use the P/B Ratio Effectively

- Stick to Apples-to-Apples Comparisons

Only compare P/B ratios within the same sector or industry. - Look Beyond the Numbers

Research qualitative factors like management quality, competitive advantages, and market trends. - Monitor Market Conditions

Economic shifts can impact how investors perceive value, influencing P/B ratios across the board.

Final Thoughts: Is the P/B Ratio Right for You?

The Price-to-Book Ratio is like a compass for investors—it points you in the right direction but doesn’t do all the work for you.

By understanding the P/B ratio and using it alongside other tools, you can make smarter, more informed decisions.

However, remember: investing is both an art and a science. Use the P/B ratio as one piece of the puzzle, not the entire picture. And most importantly, stay curious—because the more you learn, the better your decisions will be.

Also, Read | Earnings Per Share (EPS): A Clear Guide to Understanding This Financial Metric