In the volatile world of financial markets, where prices can swing dramatically on a mere tweet or unexpected news event, successful traders often share one crucial characteristic—they’ve mastered the art of emotionless option trading. But what is emotionless option trading exactly, and why has it become the differentiating factor between consistent profit-makers and those who repeatedly fall victim to market psychology traps?

Emotionless option trading means making trading decisions based solely on predefined rules, technical analysis, and logical reasoning rather than emotional impulses like fear, greed, or excitement. This disciplined approach creates a shield against the psychological pitfalls that plague most traders, especially in the options market where leverage can amplify both gains and losses.

According to recent data from the Chicago Board Options Exchange (CBOE), options trading volume hit a record 1.2 billion contracts in January 2025, demonstrating the growing popularity of this investment vehicle. Yet, statistics show that only about 10% of options traders consistently turn a profit. The difference? The profitable minority has learned to trade with their heads, not their hearts.

In this comprehensive guide, we’ll explore what emotionless option trading is, why it’s critical for success, practical techniques to implement it, and the tools that can help you trade more systematically in 2025’s increasingly algorithm-driven markets.

Understanding Market Psychology and Emotional Trading

The Emotional Trading Cycle

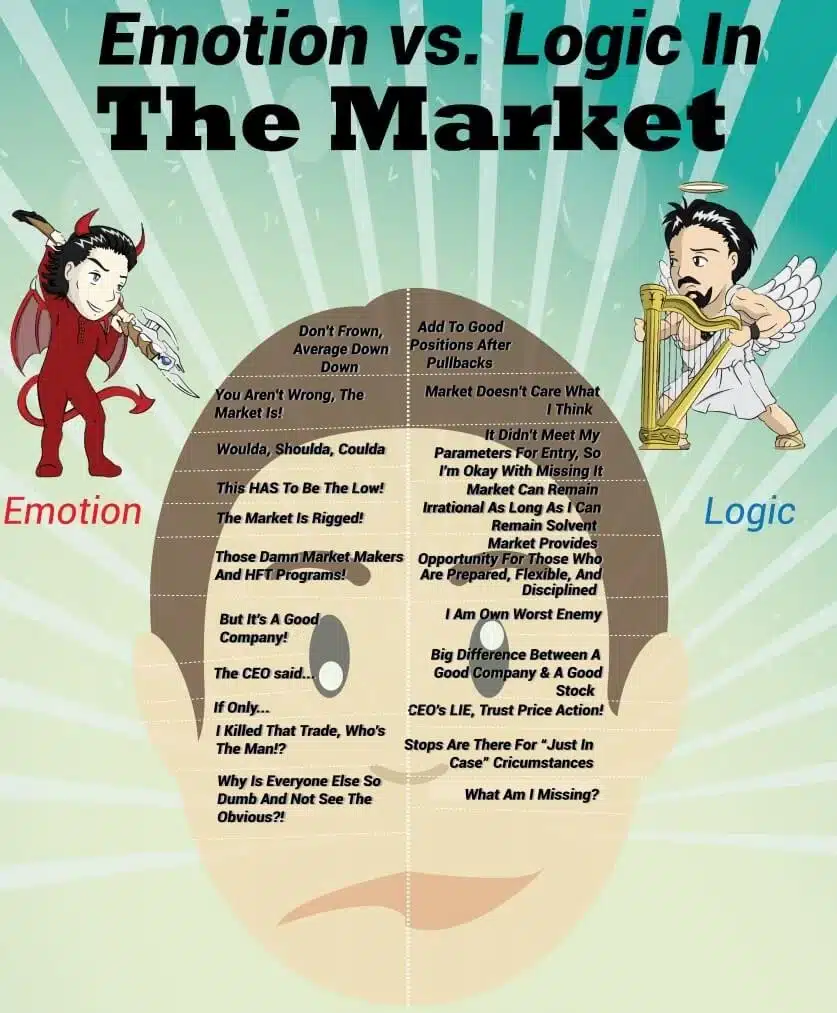

The market operates in cycles, and so do human emotions. When you overlay the emotional cycle with market movements, a telling pattern emerges. Most traders buy at peaks (driven by greed and FOMO) and sell at bottoms (driven by fear and panic), resulting in the exact opposite of the “buy low, sell high” axiom.

Common Emotional Pitfalls in Options Trading

Fear of Missing Out (FOMO)

FOMO drives traders to enter positions after a significant price movement has already occurred, often near the top. In options trading, this frequently results in buying calls with inflated premiums during market euphoria, only to watch those options lose value when the inevitable correction comes.

Fear, Uncertainty, and Doubt (FUD)

When markets decline or negative news emerges, FUD can cause traders to abandon sound strategies and exit positions prematurely. For options traders, this might mean selling potentially profitable positions at a loss when temporary volatility spikes.

Greed

Greed pushes traders to extend winning positions beyond logical exit points or increase position sizes after a string of wins. In options trading, this often manifests as refusing to take profits on deep in-the-money options, only to see time decay and market reversals erode those gains.

Hopium

This dangerous emotion—a blend of hope and optimism—leads traders to hold losing positions far too long, hoping for a miraculous recovery. Options traders affected by “hopium” might refuse to cut losses on out-of-the-money contracts, watching as time decay gradually reduces their value to zero.

Revenge Trading

After a loss, many traders immediately try to “win back” what they lost through larger, riskier positions. This emotional reaction typically leads to compounded losses and an even deeper psychological hole.

The Real Cost of Emotional Trading

Recent research from the Journal of Behavioral Finance reveals that emotional decision-making costs the average trader 3-7% in annual returns. For options traders specifically, this figure jumps to 11-15% due to the leveraged nature of options contracts and their sensitivity to timing.

“The investor’s chief problem—and even his worst enemy—is likely to be himself.” — Benjamin Graham

What is Emotionless Option Trading?

Definition and Core Principles

Emotionless option trading is a systematic approach to trading options contracts that relies on:

- Predefined rules and criteria for entries and exits

- Technical and/or quantitative analysis rather than feelings or hunches

- Risk management parameters established before entering trades

- Consistent application of strategy regardless of short-term results

- Review and optimization based on data, not emotional reactions

The Science Behind Emotionless Trading

Our brains are wired for survival, not trading. When facing financial risk, the amygdala (our brain’s fear center) activates, triggering fight-or-flight responses that served our ancestors well when facing predators but work against us in financial markets.

Neuroimaging studies show that successful traders exhibit greater activation in the prefrontal cortex (responsible for logical thinking) and less activity in the amygdala during market decisions. Emotionless trading frameworks essentially train the brain to operate in this more rational mode.

How Emotionless Option Trading Works

Technical Analysis Foundation

Emotionless trading relies heavily on technical indicators and chart patterns to make decisions. Some key technical analysis tools specifically useful for options trading include:

Moving Averages

Moving averages smooth out price data over a specified period, making it easier to identify trends. When a short-term moving average (e.g., 20-day) crosses above a longer-term average (e.g., 50-day), this might signal an entry point for call options. Conversely, when the short-term average drops below the longer-term average, it could indicate a put option opportunity.

Volume Analysis

Volume confirms price movements. A price breakout accompanied by high volume suggests stronger conviction and potentially more sustainable trends—important information when selecting option strike prices and expiration dates.

Relative Strength Index (RSI)

This momentum oscillator measures the speed and change of price movements, identifying overbought (above 70) or oversold (below 30) conditions. Options traders can use RSI divergences to spot potential reversals, which are particularly valuable for timing entries and exits.

Implied Volatility

Unique to options trading, implied volatility reflects the market’s expectations for future price movements. High implied volatility often results in more expensive option premiums. By tracking implied volatility, emotionless traders can determine when options are relatively cheap or expensive, guiding decisions about buying or selling options.

Statistical Edge and Probability

Unlike emotional traders who feel they need to “be right” on every trade, emotionless traders understand that success comes from having a statistical edge applied consistently over time. They focus on:

- Expected value of each trade

- Win rate vs. reward-to-risk ratio

- Position sizing based on probability

- Managing the distribution of outcomes

According to statistics from successful option trading firms, a strategy with just a 55% win rate can be highly profitable if the average winner is 1.5 times the size of the average loser. This mathematical reality forms the foundation of emotionless trading systems.

Creating an Emotionless Option Trading Strategy

Step 1: Define Your Trading Plan

An emotionless trading plan must be comprehensive and specific enough to eliminate ambiguity. It should include:

- Trading style and timeframe (day trading, swing trading, position trading)

- Option strategies to use (spreads, naked options, combinations)

- Criteria for underlying assets (sector, market cap, liquidity)

- Specific entry signals with no room for interpretation

- Position sizing rules based on account size and risk tolerance

- Exit parameters for both profit targets and stop losses

- Maximum allowed risk per trade and portfolio

Step 2: Focus on Technical Analysis and Data

Unlike discretionary traders who rely on intuition or “feel,” emotionless traders base decisions on concrete data points:

| Technical Aspect | Implementation in Options Trading |

|---|---|

| Trend Identification | Use multiple timeframes to confirm trend direction before selecting call or put options |

| Support/Resistance Levels | Set strikes near these levels for credit spreads or use as targets for debit spreads |

| Volatility Assessment | Compare historical vs. implied volatility to determine if options are fairly priced |

| Correlation Analysis | Evaluate correlation between assets for multi-leg strategies or portfolio balancing |

Step 3: Establish Clear Entry and Exit Rules

Emotionless option trading requires precise triggers for both entering and exiting positions:

Entry Rules Example:

- Enter a call debit spread when:

- Underlying breaks above 50-day moving average

- RSI is above 50 but below 70

- MACD shows positive momentum

- Implied volatility is in the bottom 30% of its 6-month range

Exit Rules Example:

- Exit a position when:

- Profit target of 50% of maximum potential gain is reached

- Stop loss of 25% of maximum risk is hit

- Time decay acceleration point (21 days before expiration)

- Technical invalidation (e.g., moving average crossover reversal)

Step 4: Implement Risk Management

Risk management is perhaps the most critical component of emotionless trading. Research shows that professional options traders rarely risk more than 1-3% of their capital on a single trade.

Effective risk management includes:

- Position sizing formula based on account equity

- Portfolio-level exposure limits by strategy type and underlying

- Correlation management to avoid over-concentration

- Volatility-adjusted position sizing (smaller positions in high-vol markets)

Step 5: Use Automation and Tools

In 2025, traders have access to sophisticated tools that facilitate emotionless trading:

- Automated trading platforms that execute pre-programmed rules

- Backtesting software to validate strategies with historical data

- Screening tools that identify opportunities matching specific criteria

- Risk analysis dashboards providing real-time portfolio statistics

Market Analysis: What’s Driving Emotionless Option Trading?

Key Developments and Their Impact

The options market has evolved significantly in recent years, with several developments making emotionless trading both more accessible and more necessary:

- Algorithmic Trading Dominance

In 2025, over 70% of options market volume is now driven by algorithms. These emotionless systems operate on mathematical principles and technical patterns, creating a market environment where emotional traders are at an even greater disadvantage than before.

- Increased Retail Participation

The number of retail option traders increased by 35% since 2023, creating opportunities for disciplined traders to capitalize on the emotional trading patterns of inexperienced participants.

- Enhanced Analytical Tools

The proliferation of AI-powered trading tools has democratized access to sophisticated analysis previously available only to institutions.

- Regulatory Changes

New regulations requiring greater transparency in options markets have leveled the playing field for retail traders with disciplined approaches.

Expert Analysis

According to Jason Stevens, head options strategist at Quantum Capital:

“The most successful option traders we work with have all implemented systematic, emotion-free trading methodologies. In today’s markets, the ability to execute consistently on a well-defined plan is more important than trying to predict market direction.”

Tools for Emotionless Option Trading in 2025

Trading Platforms with Rule-Based Systems

Modern platforms allow traders to implement and automate emotionless trading systems:

- TradeStation – Known for its robust strategy building and backtesting capabilities

- ThinkOrSwim – Offers advanced option analytics and customizable scanning

- Tastyworks – Designed specifically for options traders with probability-based tools

- OptionAlpha – Provides automated options strategies with backtested performance

Technical Analysis Tools

Several tools specifically designed for options traders help maintain an emotionless approach:

- OptionVue – Sophisticated volatility analysis and strategy modeling

- Market Chameleon – Historical volatility patterns and options-specific indicators

- TradingView – Customizable technical analysis with options-focused indicators

- OptionsStrat – Visual modeling of strategies with profit/loss projections

Risk Management Software

Risk management tools help keep emotions in check:

- PortfolioVisualizer – Portfolio-level risk analysis and correlation tracking

- Option Net Explorer – Position modeling with risk metrics and scenario analysis

- Optuma – Advanced statistical analysis of strategy performance

- Deltix – Enterprise-grade risk management for active options traders

Benefits of Emotionless Option Trading

Consistency in Results

By removing emotional variables from the equation, traders typically experience:

- More consistent monthly returns

- Reduced performance volatility

- Better long-term compounding

- Easier strategy optimization

Research from trading psychology firm TradingVibes shows that traders following mechanical systems had 68% less variation in monthly returns compared to discretionary traders.

Improved Mental Health

Many traders underestimate the psychological toll of emotional trading:

- Lower stress levels with predefined risk parameters

- Reduced decision fatigue

- Better sleep and work-life balance

- Sustainable long-term trading career

Higher Potential Returns

Statistics from brokerage performance data reveal that traders using mechanical systems outperformed discretionary traders by an average of 12.7% annually over a five-year period.

Limitations of Emotionless Option Trading

Adaptation to Changing Markets

Markets evolve, and mechanical systems must evolve with them. Without periodic review and optimization, once-effective strategies can become ineffective.

Over-Optimization Risk

The temptation to fine-tune systems based on past performance can lead to “curve fitting”—creating strategies that worked perfectly in the past but fail in the future.

The Need for Flexibility

In rare market events (e.g., flash crashes, geopolitical shocks), rigid systems may underperform and require human oversight.

Technological Requirements

Implementing fully automated trading systems requires technical skills and infrastructure not accessible to all traders.

Real-World Examples: Case Studies

Case Study 1: The Retail Trader’s Transformation

John M., a retail trader, switched from emotional discretionary trading to a rules-based volatility strategy in 2023. His annual returns increased from 9% to 27%, with a significant reduction in drawdowns. The key difference? A mechanical system that sold puts on high-quality stocks when implied volatility spiked above historical averages.

Case Study 2: The Institution’s Edge

Quantum Trading Group implements emotionless systems across all their option strategies. Their flagship volatility arbitrage fund has delivered 19% annualized returns since 2022 by mechanically exploiting discrepancies between implied and realized volatility, completely removing trader emotions from the equation.

Case Study 3: The Recovery Story

Maria L. lost 60% of her trading account in 2023 using a discretionary approach. After implementing an emotionless iron condor strategy with strict position sizing and mechanical adjustments, she not only recovered her losses but grew her account by 43% in 2024.

Conclusion: The Path to Emotionless Trading Mastery

Emotionless option trading isn’t about becoming a robot—it’s about implementing systems that protect you from your natural psychological biases. By creating clear rules, relying on technical analysis, managing risk effectively, and leveraging modern tools, you can join the minority of traders who consistently profit from the options market.

The journey to emotionless trading mastery requires dedication to create and refine your system, discipline to follow it without exception, and patience to let the statistical edge work over time. But the rewards—consistent profits, reduced stress, and a sustainable trading career—are well worth the effort.

As markets continue evolving in 2025 and beyond, the advantage will increasingly go to traders who can execute emotionlessly within well-defined systems while the majority continue to be swayed by the emotional winds of fear and greed.

Ready to transform your options trading through emotionless discipline? Start by documenting your current trading process, identifying emotional triggers, and creating clear rules for your next 10 trades. Track the results and compare them to your previous performance. You might be surprised by how quickly removing emotions can improve your returns.

Frequently Asked Questions

What is emotionless option trading?

Emotionless option trading is a disciplined approach where decisions are based solely on predefined rules, technical analysis, and risk management principles rather than feelings or impulses like fear, greed, or excitement. It removes psychological biases from the trading process to enable more consistent execution and results.

How can I start trading options without emotions?

Start by developing a comprehensive trading plan with specific entry and exit criteria, implement strict position sizing rules, use technical indicators rather than “gut feelings,” keep a detailed trading journal, and consider automation tools to execute your strategy without emotional interference.

What are the most common emotional mistakes in options trading?

The most common emotional mistakes include FOMO (fear of missing out) leading to chasing trades, holding losing positions too long due to hope or denial, taking profits too early out of fear, revenge trading after losses, and overtrading during periods of excitement or boredom.

What technical indicators work best for emotionless options trading?

Effective indicators include moving averages for trend identification, RSI for overbought/oversold conditions, MACD for momentum shifts, Bollinger Bands for volatility assessment, and volume indicators for confirmation. Implied volatility metrics specific to options are also crucial for evaluating option prices.

Can automated systems completely remove emotions from trading?

Automated systems can execute trades based on predefined rules without emotional interference, but emotions can still influence how traders design, monitor, and intervene with these systems. Complete emotional detachment requires both systematic approaches and psychological discipline.

How important is risk management in emotionless trading?

Risk management is the foundation of emotionless trading. Without clear risk parameters, even the most sophisticated technical system will eventually fail due to emotional decision-making during drawdowns. Professional traders typically prioritize risk management over entry signals.

What percentage of my account should I risk per options trade?

Most professional options traders limit risk to 1-3% of their total account value per trade. This conservative approach ensures that no single loss can significantly damage your trading capital and helps maintain emotional equilibrium during inevitable losing streaks.