Entering into the financial world involves making smart choices, and one common approach is technical analysis.

It’s like a detective work for stocks, using past price data to guess what might happen next.

Sounds cool, right? But, like everything, technical analysis has its advantages and disadvantages.

Technical analysis helps you see patterns, making it easier to predict where things might go. It’s like having a map of the stock market.

But hold on. It’s not foolproof. Sometimes, the predictions can go off track. It’s like relying on a weather forecast – it’s not always right.

In this article, we’ll break down the pros and cons of technical analysis in easy-to-understand examples to ensure you grasp the concepts easily.

What is technical analysis?

Before going for the Advantages and Disadvantages of Technical analysis you need to understand what is technical analysis.

In simple terms, technical analysis involves examining historical price and volume data to predict future price movements in financial markets, such as stocks, currencies, commodities, etc. britannica.com

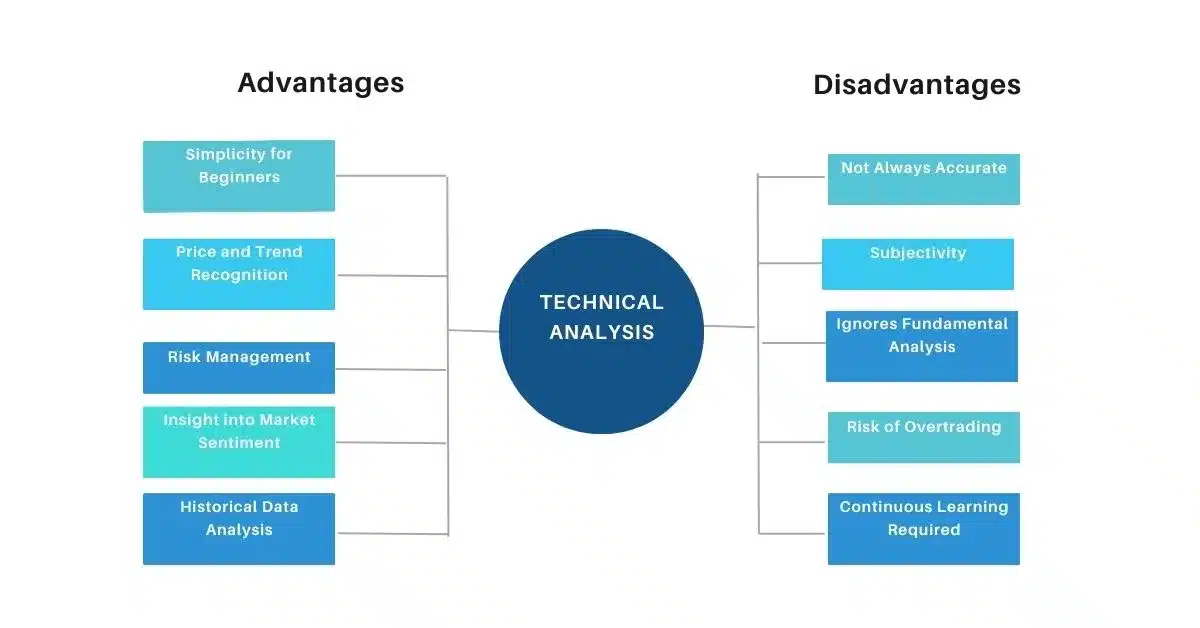

Advantages and Disadvantages of Technical Analysis

Like any approach to market analysis, technical analysis has its advantages and disadvantages. Here are some of the key points to consider:

Advantages of Technical Analysis:

1. Simplicity for Beginners:

Technical analysis is like learning to ride a bicycle. Once you grasp the basics, it becomes a valuable skill. You don’t need an advanced finance degree to get started.

By understanding simple charts and patterns, even newcomers can begin making sense of market trends.

Imagine you’re learning to ride a bike, and you notice that you maintain balance by pedaling at a certain speed.

Similarly, in technical analysis, recognizing patterns can help you maintain balance in your investments.

2. Insight into Market Sentiment:

Think of the stock market as a bustling marketplace. Technical analysis allows you to gauge the mood of the crowd.

By examining charts and indicators, you can identify whether investors are feeling bullish (optimistic) or bearish (pessimistic).

Just as you can sense excitement at a bustling market with vendors shouting their best deals, technical analysis helps you sense when buyers are excited and prices are rising.

3. Price and Trend Recognition:

Technical analysis is like a weather forecast for the financial markets. It helps you anticipate whether conditions are likely to be sunny (an uptrend) or stormy (a downtrend).

Recognizing these trends is very important for making well-informed trading decisions.

If you know that the weather forecast predicts sunny days, you might plan a picnic.

Similarly, when technical analysis indicates an uptrend, you might plan to buy stocks.

4. Risk Management:

Technical analysis offers a safety net for your investments, much like setting a speed limit while driving to avoid accidents.

It helps you to identify potential stop-loss zones so that you can set your stoploss order to avoid big losses and wipe out the entire capital that you invested.

This way you can save your day from taking big losses and emotional disturbances.

Just as setting a speed limit protects you on the road, setting a stop-loss order protects your investments from significant losses.

5. Historical Data Analysis:

Consider historical price data as clues from the past that help you predict the future. Technical analysis helps you to analyze past market behavior, identifying patterns and trends that can guide your investment decisions.

Also, Read | Understanding Price Action Trading: A Comprehensive Guide

Imagine you’re planning a road trip, and you check past traffic data to choose the best route. Similarly, in technical analysis, past price data helps you navigate the markets.

Disadvantages of Technical Analysis:

1. Not Always Accurate:

In Technical analysis sometimes Charts and indicators can provide false signals, leading to poor investment decisions. Relying solely on technical analysis can be risky.

Just as a weather forecast can occasionally be wrong, technical analysis can sometimes give inaccurate predictions, leading to losses.

That’s why you must always decide the stop-loss before entering into the trade.

2. Subjectivity:

Much like interpreting art, technical analysis can be subjective. What one analyst sees as a buy signal, another may interpret differently.

This subjectivity can lead to conflicting opinions in the market.

Consider a group of people looking at an abstract painting. They might have different interpretations. Similarly, analysts can have varying views when analyzing charts.

3. Ignores Fundamental Analysis:

Technical analysis focuses on price data but overlooks crucial factors such as a company’s financial health, management, and industry trends, which we generally learn in fundamental analysis.

Relying solely on technical analysis may result in incomplete investment decisions.

It’s like evaluating a cake based solely on its appearance without knowing the ingredients. Technical analysis looks at price but not the underlying factors.

4. Risk of Overtrading:

Technical analysis can be like having a constant snack supply. It can tempt traders to make excessive trades, incurring higher brokerage, fees and taxes. Overtrading can lead to losses.

If you have an abundance of snacks available, you might end up eating too much. Similarly, if you act on every small signal in technical analysis, you could incur losses.

5. Continuous Learning Required:

Technical analysis is not a one-time skill. It’s more like learning a language that evolves over time.

To stay proficient, you need to keep learning new patterns and indicators as market conditions change.

Learning technical analysis is similar to learning a language. It requires continuous practice and adaptation.

Watch on YouTube – Advantages & Disadvantages of Technical Analysis

Bottom Line

Success in trading requires a balanced approach, and understanding the advantages and disadvantages of technical analysis is a vital step toward making informed decisions in the financial markets.

Frequently Asked Questions:

What are the advantages and disadvantages of fundamental analysis?

Advantages: Fundamental analysis provides a comprehensive view of a company’s financial health, assists in long-term investment decisions, and focuses on real and tangible factors.

Disadvantages: It can be time-consuming due to extensive research, has limited usefulness for short-term trading, and relies heavily on accurate and transparent financial information.

What are the benefits of a technical analysis course?

A technical analysis course helps individuals develop skills to analyze price charts and patterns, enhances the ability to identify trends and reversals, and aids in making informed trading decisions based on historical price data.

What are the advantages of fundamental and technical analysis?

Fundamental Analysis: Useful for long-term investors, focuses on a company’s intrinsic value, and incorporates economic and industry factors.

Technical Analysis: Valuable for short-term traders, analyzes historical price and volume patterns, and helps in identifying entry and exit points.

What is the problem with technical analysis?

The problem with technical analysis lies in its reliance on historical data, which may not predict future market movements accurately.

It is also subject to interpretation, leading to potential biases, and ignores fundamental factors that can impact a stock’s value.

What are the disadvantages of trend analysis?

Trend analysis may not account for sudden market changes, relies on historical data that may not accurately predict future trends, and is limited in predicting trend reversals.

What is the difference between fundamental and technical analysis?

Fundamental Analysis: Examines a company’s financial health, management, industry position, and economic factors.

Technical Analysis: Analyzes historical price and volume data to predict future price movements.

What are the limitations of technical analysis of stocks?

Limitations of technical analysis include the potential inaccuracy of historical data in predicting future market movements, susceptibility to psychological biases and emotions, and the exclusion of fundamental factors.

What is the opposite of technical analysis?

The opposite of technical analysis is Fundamental Analysis, which focuses on a company’s financial health, earnings, and other fundamental factors rather than price movements.

What is the opposite of technical analysis in stocks?

The opposite of technical analysis in stocks is Fundamental Analysis, which involves examining a company’s financial statements, management, and industry position.

What are the criticisms of technical analysis?

Technical analysis is often criticized for being seen as more art than science, not considering fundamental factors, and potentially leading to self-fulfilling prophecies if widely followed.

What are the advantages of technical analysis in the stock market?

Technical analysis in the stock market helps identify trends and potential entry/exit points, is useful for short-term traders, and can be applied to various financial instruments.

What are the major challenges to technical analysis and its rules?

Major challenges to technical analysis include changes in market sentiment, the need to adapt to evolving market conditions, and the risk of relying too heavily on historical patterns that may result in false signals.